- Canada

- /

- Oil and Gas

- /

- TSXV:CWV

Crown Point Energy Inc.'s (CVE:CWV) Shares Leap 80% Yet They're Still Not Telling The Full Story

Crown Point Energy Inc. (CVE:CWV) shareholders have had their patience rewarded with a 80% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 49% in the last twelve months.

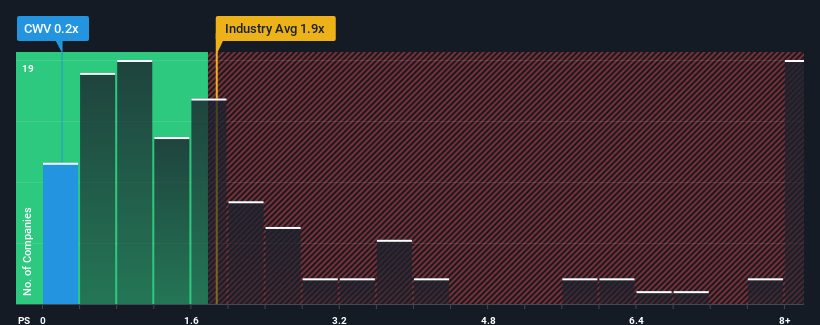

Even after such a large jump in price, Crown Point Energy may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Oil and Gas industry in Canada have P/S ratios greater than 1.9x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Crown Point Energy

How Crown Point Energy Has Been Performing

For example, consider that Crown Point Energy's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Crown Point Energy will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Crown Point Energy?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Crown Point Energy's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 122% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that Crown Point Energy is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

The latest share price surge wasn't enough to lift Crown Point Energy's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Crown Point Energy currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 4 warning signs for Crown Point Energy that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CWV

Crown Point Energy

A junior international oil and gas company, explores for, develops, and produces petroleum and natural gas properties.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026