- Canada

- /

- Oil and Gas

- /

- TSXV:CWV

Would Shareholders Who Purchased Crown Point Energy's (CVE:CWV) Stock Year Be Happy With The Share price Today?

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So spare a thought for the long term shareholders of Crown Point Energy Inc. (CVE:CWV); the share price is down a whopping 81% in the last twelve months. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. We note that it has not been easy for shareholders over three years, either; the share price is down 73% in that time. The falls have accelerated recently, with the share price down 23% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Crown Point Energy

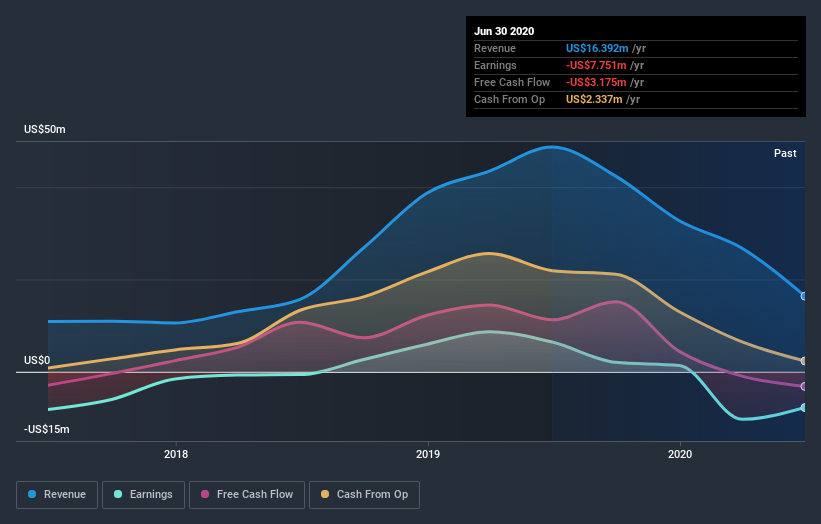

Crown Point Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Crown Point Energy's revenue didn't grow at all in the last year. In fact, it fell 66%. That looks like a train-wreck result to investors far and wide. The market didn't mess around, sending shares down the garbage shute. (Or down 81% to be specific). This kind of performance makes us wary, and usually gives us reason to forget about a stock. A healthy aversion to bagholding (holding potentially worthless stocks) sees many shareholders avoid buying shares like this, rightly or wrongly.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Crown Point Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Crown Point Energy's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Crown Point Energy shareholders, and that cash payout explains why its total shareholder loss of 71%, over the last year, isn't as bad as the share price return.

A Different Perspective

Crown Point Energy shareholders are down 71% for the year, but the market itself is up 3.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Crown Point Energy .

We will like Crown Point Energy better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Crown Point Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:CWV

Crown Point Energy

A junior international oil and gas company, explores for, develops, and produces petroleum and natural gas properties.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026