- Canada

- /

- Oil and Gas

- /

- TSX:VLE

The Valeura Energy (TSE:VLE) Share Price Has Soared 545%, Delighting Many Shareholders

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the Valeura Energy Inc. (TSE:VLE) share price has soared 545% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 12% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

We love happy stories like this one. The company should be really proud of that performance!

View our latest analysis for Valeura Energy

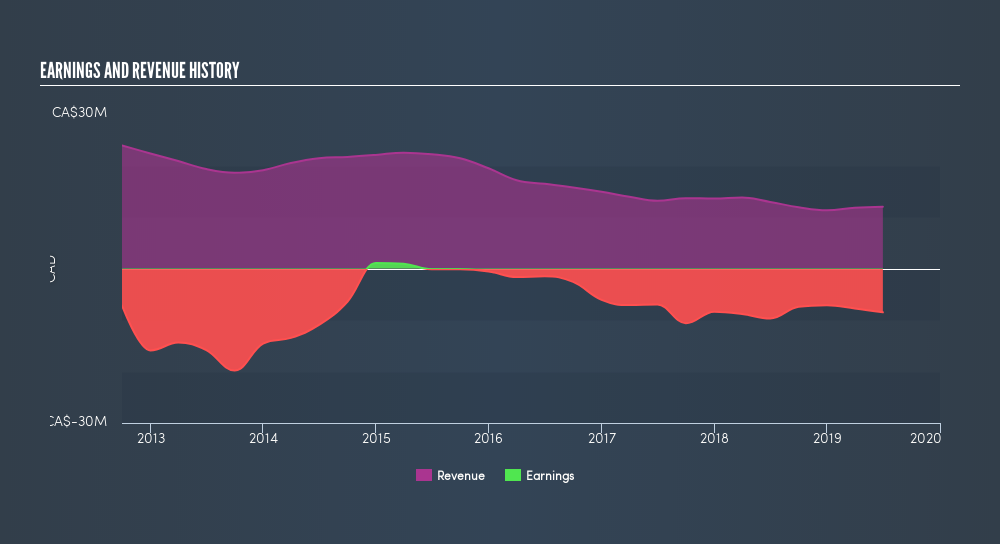

Valeura Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade Valeura Energy's revenue has actually been trending down at about 15% per year. So it's pretty surprising to see that the share price is up 45% per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. I think it's fair to say there is probably a fair bit of excitement in the price.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Valeura Energy will earn in the future (free profit forecasts).

A Different Perspective

Valeura Energy shareholders are down 34% for the year, but the market itself is up 0.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 45%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Valeura Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:VLE

Valeura Energy

Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives