- Canada

- /

- Oil and Gas

- /

- TSX:WCP

Weekly Picks: 🛢️ WCP's Global Leverage, MSFT's AI Momentum, and CDPR's Upside Potential

Each week our analysts hand pick their favourite Narratives from the community ( what is a Narrative? ).

This week’s picks cover:

-

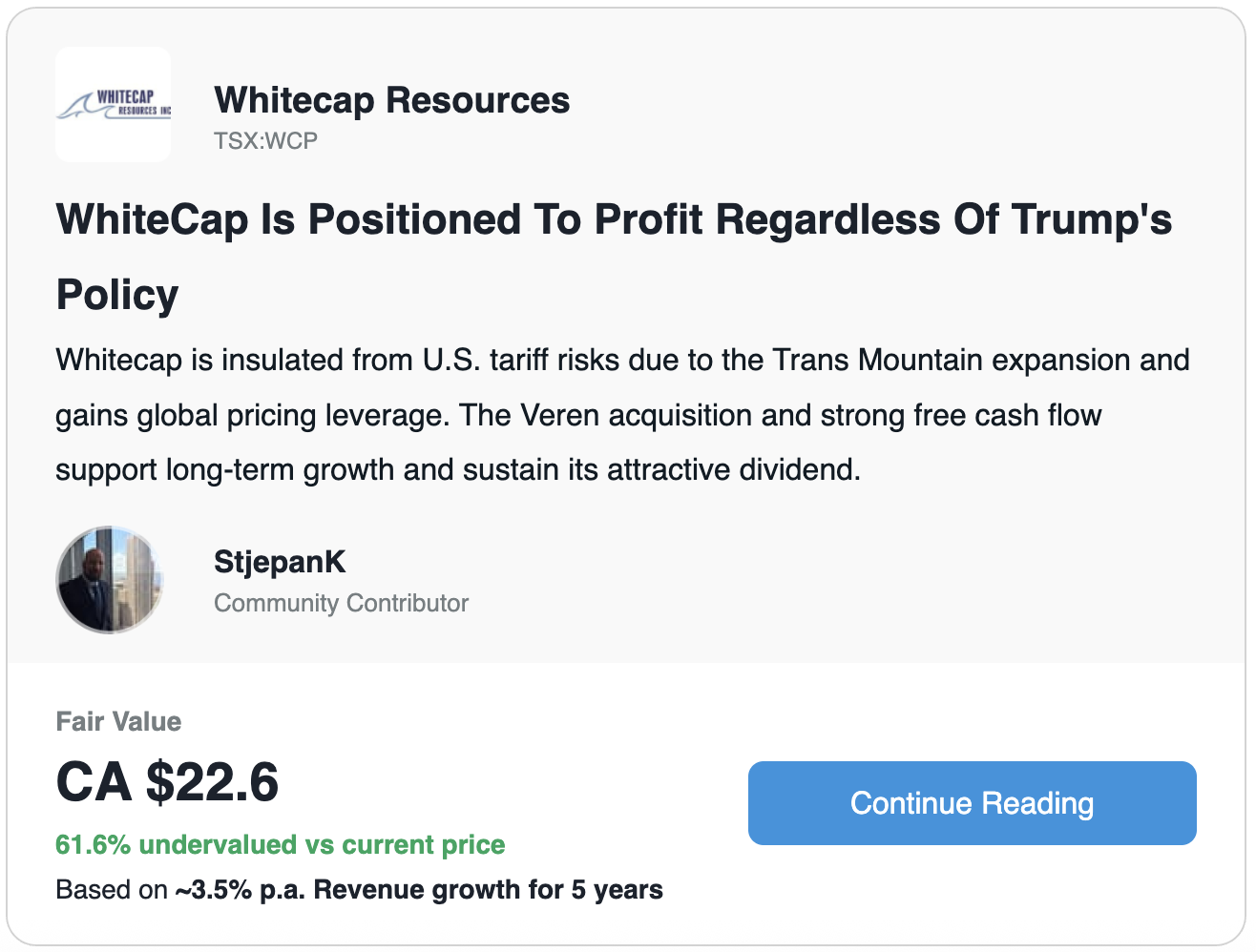

🛢️ Why Whitecap Resources can perform regardless of US policy decisions

-

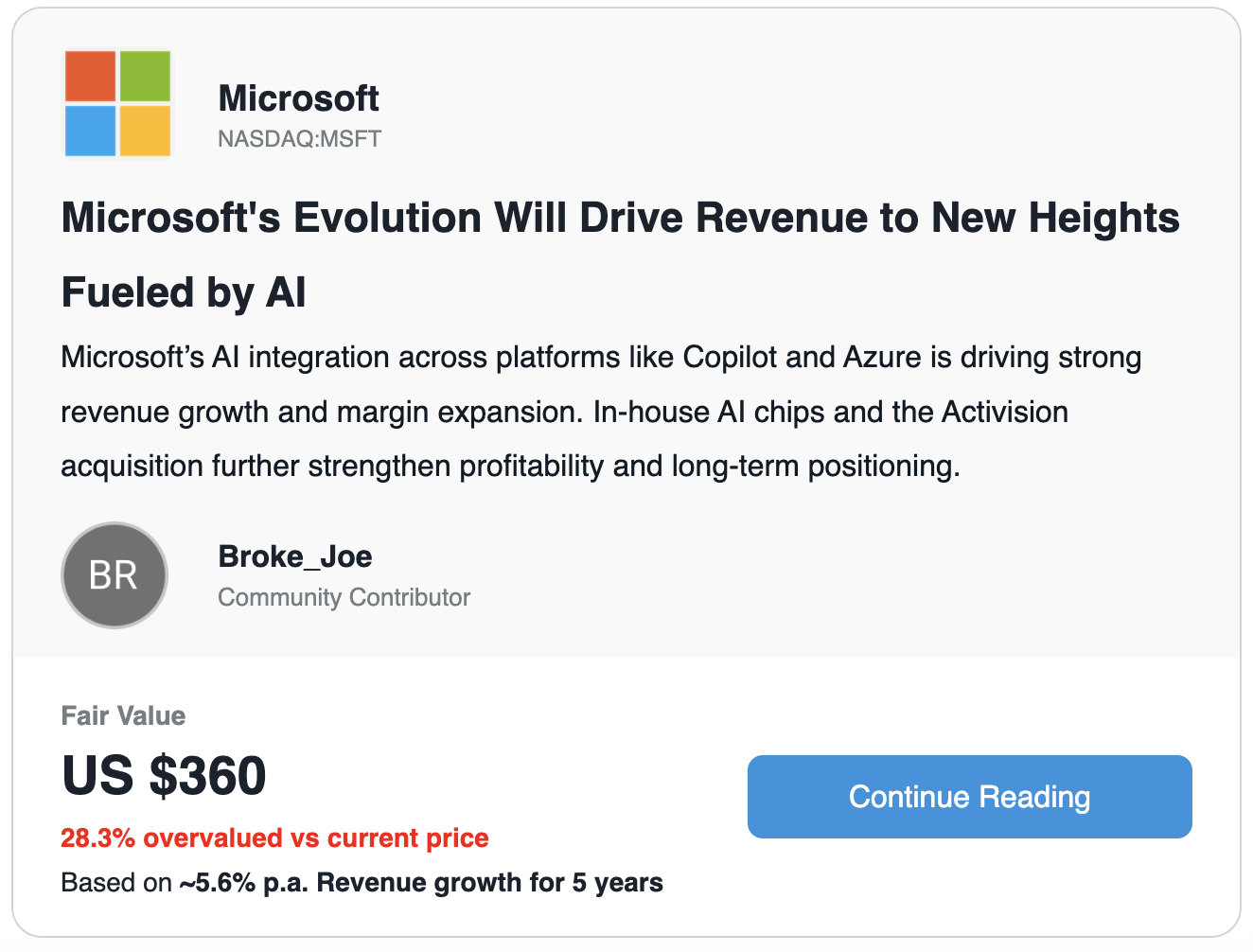

📈 Why Microsoft is exceptionally well positioned to grow in an AI world.

- 🪙 Why Cerro De Pasco’s possible shift from an explorer to producer could deliver big upside.

💡 Why we like it: It’s a sharp, well-reasoned narrative on a company balancing geopolitical risk with execution and scale. The author connects the macro dots of Trump, tariffs, and pipelines, with company-level discipline. The update on May 30th is great as a checkin.

💡 Why we like it: It has thoughtful risk analysis and growth expectations, explaining the upside potential. The base/bull/bear framing makes the possible scenarios easy to digest. However, we think the valuation may be using the bear case numbers, since it doesn’t match the base/bull case commentary.

💡 Why we like it: The author balances macro tailwinds (USD $100 silver, cheaper oil) with credible operational milestones, and ties it all together with thoughtful comps and valuation math. It could be considered a speculative pick, but the logic is tight and the risk/reward is clearly mapped out.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page .

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Whitecap Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About TSX:WCP

Whitecap Resources

Engages in the acquisition, development, and production of petroleum and natural gas properties and assets in Western Canada.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion