- Canada

- /

- Energy Services

- /

- TSXV:CTEK

Investors Give Cleantek Industries Inc. (CVE:CTEK) Shares A 32% Hiding

Cleantek Industries Inc. (CVE:CTEK) shares have had a horrible month, losing 32% after a relatively good period beforehand. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

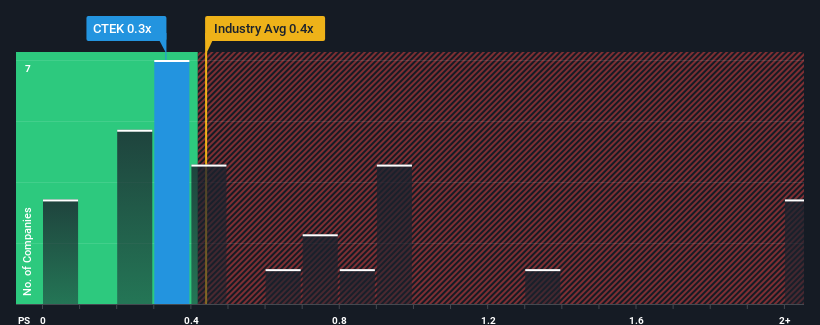

Although its price has dipped substantially, there still wouldn't be many who think Cleantek Industries' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Canada's Energy Services industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Cleantek Industries

What Does Cleantek Industries' P/S Mean For Shareholders?

Cleantek Industries could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Cleantek Industries will help you uncover what's on the horizon.How Is Cleantek Industries' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Cleantek Industries' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 88% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 18%. With the rest of the industry predicted to shrink by 15%, that would be a fantastic result.

With this information, we find it odd that Cleantek Industries is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for Cleantek Industries looks to be in line with the rest of the Energy Services industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cleantek Industries currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Cleantek Industries that you should be aware of.

If these risks are making you reconsider your opinion on Cleantek Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CTEK

Cleantek Industries

Manufactures and markets technology-based equipment in Western Canada and the United States.

Slight risk and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success