- Canada

- /

- Oil and Gas

- /

- TSXV:LOU

TSX Penny Stock Opportunities To Watch In January 2025

Reviewed by Simply Wall St

As we step into 2025, the Canadian market is navigating a landscape of policy changes and economic growth, building on a strong performance from the previous year. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated label—remain an intriguing area for uncovering potential value. These stocks can offer significant opportunities when they are backed by solid financial health, and this article will explore three such examples that may present promising prospects for long-term gains.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.04 | CA$379.39M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$122.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.42 | CA$961.62M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$583.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.45 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.66 | CA$307.33M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 945 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

American Lithium (TSXV:LI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, and developing mineral properties in North and South America, with a market cap of CA$132.94 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$132.94M

American Lithium Corp., with a market cap of CA$132.94 million, is pre-revenue and focuses on mineral exploration and development in North and South America. Despite being debt-free, the company faces financial challenges with less than a year of cash runway and has experienced increased losses over the past five years. Recent developments include its removal from major indices, reflecting potential investor concerns. However, ongoing projects like the TLC Lithium Project show promise as they advance through feasibility stages. The board's experience may provide strategic guidance during this critical phase for potential long-term growth opportunities in lithium and uranium sectors.

- Click to explore a detailed breakdown of our findings in American Lithium's financial health report.

- Gain insights into American Lithium's past trends and performance with our report on the company's historical track record.

Lucero Energy (TSXV:LOU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lucero Energy Corp. is an independent oil company focused on acquiring, developing, and producing oil-weighted assets in the Bakken and Three Forks formations in North Dakota's Williston Basin, with a market cap of CA$280.57 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, which generated CA$148.21 million.

Market Cap: CA$280.57M

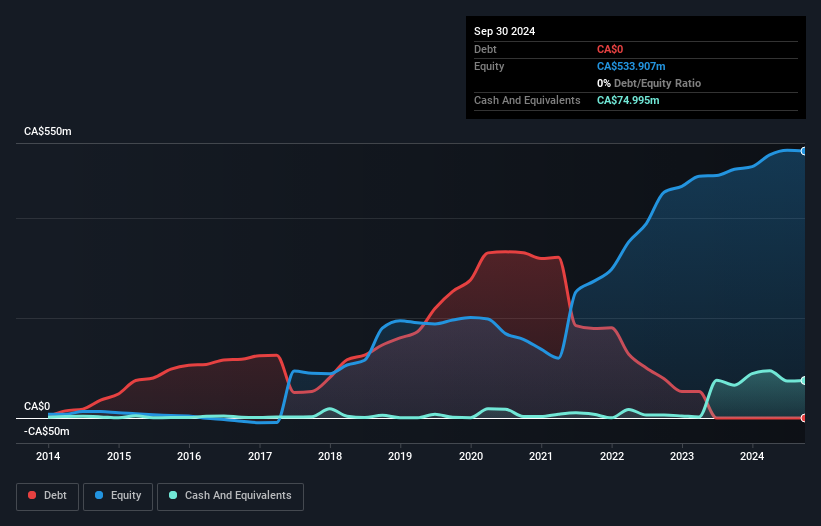

Lucero Energy, with a market cap of CA$280.57 million, is undergoing significant changes as it enters an agreement to be acquired by Vitesse Energy in an all-stock transaction valued at approximately US$230 million. This move could enhance Vitesse's financial metrics and strategic positioning. Lucero has demonstrated strong earnings growth over the past five years but faced a recent decline in net income and production figures compared to last year. The company remains debt-free, with short-term assets exceeding liabilities, indicating sound financial health despite recent performance challenges and upcoming acquisition-related uncertainties.

- Dive into the specifics of Lucero Energy here with our thorough balance sheet health report.

- Understand Lucero Energy's earnings outlook by examining our growth report.

Mayfair Gold (TSXV:MFG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mayfair Gold Corp. is an exploration-stage company focused on acquiring, exploring, evaluating, and developing mineral properties with a market cap of CA$196.71 million.

Operations: There are no revenue segments reported for this exploration-stage company focused on mineral properties.

Market Cap: CA$196.71M

Mayfair Gold Corp., with a market cap of CA$196.71 million, is pre-revenue and focused on mineral exploration. The company remains debt-free, with short-term assets (CA$5.8M) comfortably exceeding liabilities (CA$388.3K), which suggests strong liquidity despite its unprofitable status and negative return on equity (-78.02%). Recent developments include a private placement raising CA$6.01 million, indicating investor interest despite shareholder dilution over the past year by 8.9%. Although Mayfair reported reduced net losses for Q3 2024 compared to the previous year, it still faces challenges with an inexperienced management team and board of directors.

- Unlock comprehensive insights into our analysis of Mayfair Gold stock in this financial health report.

- Learn about Mayfair Gold's historical performance here.

Make It Happen

- Click through to start exploring the rest of the 942 TSX Penny Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LOU

Lucero Energy

An independent oil company, engages in the acquisition, development, and production of oil-weighted assets in the Bakken and Three Forks formations in the Williston Basin area of North Dakota.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives