- Canada

- /

- Oil and Gas

- /

- TSX:VRN

Veren (TSX:VRN) Reports Strong Q3 Earnings and Declares Dividend Amid Undervaluation Concerns

Reviewed by Simply Wall St

Navigate through the intricacies of Veren with our comprehensive report here.

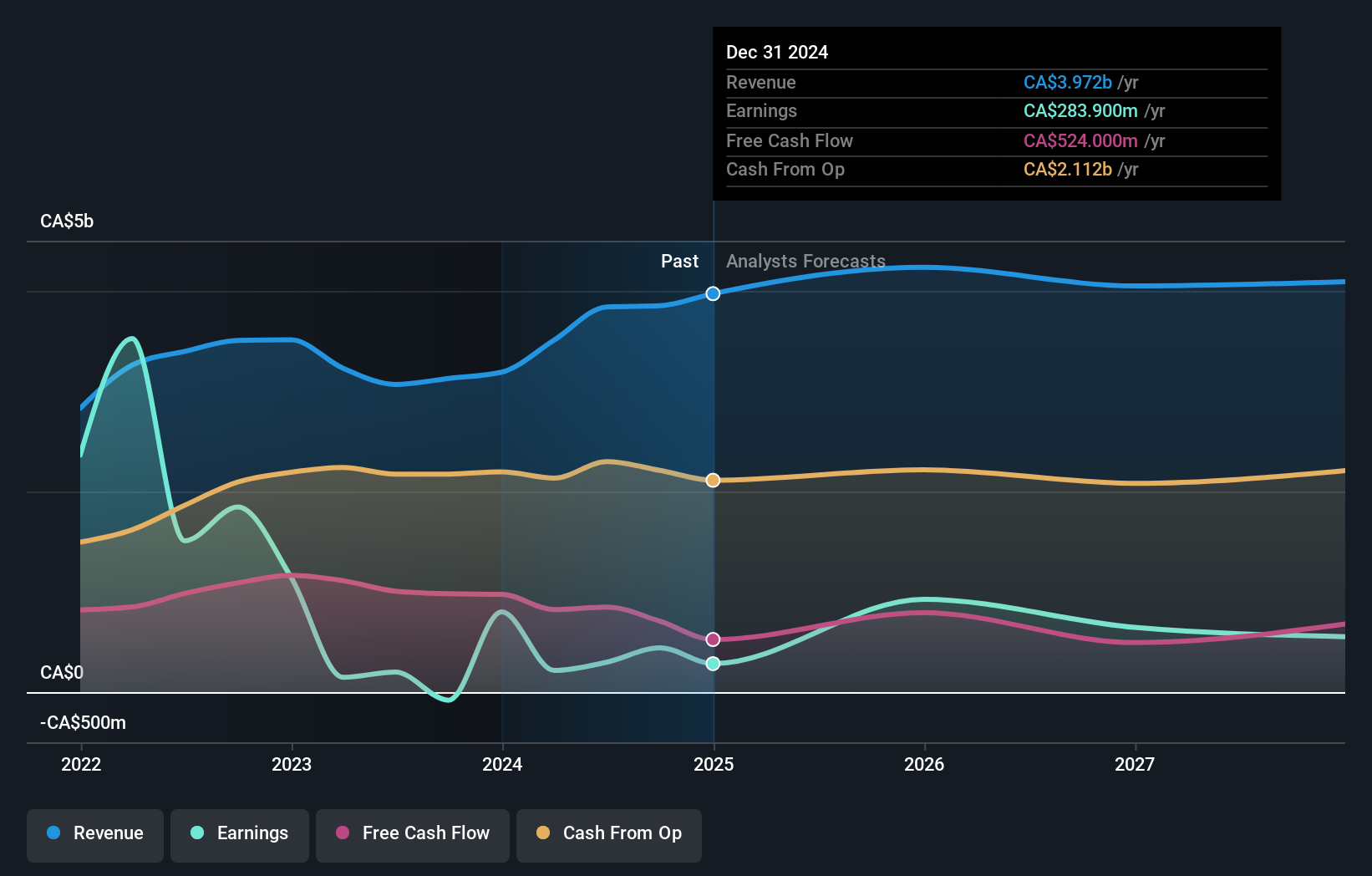

Unique Capabilities Enhancing Veren's Market Position

Veren has demonstrated strong financial health, becoming profitable over the past five years with an impressive earnings growth of 42.8% annually. This growth is supported by high-quality past earnings and a dividend yield of 6.43%, placing it among the top dividend payers in Canada. The leadership team, with an average tenure of 6.5 years, brings a wealth of experience that contributes to strategic decision-making and stability. The recent earnings report highlights a significant improvement, with third-quarter revenue reaching CAD 1.11 billion, a substantial increase from the previous year's CAD 830.7 million, and net income soaring to CAD 277.2 million from a loss of CAD 809.9 million. This financial performance underscores the company's ability to capitalize on market opportunities effectively. Furthermore, Veren is trading at 66.1% below its estimated fair value, indicating it is undervalued compared to industry peers, suggesting potential for future growth.

To gain deeper insights into Veren's historical performance, explore our detailed analysis of past performance.Vulnerabilities Impacting Veren

Despite the strong financial performance, Veren faces challenges with its revenue and earnings growth forecasted to be slower than the Canadian market average. The Return on Equity stands at a modest 6.6%, and the company's high net debt to equity ratio of 41.2% indicates significant leverage. Additionally, the dividend payments have been inconsistent over the past decade, which may concern investors. The company's valuation, while highlighting undervaluation, also reflects these financial challenges. Addressing these issues will be crucial for sustaining long-term growth.

To dive deeper into how Veren's valuation metrics are shaping its market position, check out our detailed analysis of Veren's Valuation.Areas for Expansion and Innovation for Veren

Analysts are optimistic about Veren's stock, predicting a potential price increase of over 20%. The company's strategic position is bolstered by trading at a favorable value compared to peers, offering opportunities for market expansion. The recent product launches have exceeded expectations, contributing to a 10% increase in market share, reflecting the company's commitment to innovation. These initiatives position Veren well to capitalize on emerging opportunities and enhance its market presence.

See what the latest analyst reports say about Veren's future prospects and potential market movements.Key Risks and Challenges That Could Impact Veren's Success

Veren faces several external threats, including shareholder dilution, with shares outstanding increasing by 17.3% last year. The high debt level poses financial risks, potentially impacting future operations. Additionally, the unstable dividend track record may deter potential investors. The company must navigate these challenges carefully to maintain its competitive edge and ensure continued growth.

Learn about Veren's dividend strategy and how it impacts shareholder returns and financial stability.Conclusion

Veren's strong financial health, evidenced by a 42.8% annual earnings growth and a significant improvement in net income, highlights its capability to effectively seize market opportunities. The leadership's strategic acumen and the company's high dividend yield reinforce its position as a top dividend payer in Canada. Challenges such as modest Return on Equity and high debt levels necessitate careful management to sustain growth. With its stock trading at 66.1% below estimated fair value, Veren presents a compelling investment opportunity, provided it addresses its financial vulnerabilities and capitalizes on its innovation-driven market expansion potential.

Summing It All Up

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:VRN

Veren

Engages in acquiring, developing, and holding interests in petroleum assets operations across western Canada.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives