- Canada

- /

- Metals and Mining

- /

- TSXV:NIM

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As 2025 unfolds, the Canadian market faces a complex landscape influenced by potential tariff impacts, which could act as a tax on consumers and affect economic growth. Despite these uncertainties, opportunities exist for investors to diversify their portfolios and capitalize on market volatility. Penny stocks, often overlooked but still relevant, offer potential growth at lower price points when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$1B | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$177.31M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.70 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.45 | CA$120.49M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$628.96M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$236.24M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.99 | CA$26.06M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$176.7M | ★★★★★☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Calfrac Well Services (TSX:CFW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Calfrac Well Services Ltd. and its subsidiaries offer specialized oilfield services in Canada, the United States, and Argentina, with a market cap of CA$330.60 million.

Operations: The company generates revenue primarily from its Oil Well Equipment & Services segment, amounting to CA$1.61 billion.

Market Cap: CA$330.6M

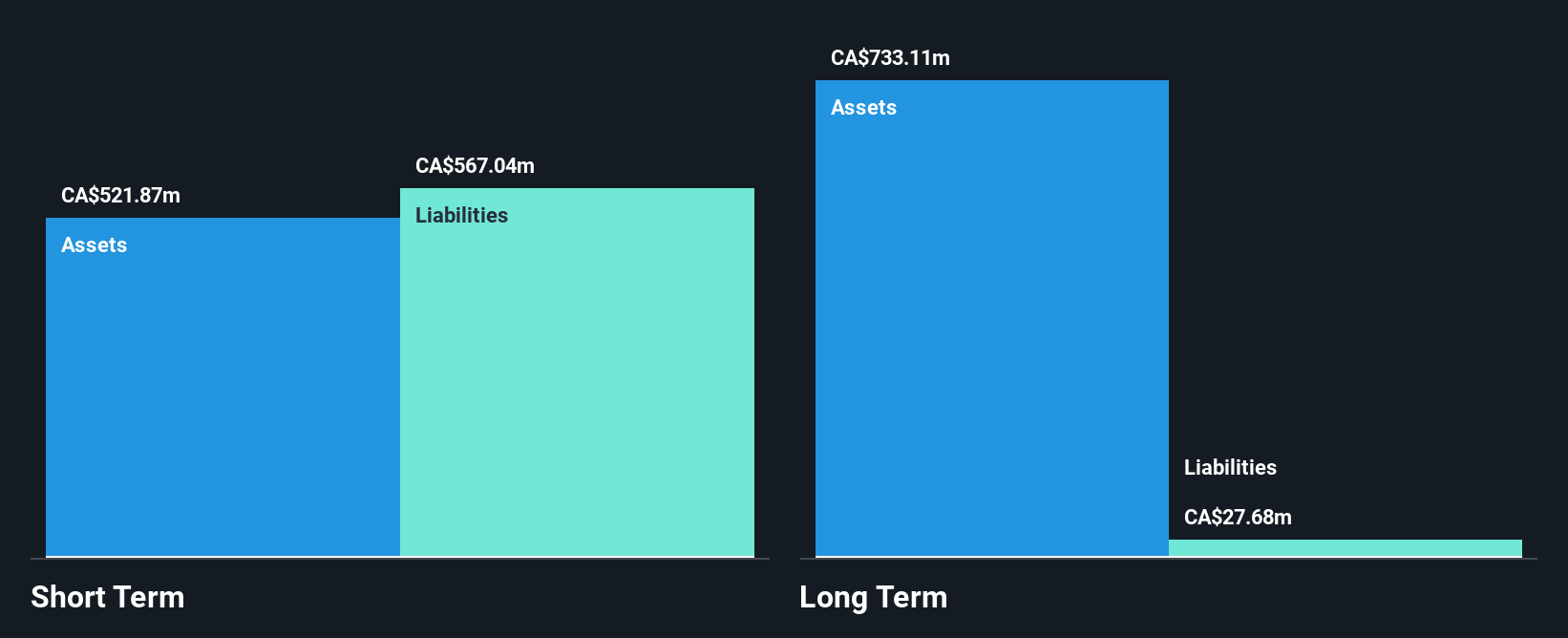

Calfrac Well Services, with a market cap of CA$330.60 million, has seen significant improvements in its financial structure, reducing its debt-to-equity ratio from 234% to 54.4% over five years. While the company has high-quality earnings and short-term assets exceeding both short and long-term liabilities, challenges remain with interest payments not fully covered by EBIT. Despite a low return on equity at 4.4%, the price-to-earnings ratio of 11.8x suggests potential value relative to the Canadian market average of 14.6x. Earnings are forecasted to grow significantly at an annual rate of 34.61%.

- Click here to discover the nuances of Calfrac Well Services with our detailed analytical financial health report.

- Evaluate Calfrac Well Services' prospects by accessing our earnings growth report.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hemisphere Energy Corporation is involved in the acquisition, exploration, development, and production of petroleum and natural gas interests in Canada with a market cap of CA$176.70 million.

Operations: The company generates revenue of CA$78.57 million from its petroleum and natural gas interests in Canada.

Market Cap: CA$176.7M

Hemisphere Energy, with a market cap of CA$176.70 million, demonstrates financial stability and growth potential in the Canadian penny stock arena. The company is debt-free, eliminating concerns about interest coverage and enhancing its financial resilience. Its earnings have grown significantly over five years at 54.3% annually, although recent growth has decelerated to 26.7%. Hemisphere's price-to-earnings ratio of 6.2x suggests it is trading at a good value compared to industry peers. Despite strong short-term asset coverage for liabilities, long-term liabilities remain uncovered by current assets, posing a risk factor for investors to consider alongside its robust dividend policy and share buyback activities.

- Dive into the specifics of Hemisphere Energy here with our thorough balance sheet health report.

- Gain insights into Hemisphere Energy's outlook and expected performance with our report on the company's earnings estimates.

Nicola Mining (TSXV:NIM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nicola Mining Inc. is a junior exploration and custom milling company focused on identifying, acquiring, and exploring mineral properties in Canada, with a market cap of CA$51.49 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: CA$51.49M

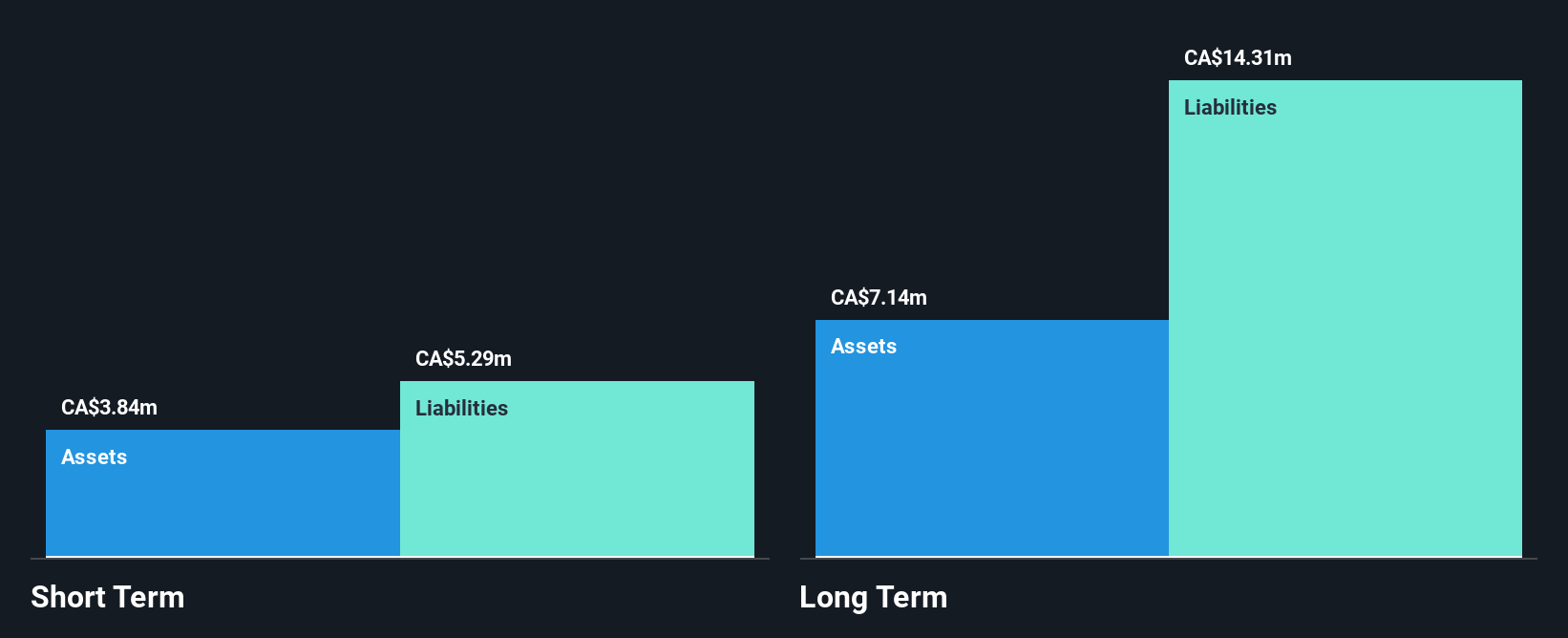

Nicola Mining Inc., with a market cap of CA$51.49 million, is a pre-revenue company in the exploration phase, focusing on its New Craigmont Copper Project and Dominion Creek Gold/Silver Project. The company recently completed significant drilling activities and raised capital through private placements to support ongoing exploration efforts. Despite having sufficient short-term assets to cover liabilities, Nicola's long-term liabilities exceed its current asset base, indicating potential financial strain. While it has improved shareholder equity from negative levels five years ago, the company's high net debt-to-equity ratio and unprofitability remain concerns for investors seeking stability in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Nicola Mining.

- Gain insights into Nicola Mining's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Gain an insight into the universe of 940 TSX Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nicola Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NIM

Nicola Mining

A junior exploration and custom milling company, engages in the identification, acquisition, and exploration of mineral property interests in Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives