- Canada

- /

- Oil and Gas

- /

- TSXV:NSE

3 TSX Penny Stocks With Market Caps Larger Than CA$70M

Reviewed by Simply Wall St

The Canadian market remained flat over the last week, but it is up 22% over the past year, with earnings forecasted to grow by 16% annually. In light of these conditions, identifying stocks with strong financial health and growth potential becomes crucial for investors. Although "penny stocks" may seem like an outdated term, they continue to represent smaller or less-established companies that can offer significant value.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.64 | CA$173.17M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$286.83M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$116.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$584.01M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.38 | CA$325.16M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.75M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.10 | CA$207.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 967 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Loncor Gold (TSX:LN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Loncor Gold Inc. is a gold exploration company focused on acquiring, exploring, and developing precious metal projects in the Ngayu greenstone belt in the Democratic Republic of the Congo and Canada, with a market cap of CA$73.44 million.

Operations: Loncor Gold Inc. does not have any reported revenue segments at this time.

Market Cap: CA$73.44M

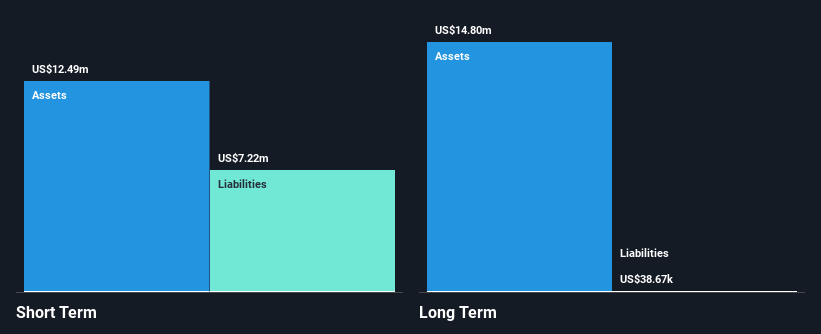

Loncor Gold Inc., with a market cap of CA$73.44 million, remains pre-revenue and unprofitable, reporting increased net losses for the third quarter and nine months ending September 2024. The company's short-term assets significantly exceed its liabilities, and it is debt-free, yet it faces cash runway challenges with less than a year remaining at current spending rates. Despite these financial constraints, Loncor has initiated an ambitious 11,000-meter drilling program at the Adumbi site in the DRC to expand its gold resources further. Management's extensive experience may aid in navigating these exploration activities amidst financial pressures.

- Take a closer look at Loncor Gold's potential here in our financial health report.

- Review our historical performance report to gain insights into Loncor Gold's track record.

Cornish Metals (TSXV:CUSN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cornish Metals Inc. focuses on acquiring, evaluating, exploring, and developing mineral properties in the United Kingdom with a market cap of CA$74.94 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$74.94M

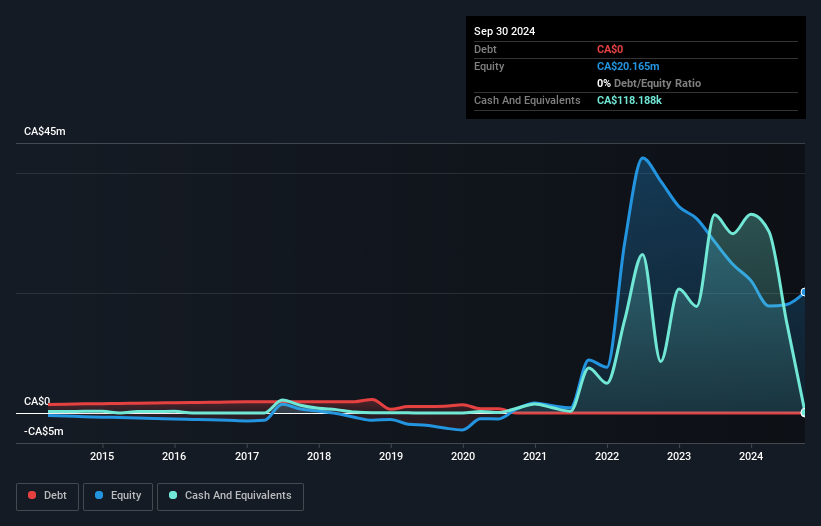

Cornish Metals Inc., with a market cap of CA$74.94 million, is pre-revenue but recently reported a net income of CA$4.61 million for Q3 2024, marking a turnaround from previous losses. The company has no debt and its short-term assets exceed both short- and long-term liabilities. Recent developments include a secured credit facility to fund the South Crofty tin project in Cornwall, which boasts high-grade resources and potential for further mineralisation expansion. Despite earnings volatility, Cornish Metals' seasoned management team continues to explore growth opportunities within its extensive mineral rights holdings in Cornwall.

- Unlock comprehensive insights into our analysis of Cornish Metals stock in this financial health report.

- Understand Cornish Metals' track record by examining our performance history report.

New Stratus Energy (TSXV:NSE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Stratus Energy Inc. is an exploitation and production company in the oil and gas sector with a market cap of CA$92.05 million.

Operations: New Stratus Energy Inc. currently does not report any specific revenue segments.

Market Cap: CA$92.05M

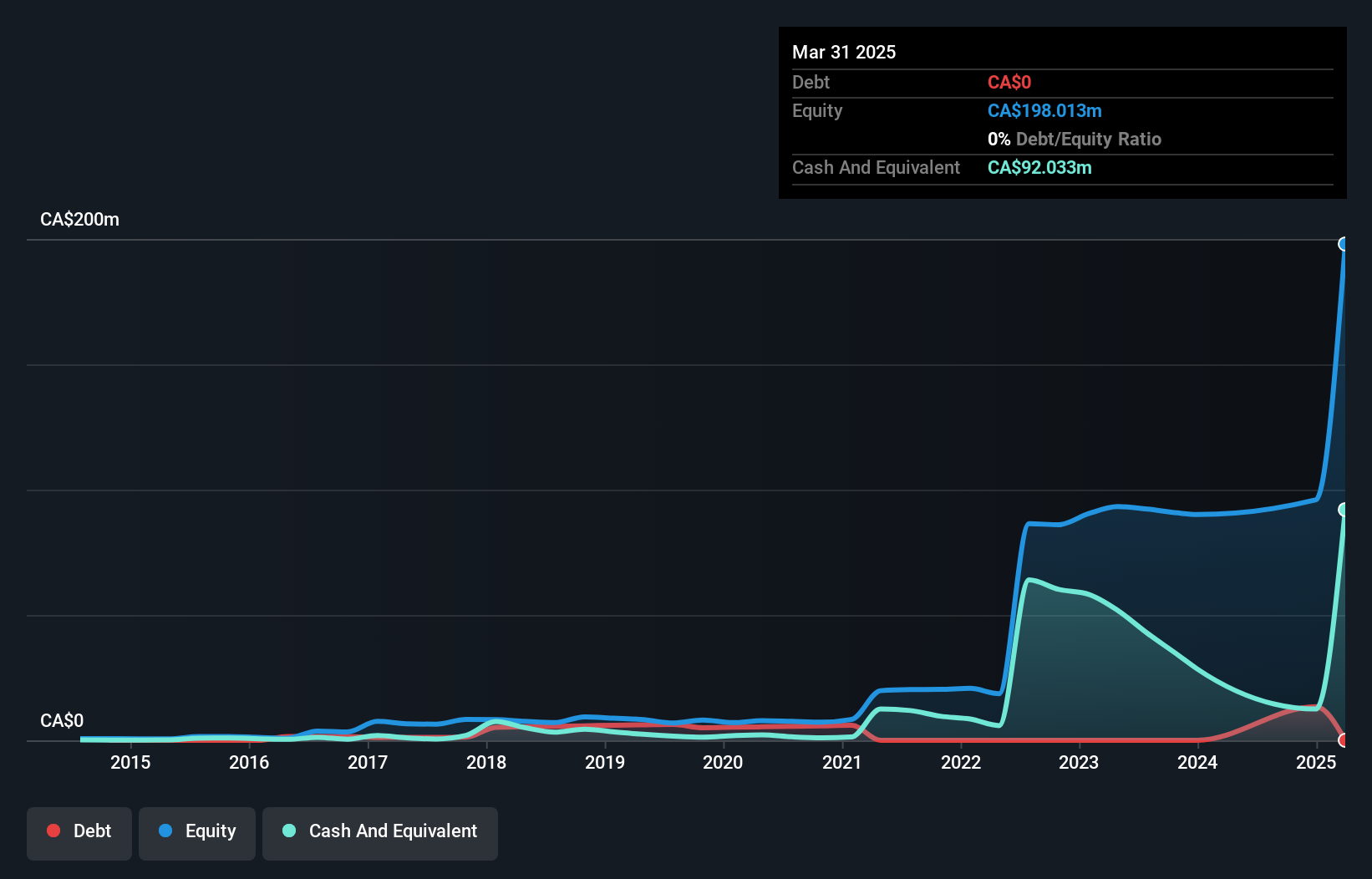

New Stratus Energy Inc., with a market cap of CA$92.05 million, is currently pre-revenue and unprofitable, with losses narrowing in recent quarters. The company has no debt, and its short-term assets comfortably cover both short- and long-term liabilities. However, it faces challenges such as high share price volatility and significant insider selling recently. The management team is experienced but must address the limited cash runway of less than a year based on current free cash flow levels. Shareholders have experienced dilution over the past year as total shares outstanding increased by 8.5%.

- Navigate through the intricacies of New Stratus Energy with our comprehensive balance sheet health report here.

- Assess New Stratus Energy's previous results with our detailed historical performance reports.

Taking Advantage

- Explore the 967 names from our TSX Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Stratus Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NSE

New Stratus Energy

Engages in the acquisition, exploration, and development of oil and gas properties in Mexico, Ecuador, Colombia, and Canada.

Medium-low with weak fundamentals.

Market Insights

Community Narratives