- Canada

- /

- Oil and Gas

- /

- TSXV:ALV

Investors Continue Waiting On Sidelines For Alvopetro Energy Ltd. (CVE:ALV)

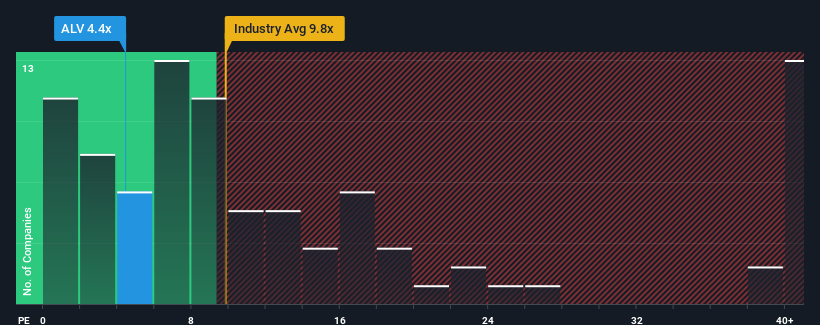

With a price-to-earnings (or "P/E") ratio of 4.4x Alvopetro Energy Ltd. (CVE:ALV) may be sending very bullish signals at the moment, given that almost half of all companies in Canada have P/E ratios greater than 14x and even P/E's higher than 27x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings that are retreating more than the market's of late, Alvopetro Energy has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Alvopetro Energy

How Is Alvopetro Energy's Growth Trending?

In order to justify its P/E ratio, Alvopetro Energy would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 16%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 349% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 28% as estimated by the two analysts watching the company. With the market only predicted to deliver 23%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Alvopetro Energy's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Alvopetro Energy's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Alvopetro Energy currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Alvopetro Energy you should be aware of.

If you're unsure about the strength of Alvopetro Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ALV

Alvopetro Energy

Engages in the acquisition, exploration, development, and production of hydrocarbons in Brazil and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives