- Canada

- /

- Metals and Mining

- /

- TSXV:SLVR

Discover illumin Holdings And 2 Other Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As the Canadian economy experiences a cooling labor market and potential rate cuts from the Bank of Canada, investors are watching closely for opportunities in various sectors. Penny stocks, often representing smaller or newer companies, continue to offer intriguing possibilities for those willing to explore beyond well-known names. Despite being considered a niche area, these stocks can present growth opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$182.69M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$118.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.32M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.34 | CA$231.56M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.21 | CA$135.82M | ★★★★☆☆ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

illumin Holdings (TSX:ILLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: illumin Holdings Inc. is a technology company offering digital media solutions across the United States, Canada, Europe, Latin America, and other international markets with a market cap of CA$84.89 million.

Operations: The company generates CA$120.79 million in revenue from its Internet Information Providers segment.

Market Cap: CA$84.89M

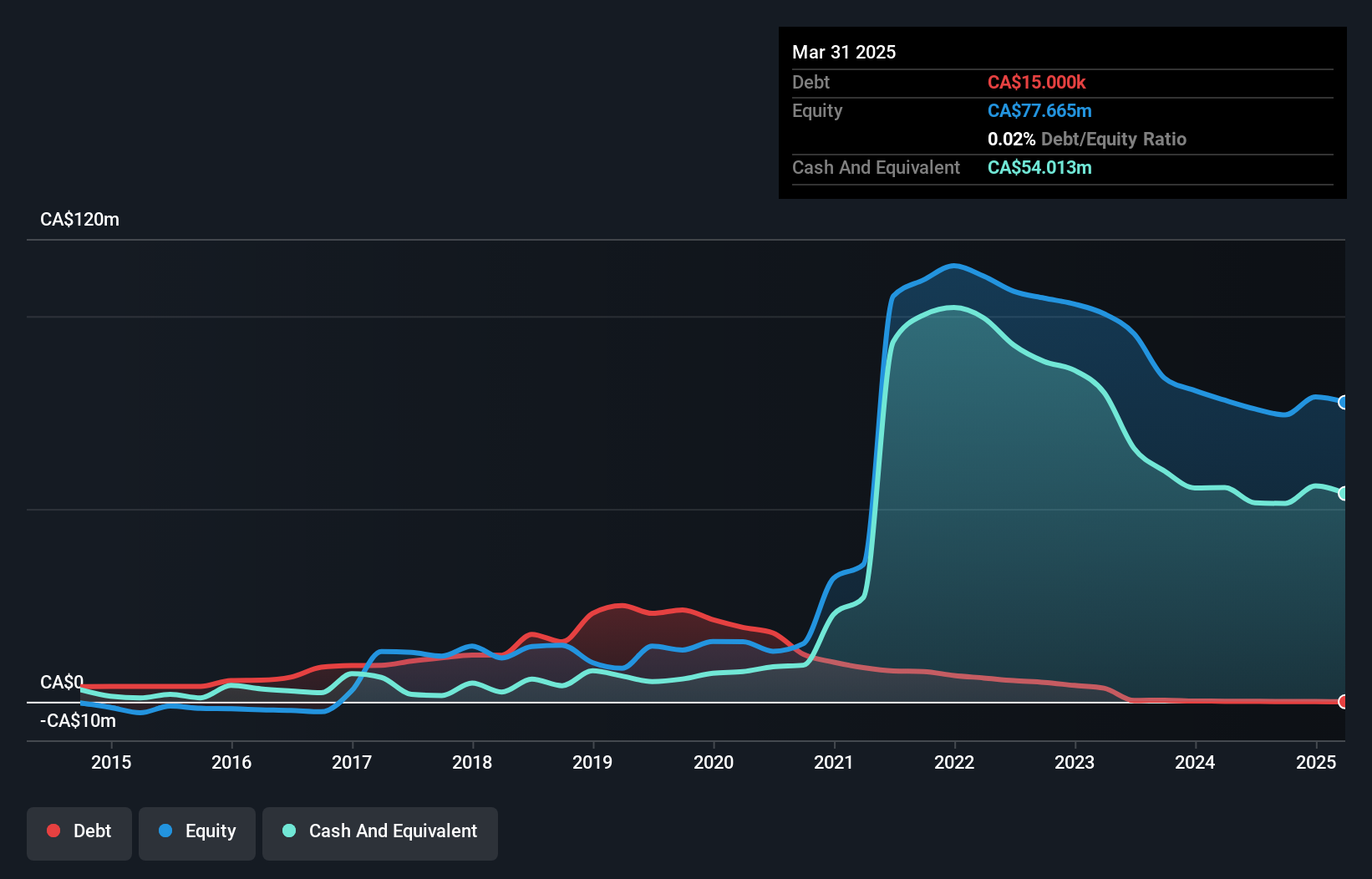

illumin Holdings Inc., a technology company with a market cap of CA$84.89 million, has shown some mixed financial signals typical of penny stocks. The company is unprofitable, with increasing losses over the past five years; however, it maintains a strong cash position and has reduced its debt significantly. Recent earnings reports indicate growth in revenue to CA$36.31 million for Q3 2024 from CA$29.63 million the previous year, though net losses persist at CA$1.11 million compared to net income previously recorded. Despite these challenges, illumin's management team is experienced and its board seasoned, potentially positioning it for future improvements if current trends continue.

- Click here to discover the nuances of illumin Holdings with our detailed analytical financial health report.

- Evaluate illumin Holdings' prospects by accessing our earnings growth report.

Canuc Resources (TSXV:CDA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canuc Resources Corporation is involved in acquiring, exploring, developing, and extracting oil, gas properties, and precious metals across Canada, the United States, and Mexico with a market cap of CA$8.80 million.

Operations: The company's revenue segment is Oil & Gas - Exploration & Production, generating CA$0.10 million.

Market Cap: CA$8.8M

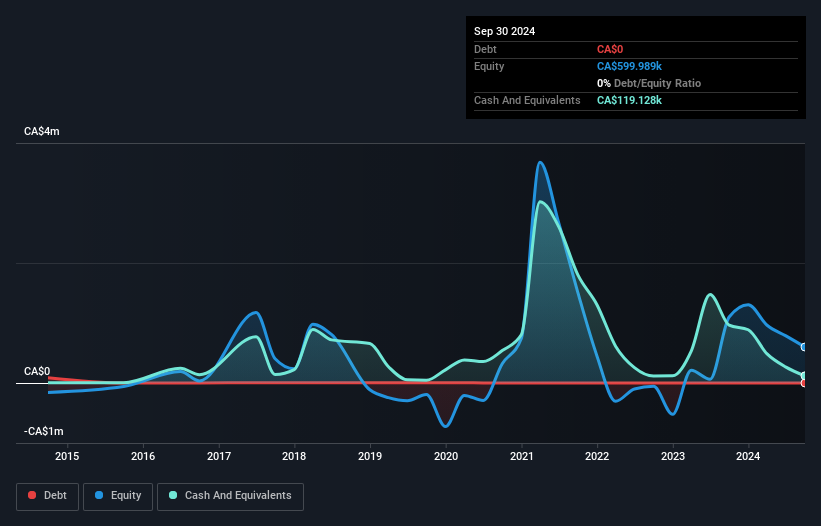

Canuc Resources Corporation, with a market cap of CA$8.80 million, is pre-revenue and has faced financial challenges typical of penny stocks. The company reported a net loss for the first half of 2024, though losses have slightly decreased from the previous year. It operates without debt but has less than a year of cash runway. Recent operational updates include successful repairs on its Coody-Morales Trac 3-3 natural gas well in Texas, which returned to production levels averaging ~100 MCF/day. This development highlights potential upsides in Canuc's asset base despite ongoing financial constraints.

- Click to explore a detailed breakdown of our findings in Canuc Resources' financial health report.

- Review our historical performance report to gain insights into Canuc Resources' track record.

Silver Tiger Metals (TSXV:SLVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver Tiger Metals Inc. is involved in the exploration and evaluation of mineral properties in Mexico, with a market capitalization of CA$93.09 million.

Operations: Silver Tiger Metals Inc. currently does not report any revenue segments.

Market Cap: CA$93.09M

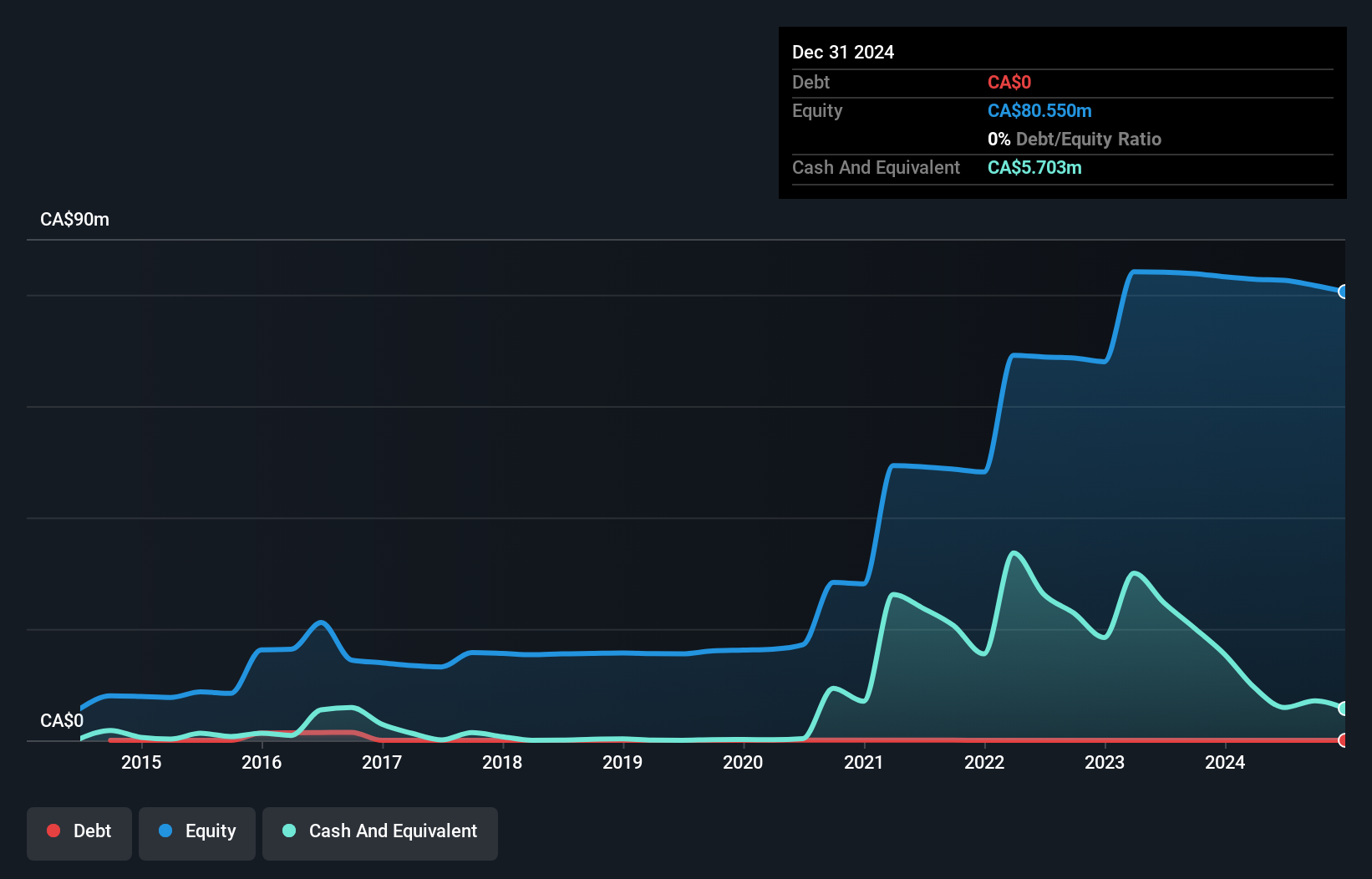

Silver Tiger Metals Inc., with a market cap of CA$93.09 million, is currently pre-revenue and debt-free, typical of many penny stocks. The company has been advancing its El Tigre Project in Mexico, recently completing a Preliminary Feasibility Study that outlines the potential for open pit mining operations. Despite having less than a year of cash runway and increasing losses over the past five years, recent drilling results indicate strong near-surface mineralization and expansion potential for the Stockwork Zone. These developments suggest promising exploration prospects but also highlight financial challenges common to early-stage mining ventures.

- Navigate through the intricacies of Silver Tiger Metals with our comprehensive balance sheet health report here.

- Evaluate Silver Tiger Metals' historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 963 TSX Penny Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SLVR

Silver Tiger Metals

Engages in the exploration and evaluation of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives