- Canada

- /

- Oil and Gas

- /

- TSX:YGR

We Ran A Stock Scan For Earnings Growth And Yangarra Resources (TSE:YGR) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Yangarra Resources (TSE:YGR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Yangarra Resources

Yangarra Resources' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Yangarra Resources grew its EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

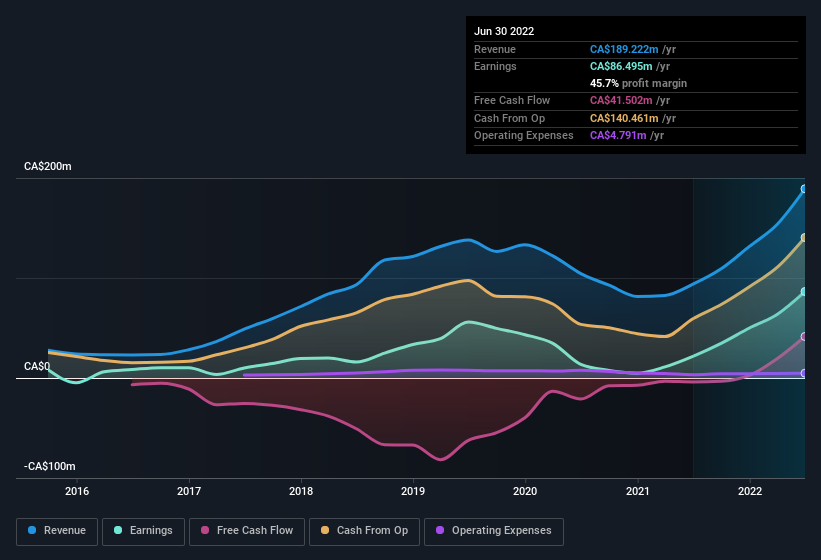

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Yangarra Resources shareholders is that EBIT margins have grown from 42% to 65% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Yangarra Resources is no giant, with a market capitalisation of CA$249m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Yangarra Resources Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Yangarra Resources shareholders can gain quiet confidence from the fact that insiders shelled out CA$350k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was Independent Director Frederick Morton who made the biggest single purchase, worth CA$85k, paying CA$3.04 per share.

The good news, alongside the insider buying, for Yangarra Resources bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$34m worth of shares. This considerable investment should help drive long-term value in the business. That amounts to 14% of the company, demonstrating a degree of high-level alignment with shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Yangarra Resources' CEO, Jim Evaskevich, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between CA$128m and CA$510m, like Yangarra Resources, the median CEO pay is around CA$887k.

The Yangarra Resources CEO received CA$671k in compensation for the year ending December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Yangarra Resources Worth Keeping An Eye On?

One important encouraging feature of Yangarra Resources is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. However, before you get too excited we've discovered 1 warning sign for Yangarra Resources that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Yangarra Resources isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:YGR

Yangarra Resources

A junior oil and gas company, engages in the exploration, development, and production of natural gas and conventional oil resource properties in Western Canada.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives