- Canada

- /

- Oil and Gas

- /

- TSX:VLE

There's No Escaping Valeura Energy Inc.'s (TSE:VLE) Muted Earnings Despite A 28% Share Price Rise

Valeura Energy Inc. (TSE:VLE) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

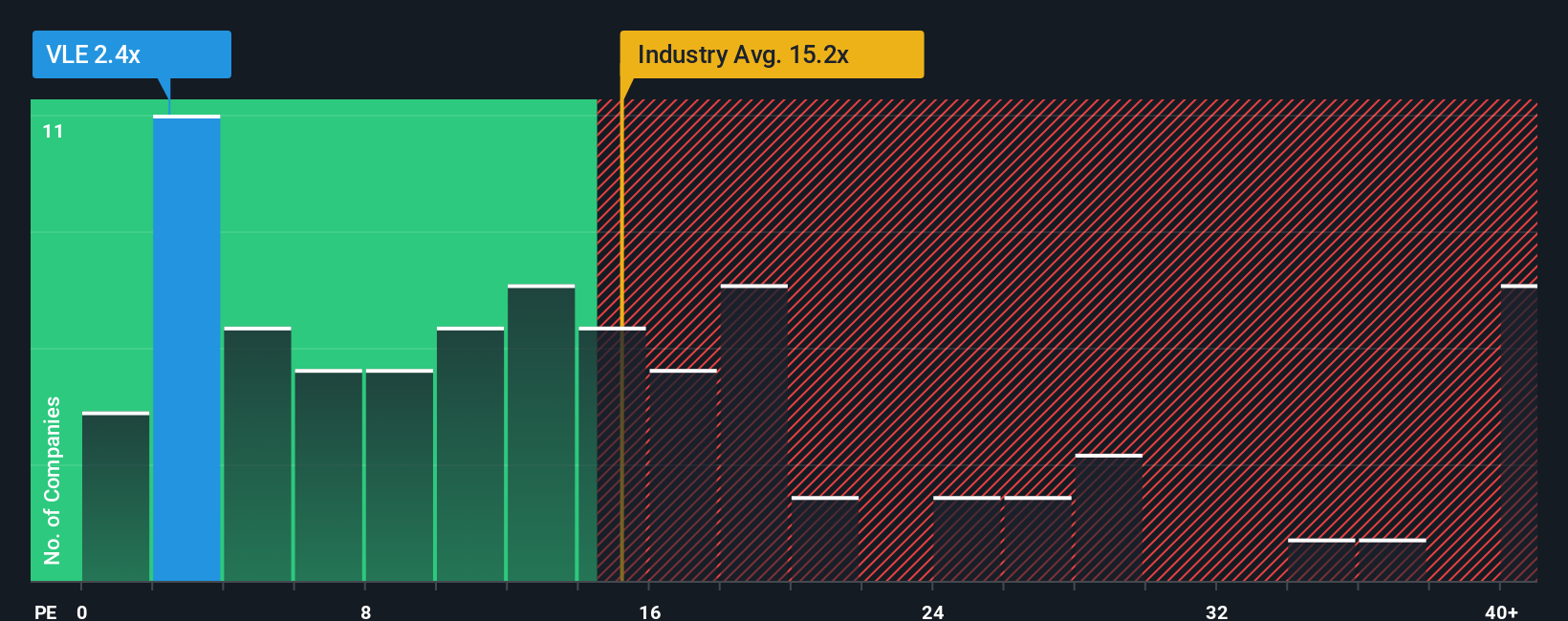

Even after such a large jump in price, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 17x, you may still consider Valeura Energy as a highly attractive investment with its 2.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's superior to most other companies of late, Valeura Energy has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Valeura Energy

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Valeura Energy's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 387%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 73% during the coming year according to the three analysts following the company. That's not great when the rest of the market is expected to grow by 23%.

With this information, we are not surprised that Valeura Energy is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Valeura Energy's P/E?

Shares in Valeura Energy are going to need a lot more upward momentum to get the company's P/E out of its slump. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Valeura Energy maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Valeura Energy that you should be aware of.

Of course, you might also be able to find a better stock than Valeura Energy. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VLE

Valeura Energy

Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026