- Canada

- /

- Oil and Gas

- /

- TSXV:EOG

TSX Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX only 4% off its record high, buoyed by a strong performance in the materials sector. In this context of cautious optimism and potential volatility, investors may find opportunities in penny stocks—an investment category that, despite its vintage terminology, continues to highlight smaller or less-established companies with promising prospects. By focusing on those with robust financials and a clear growth trajectory, investors can uncover potential gems within the penny stock realm.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$63.72M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.64 | CA$70.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.64 | CA$425.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.10 | CA$611.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.84 | CA$205.98M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.75 | CA$288.8M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.58 | CA$503.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.55 | CA$127.49M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.43 | CA$93.62M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Eco (Atlantic) Oil & Gas (TSXV:EOG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eco (Atlantic) Oil & Gas Ltd. focuses on the identification, acquisition, exploration, and development of petroleum, natural gas, and shale gas properties in Namibia and Guyana with a market cap of CA$52.01 million.

Operations: Currently, the company has not reported any revenue segments.

Market Cap: CA$52.01M

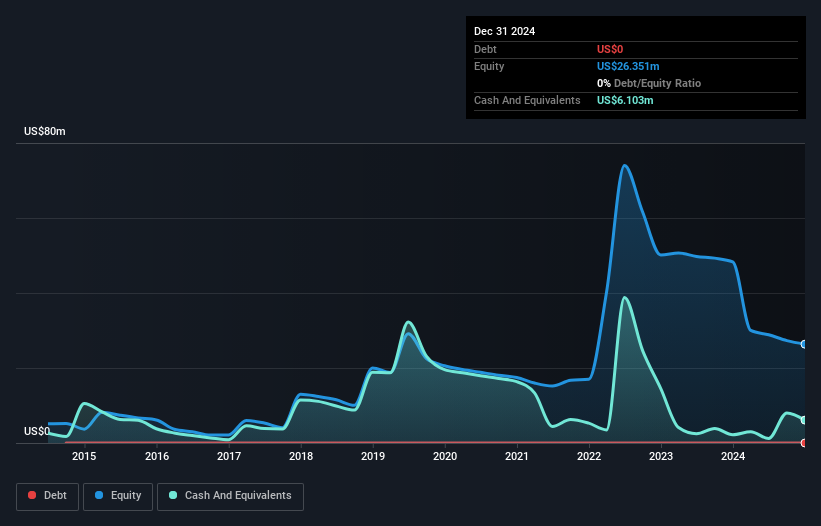

Eco (Atlantic) Oil & Gas Ltd., with a market cap of CA$52.01 million, is pre-revenue, generating less than US$1 million in revenue. It reported a net loss of US$3.67 million for the nine months ending December 2024, indicating ongoing financial challenges. The company remains debt-free and has not diluted shareholder equity recently, which may appeal to some investors seeking stability in capital structure. However, it faces significant hurdles with less than one year of cash runway and no forecasted profitability within three years. Its board is experienced with an average tenure of 7.3 years but management experience data is insufficient.

- Get an in-depth perspective on Eco (Atlantic) Oil & Gas' performance by reading our balance sheet health report here.

- Gain insights into Eco (Atlantic) Oil & Gas' outlook and expected performance with our report on the company's earnings estimates.

GoviEx Uranium (TSXV:GXU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoviEx Uranium Inc. is a mineral resources company focused on acquiring, exploring, and developing uranium properties in Africa with a market cap of CA$40.63 million.

Operations: GoviEx Uranium Inc. does not report any revenue segments, as it is primarily engaged in the acquisition, exploration, and development of uranium properties in Africa.

Market Cap: CA$40.63M

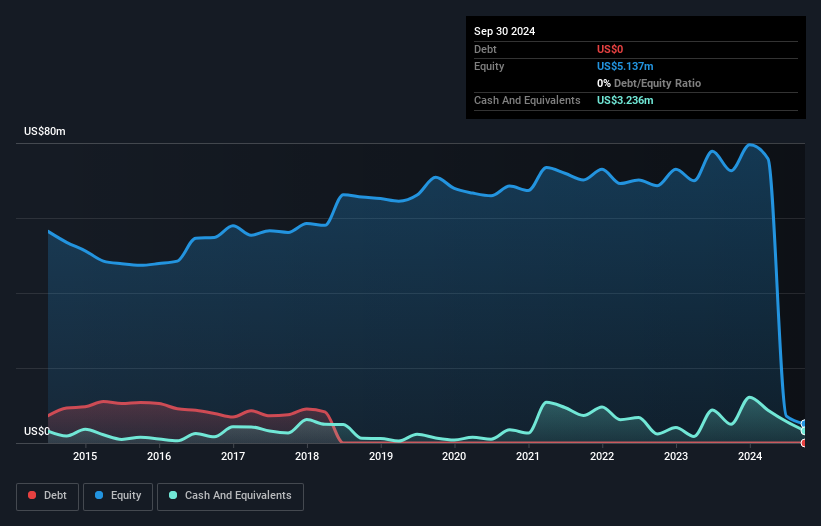

GoviEx Uranium Inc., with a market cap of CA$40.63 million, is pre-revenue and focused on advancing its Muntanga Uranium Project in Zambia. The company recently filed a draft Environmental and Social Impact Assessment, marking progress toward project execution. GoviEx remains debt-free, which may be attractive to investors looking for financial stability despite its high share price volatility. Recent capital raising efforts via private placement aim to bolster its cash runway beyond the current four months. Although unprofitable with increasing losses over five years, the company's experienced board and management team provide strategic oversight as it seeks financing options for future growth.

- Jump into the full analysis health report here for a deeper understanding of GoviEx Uranium.

- Review our historical performance report to gain insights into GoviEx Uranium's track record.

Metallic Minerals (TSXV:MMG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metallic Minerals Corp. focuses on the acquisition, exploration, and development of mineral properties in Canada and the United States, with a market cap of CA$43.83 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$43.83M

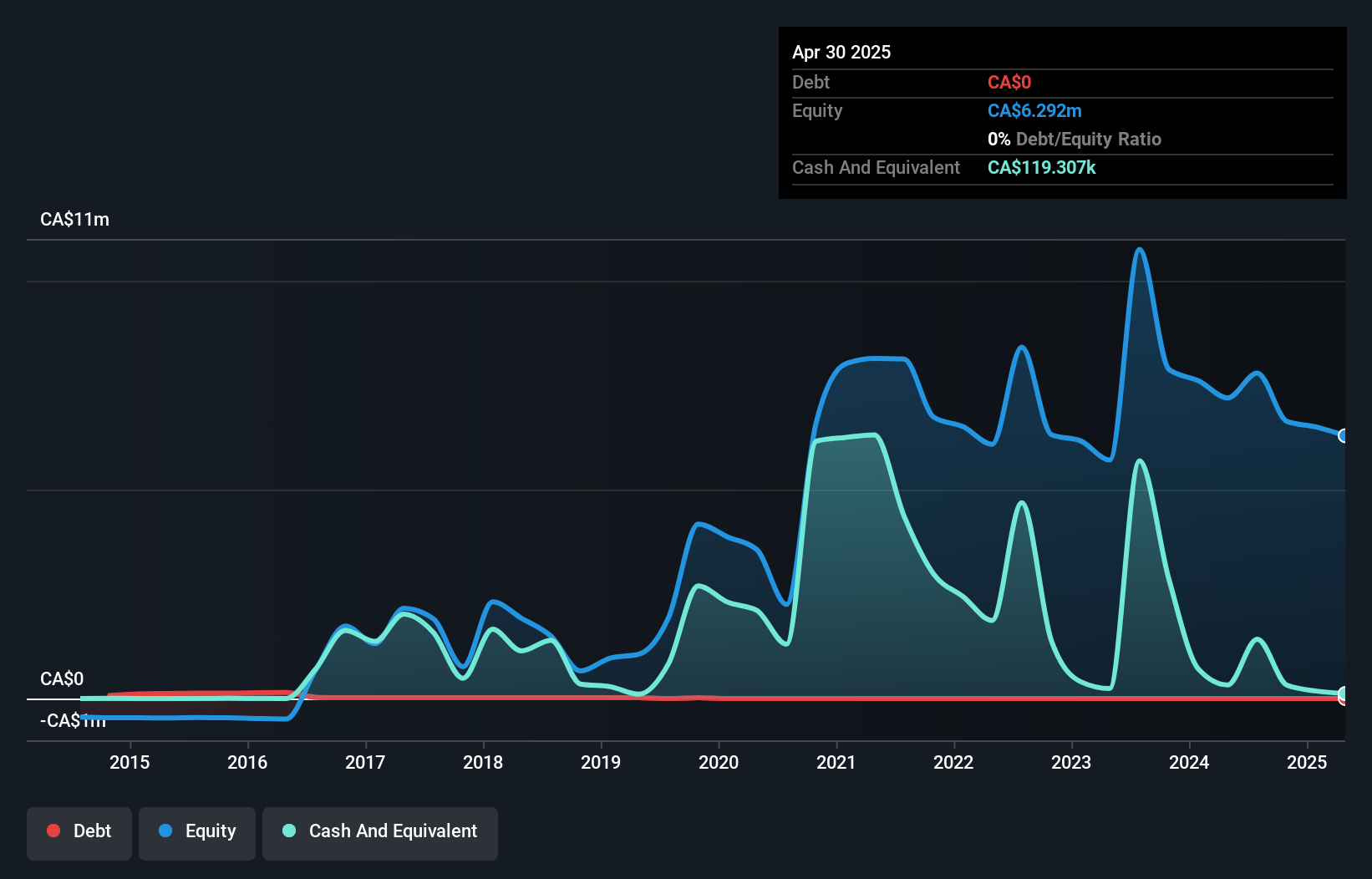

Metallic Minerals Corp., with a market cap of CA$43.83 million, is pre-revenue and debt-free, focusing on mineral exploration in Canada and the U.S. The company recently expanded its gold royalty business by signing a new production royalty agreement at Australia Creek in the Klondike Gold District, Yukon Territory. This agreement, effective immediately, involves an experienced mining operator and includes plans for two gold mining operations this season. Despite high share price volatility and less than a year of cash runway, Metallic Minerals benefits from an experienced management team guiding its strategic initiatives.

- Unlock comprehensive insights into our analysis of Metallic Minerals stock in this financial health report.

- Learn about Metallic Minerals' historical performance here.

Turning Ideas Into Actions

- Navigate through the entire inventory of 931 TSX Penny Stocks here.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eco (Atlantic) Oil & Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EOG

Eco (Atlantic) Oil & Gas

Engages in the identification, acquisition, exploration, and development of the petroleum, natural gas, and shale gas properties in the Republic of Namibia and the Co-Operative Republic of Guyana.

Adequate balance sheet slight.

Market Insights

Community Narratives