- Canada

- /

- Oil and Gas

- /

- TSXV:EU

With A 26% Price Drop For enCore Energy Corp. (CVE:EU) You'll Still Get What You Pay For

The enCore Energy Corp. (CVE:EU) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

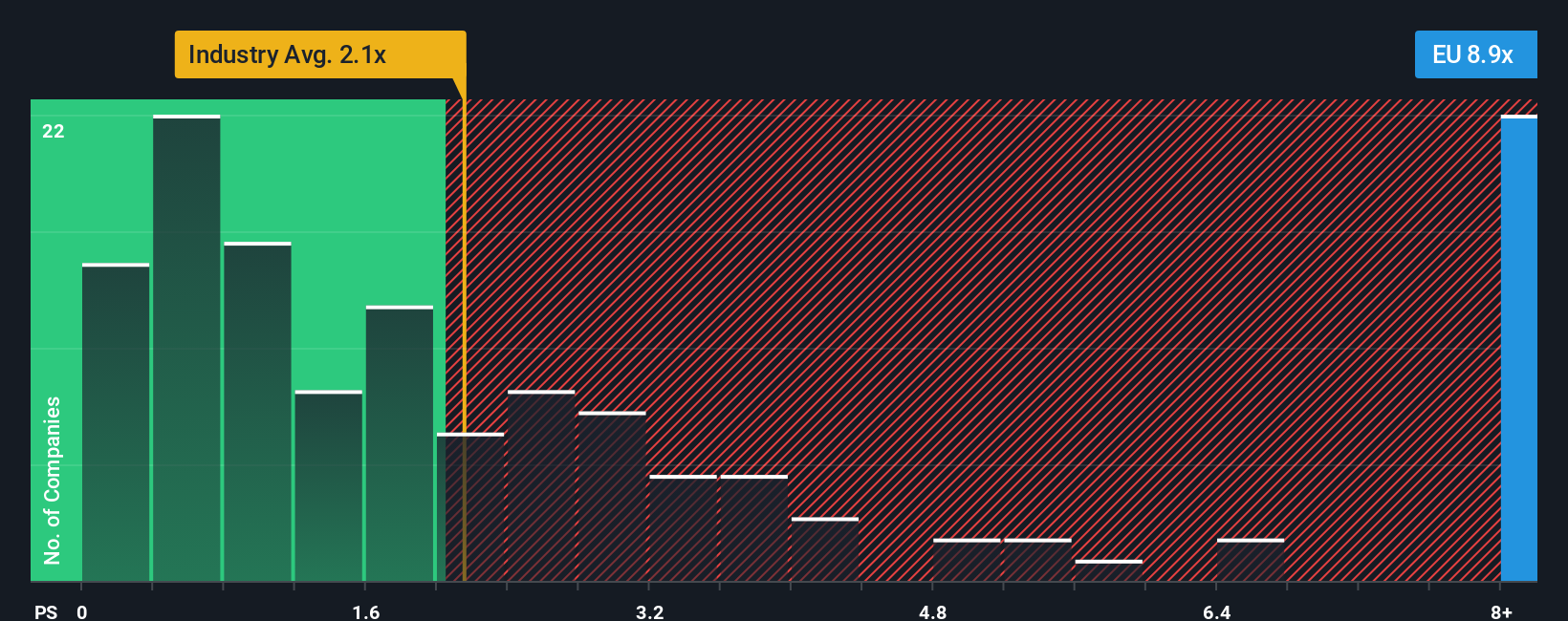

Even after such a large drop in price, you could still be forgiven for thinking enCore Energy is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.9x, considering almost half the companies in Canada's Oil and Gas industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for enCore Energy

How enCore Energy Has Been Performing

enCore Energy hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think enCore Energy's future stacks up against the industry? In that case, our free report is a great place to start.How Is enCore Energy's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like enCore Energy's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 48% per year over the next three years. With the industry only predicted to deliver 3.5% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why enCore Energy is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does enCore Energy's P/S Mean For Investors?

Even after such a strong price drop, enCore Energy's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of enCore Energy's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with enCore Energy.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EU

enCore Energy

Engages in the acquisition, exploration, development, and extraction of uranium resource properties in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026