- Canada

- /

- Oil and Gas

- /

- TSXV:CWV

Crown Point Energy Inc.'s (CVE:CWV) Shares Leap 80% Yet They're Still Not Telling The Full Story

Crown Point Energy Inc. (CVE:CWV) shares have continued their recent momentum with a 80% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 64%.

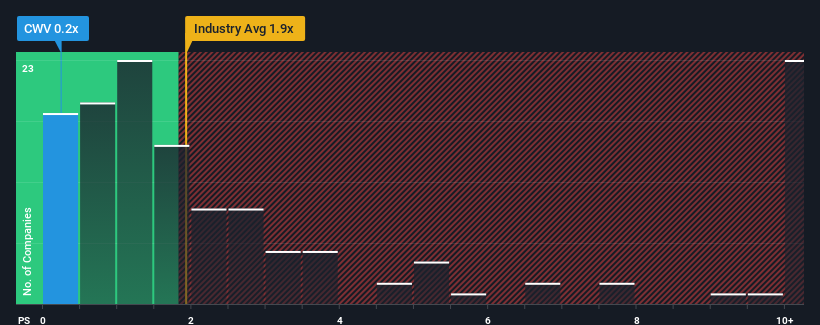

Although its price has surged higher, Crown Point Energy's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Oil and Gas industry in Canada, where around half of the companies have P/S ratios above 1.9x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Crown Point Energy

How Crown Point Energy Has Been Performing

For instance, Crown Point Energy's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Crown Point Energy will help you shine a light on its historical performance.How Is Crown Point Energy's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Crown Point Energy's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 2.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Crown Point Energy is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Crown Point Energy's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Crown Point Energy's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Crown Point Energy currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Crown Point Energy.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CWV

Crown Point Energy

A junior international oil and gas company, explores for, develops, and produces petroleum and natural gas properties.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives