- Canada

- /

- Oil and Gas

- /

- TSX:WCP

How Whitecap’s July Dividend Announcement Will Impact Whitecap Resources (TSX:WCP) Investors

Reviewed by Simply Wall St

- Whitecap Resources confirmed that a cash dividend of CA$0.0608 per common share for July operations will be paid on August 15, 2025, to shareholders of record as of July 31, 2025.

- This repeated commitment to monthly dividends highlights Whitecap’s strengthened financial foundation and offers shareholders income stability amid ongoing sector volatility.

- Next, we’ll explore how Whitecap’s sustained dividend payments reinforce confidence in its earnings and operational reliability going forward.

Whitecap Resources Investment Narrative Recap

To be a Whitecap Resources shareholder, you need to believe in the company’s ability to sustain high production growth and maintain disciplined capital management across commodity cycles. The latest dividend confirmation for July reinforces Whitecap’s near-term commitment to returning cash to shareholders, but does not materially change the most important short-term catalyst: the expected integration benefits and cost savings from the Veren combination. The biggest risk remains sensitivity to oil price fluctuations, which could impact both dividends and debt leverage.

Among Whitecap’s recent updates, the announcement of a CA$300 million senior note offering on June 18, 2025, stands out. This move to refinance debt and strengthen their balance sheet ties in with the ongoing catalysts of improving financial flexibility and supporting dividend sustainability, which many investors see as key to Whitecap’s outlook for stable shareholder returns.

On the other hand, investors should be mindful of how sudden shifts in oil prices could still challenge Whitecap’s ability to maintain its...

Read the full narrative on Whitecap Resources (it's free!)

Whitecap Resources is projected to reach CA$3.8 billion in revenue and CA$559.2 million in earnings by 2028. This outlook assumes annual revenue growth of 3.3% but a decrease in earnings of CA$355.9 million from current earnings of CA$915.1 million.

Exploring Other Perspectives

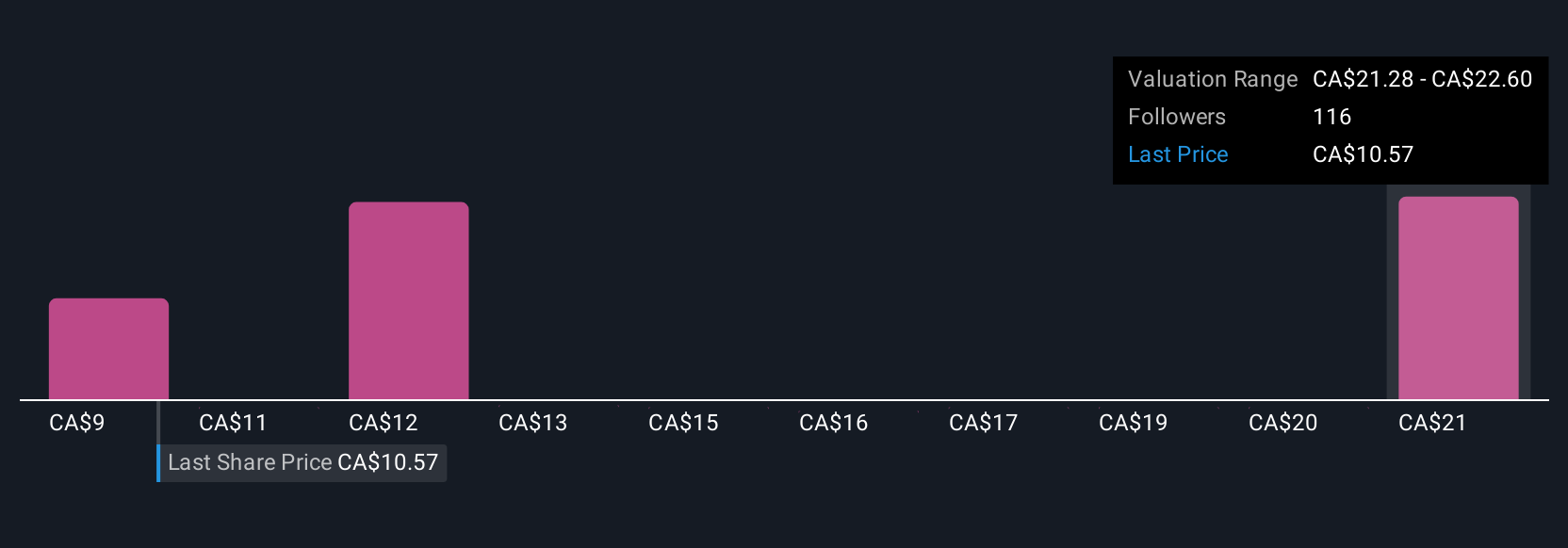

Nineteen different fair value estimates from the Simply Wall St Community span from CA$11 to over CA$37 per share, showing strong variance in outlooks. While many participants see potential for ongoing production gains and cost savings to support earnings, the company’s exposure to commodity price downturns remains a pressing concern.

Build Your Own Whitecap Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Whitecap Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Whitecap Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Whitecap Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whitecap Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WCP

Whitecap Resources

Engages in the acquisition, development, and production of petroleum and natural gas properties and assets in Western Canada.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives