- Canada

- /

- Oil and Gas

- /

- TSXV:HME

Does Hemisphere Energy's (TSXV:HME) Continued Dividends Signal Resilience Amid Lower 2025 Production Guidance?

Reviewed by Sasha Jovanovic

- Hemisphere Energy Corporation recently reported its third quarter 2025 results, announcing lower quarterly revenue of C$19.1 million and net income of C$6.93 million compared to the previous year, alongside updated production guidance for 2025 below earlier estimates.

- Despite operational challenges leading to reduced production forecasts, the company continued to emphasize shareholder returns through dividends and share buybacks.

- We'll explore how Hemisphere's commitment to dividends amid revised production guidance shapes its investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Hemisphere Energy's Investment Narrative?

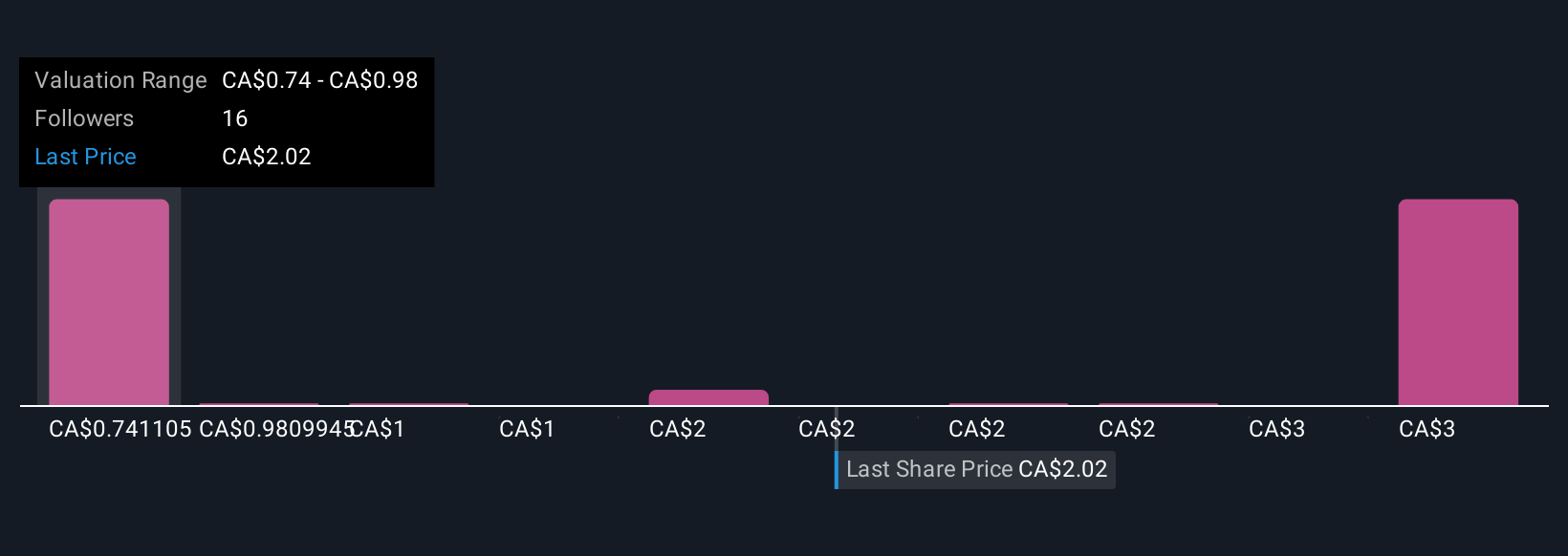

For investors drawn to Hemisphere Energy, the big picture is about balancing stable shareholder returns with the realities of a heavy oil-focused business subject to operational and market risks. The latest quarterly update brought softer revenue and net income, but did not disrupt the company’s commitment to dividends or share buybacks, keeping focus on capital returns. What does change, however, is the near-term production outlook: new guidance for 2025 now sits below previous estimates, reflecting some recent operational headwinds. This adjustment makes production performance and possible delays the main catalysts and risks right now, rather than any dramatic move in commodity prices or acquisition activity. Given the drop in the share price around the results, it appears the market has already factored in this revised outlook, limiting the likelihood of further major near-term impact, unless production guidance shifts again.

But, with reduced production targets, exposure to further operational hiccups remains a key risk that investors should watch closely. Hemisphere Energy's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 12 other fair value estimates on Hemisphere Energy - why the stock might be worth as much as 55% more than the current price!

Build Your Own Hemisphere Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hemisphere Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hemisphere Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hemisphere Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hemisphere Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HME

Hemisphere Energy

Acquires, explores, develops, and produces petroleum and natural gas properties in Canada.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.