- Canada

- /

- Metals and Mining

- /

- TSXV:SNG

InnoCan Pharma Leads 3 Promising Penny Stocks On TSX

Reviewed by Simply Wall St

The Canadian market is navigating a landscape of shifting expectations around interest rates, with the recent economic data prompting a reassessment of future rate paths. In this context, identifying promising investments requires focusing on companies with strong fundamentals and growth potential. Although "penny stocks" may seem like an outdated term, they still represent smaller or newer companies that can offer significant value when backed by solid financials. Here, we explore three such penny stocks that stand out for their financial strength and potential to deliver substantial returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.66 | CA$611.6M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$183.79M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$119.12M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.40 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.48 | CA$315.84M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.76 | CA$288.49M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$2.12 | CA$131.04M | ★★★★☆☆ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

InnoCan Pharma (CNSX:INNO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InnoCan Pharma Corporation is a pharmaceutical technology company that develops drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients across the United States, Canada, Europe, and internationally, with a market cap of CA$64.56 million.

Operations: The company's revenue is primarily generated from online sales amounting to $24.30 million, with a minor contribution from other operations at $0.09 million.

Market Cap: CA$64.56M

InnoCan Pharma, with a market cap of CA$64.56 million, has shown promising developments in its liposomal-CBD (LPT-CBD) technology for pain relief in animals and received positive feedback from the FDA for its lead drug product. Despite being unprofitable, the company has reduced losses over five years and reported improved earnings with US$8.64 million sales in Q2 2024. InnoCan is debt-free with short-term assets exceeding liabilities and a seasoned management team. However, shareholder dilution occurred recently due to private placements aimed at raising capital for future growth initiatives.

- Click to explore a detailed breakdown of our findings in InnoCan Pharma's financial health report.

- Gain insights into InnoCan Pharma's past trends and performance with our report on the company's historical track record.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hemisphere Energy Corporation is involved in the acquisition, exploration, development, and production of petroleum and natural gas interests in Canada with a market cap of CA$181.86 million.

Operations: The company generates revenue of CA$77.01 million from its petroleum and natural gas interests in Canada.

Market Cap: CA$181.86M

Hemisphere Energy Corporation, with a market cap of CA$181.86 million, demonstrates financial stability and growth potential in the Canadian oil and gas sector. The company reported significant revenue of CA$77.01 million, supported by robust earnings growth of 21.8% over the past year, outpacing industry averages. Hemisphere is debt-free, enhancing its financial flexibility and reducing risk exposure. Its seasoned management team ensures strategic oversight while maintaining shareholder value without dilution over the past year. However, short-term assets do not fully cover long-term liabilities, which may warrant attention despite strong returns on equity at 41.3%.

- Unlock comprehensive insights into our analysis of Hemisphere Energy stock in this financial health report.

- Assess Hemisphere Energy's future earnings estimates with our detailed growth reports.

Silver Range Resources (TSXV:SNG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Silver Range Resources Ltd. is a junior resource exploration company focused on acquiring, exploring, and evaluating mineral properties in Canada and the United States, with a market cap of CA$8.83 million.

Operations: Silver Range Resources Ltd. does not have any reported revenue segments.

Market Cap: CA$8.83M

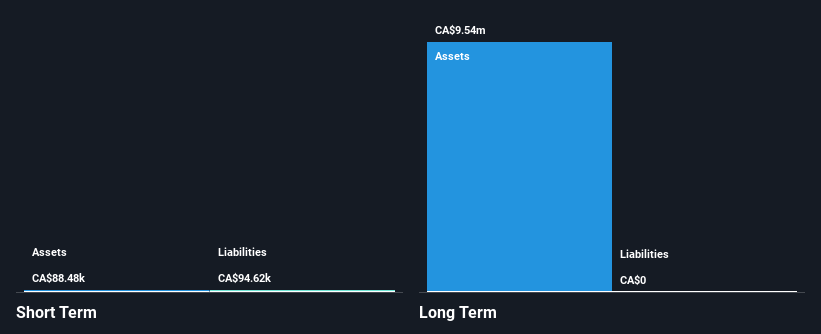

Silver Range Resources Ltd., with a market cap of CA$8.83 million, operates as a pre-revenue junior exploration company, focusing on mineral properties in Canada and the U.S. The company remains debt-free but faces financial challenges with short-term assets (CA$88.5K) not covering its short-term liabilities (CA$94.6K). Shareholder dilution occurred over the past year, with shares outstanding increasing by 3.9%. Despite having an experienced management team averaging 2.8 years in tenure, Silver Range is unprofitable and reported a net loss of CA$0.194 million for Q2 2024, though slightly improved from the previous year’s loss.

- Navigate through the intricacies of Silver Range Resources with our comprehensive balance sheet health report here.

- Gain insights into Silver Range Resources' historical outcomes by reviewing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 954 TSX Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SNG

Silver Range Resources

A junior resource exploration company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada and the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives