- Canada

- /

- Oil and Gas

- /

- TSXV:ALV

Alvopetro Energy (CVE:ALV) Shareholders Have Enjoyed A Whopping 562% Share Price Gain

For us, stock picking is in large part the hunt for the truly magnificent stocks. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One bright shining star stock has been Alvopetro Energy Ltd. (CVE:ALV), which is 562% higher than three years ago. On top of that, the share price is up 13% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 10% in 90 days).

It really delights us to see such great share price performance for investors.

Check out our latest analysis for Alvopetro Energy

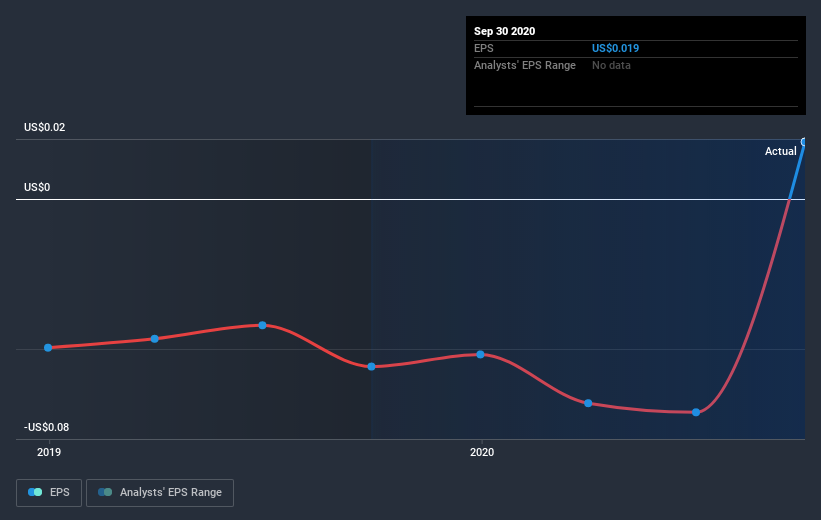

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Alvopetro Energy became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Alvopetro Energy has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Alvopetro Energy will grow revenue in the future.

A Different Perspective

Alvopetro Energy provided a TSR of 46% over the last twelve months. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 23% per year over five year. This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Alvopetro Energy you should know about.

Of course Alvopetro Energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Alvopetro Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ALV

Alvopetro Energy

Engages in the acquisition, exploration, development, and production of hydrocarbons in Brazil and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives