Global's Undervalued Small Caps With Insider Action In December 2025

Reviewed by Simply Wall St

In December 2025, global markets are navigating a complex landscape marked by mixed economic signals and varied performances across major indices. While the Russell 2000 Index saw a decline of 0.86%, reflecting challenges in the small-cap sector, broader market sentiment was buoyed by positive inflation data and strong earnings reports from key players like Micron Technology. In this environment, identifying promising small-cap stocks involves looking for companies that demonstrate resilience amid economic fluctuations and have strategic insider actions that may signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paragon Care | 16.1x | 0.1x | 27.83% | ★★★★★☆ |

| Centurion | 3.7x | 3.1x | -55.06% | ★★★★☆☆ |

| Chinasoft International | 21.2x | 0.7x | -1189.74% | ★★★★☆☆ |

| BWP Trust | 11.0x | 14.4x | 11.25% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.00% | ★★★★☆☆ |

| Dicker Data | 22.3x | 0.8x | -46.39% | ★★★☆☆☆ |

| Amaero | NA | 65.0x | 31.10% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.3x | 0.4x | -411.25% | ★★★☆☆☆ |

| PSC | 9.8x | 0.4x | 19.71% | ★★★☆☆☆ |

| Nufarm | NA | 0.3x | -126.94% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Virgin Australia Holdings (ASX:VGN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Virgin Australia Holdings operates as a major airline company in Australia, offering domestic and international air travel services, with a market cap of A$2.5 billion.

Operations: The company's primary revenue streams are from its Airlines and Velocity segments, with a significant contribution of A$5.58 billion and A$450 million, respectively. The gross profit margin has shown an upward trend in recent periods, reaching 30.33% as of June 2024. Operating expenses include notable allocations towards sales and marketing, which were A$421.4 million in the latest quarter ending December 2024.

PE: 5.4x

Virgin Australia Holdings, a notable player among smaller companies, recently joined the S&P Global BMI Index on December 20, 2025. This inclusion could enhance visibility and attract new investors. Despite carrying significant debt due to reliance on external borrowing, insider confidence is evident with purchase activities over the past year. Such moves suggest belief in potential growth or value realization. The company's financial position reflects no negative equity but highlights higher risk funding sources without customer deposits.

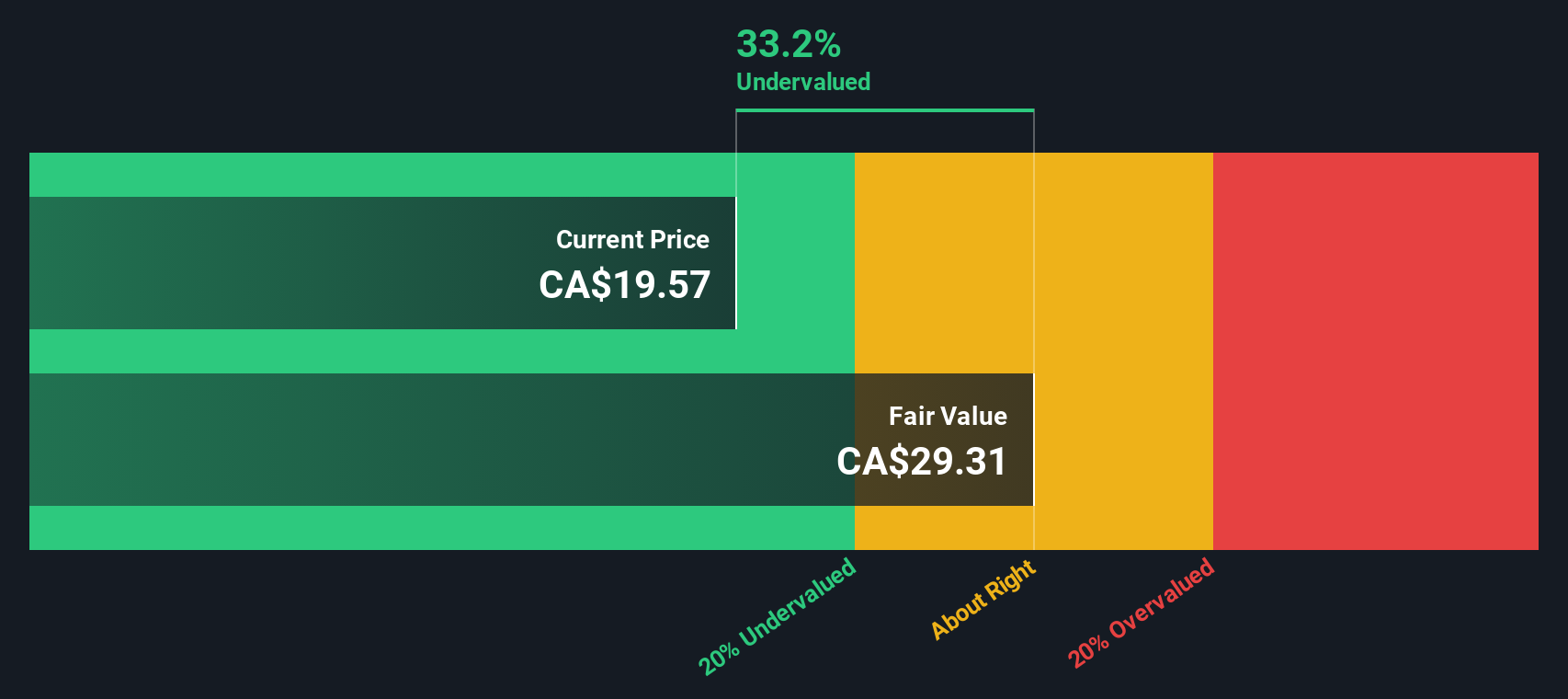

Killam Apartment REIT (TSX:KMP.UN)

Simply Wall St Value Rating: ★★★★★☆

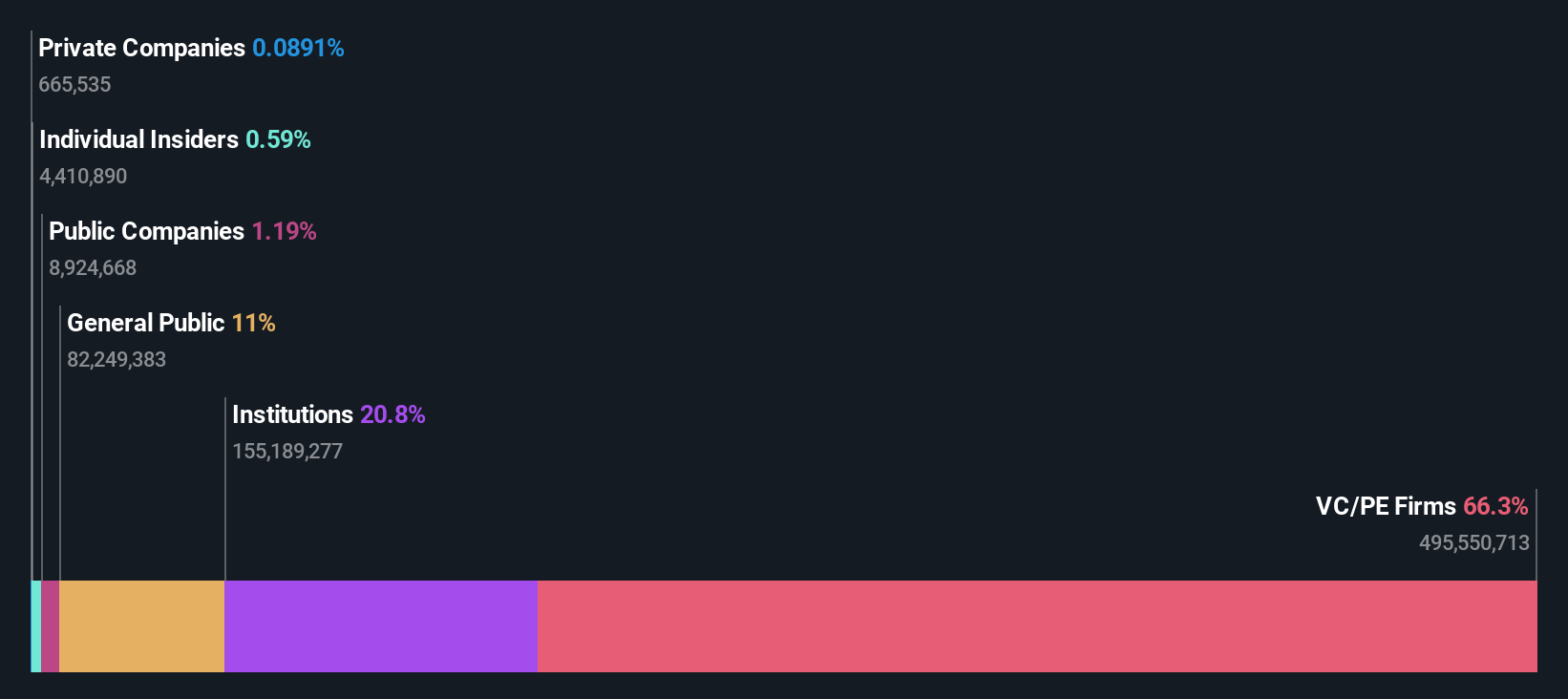

Overview: Killam Apartment REIT is a Canadian real estate investment trust primarily engaged in owning, operating, and developing apartment buildings, commercial properties, and manufactured home communities with a market capitalization of approximately CA$2.16 billion.

Operations: Killam Apartment REIT generates revenue primarily from its apartment segment, with additional contributions from commercial properties and manufactured home communities. The company has shown a gross profit margin reaching 66.57% as of the latest period. Operating expenses have fluctuated, but recent data indicates an increase to CA$22.75 million for the quarter ending June 2025.

PE: 3.7x

Killam Apartment REIT, a smaller player in the real estate sector, has shown resilience despite financial challenges. Their third-quarter 2025 sales reached C$98.47 million, up from C$93.79 million the previous year, though net income decreased to C$41.86 million from C$62.73 million. Despite relying solely on external borrowing for funding and having interest payments not fully covered by earnings, insider confidence remains high with recent purchases indicating potential long-term faith in its prospects.

- Dive into the specifics of Killam Apartment REIT here with our thorough valuation report.

Understand Killam Apartment REIT's track record by examining our Past report.

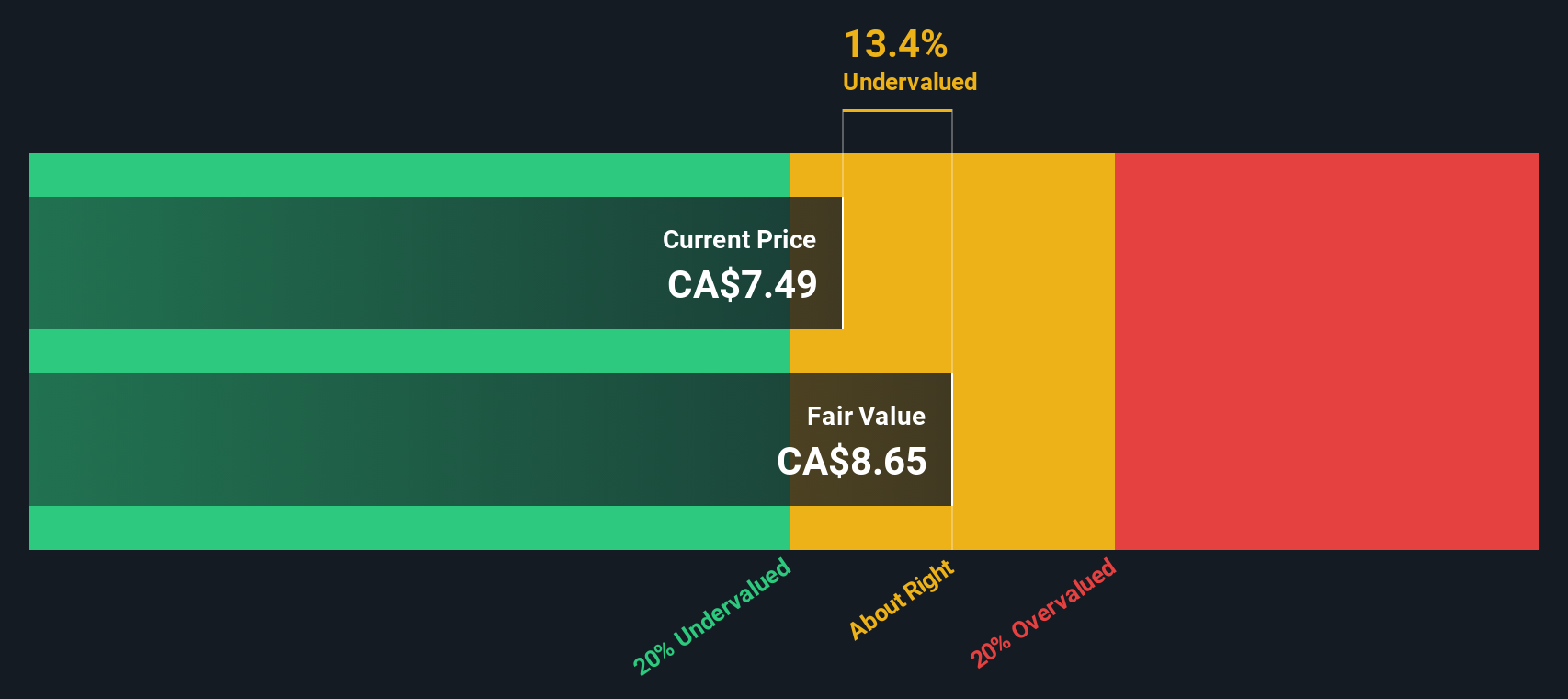

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★★

Overview: Valeura Energy is an oil and gas exploration and production company with a focus on developing assets, primarily generating revenue from its operations in this sector, and it has a market capitalization of approximately $2.4 billion.

Operations: The primary revenue stream is from oil and gas exploration and production, with a reported revenue of $667.89 million. The cost of goods sold (COGS) for the same period was $187.35 million, resulting in a gross profit margin of 71.95%. Operating expenses amounted to $262.02 million, which includes significant depreciation and amortization costs at $185.54 million, impacting overall profitability despite positive net income figures in recent periods.

PE: 2.6x

Valeura Energy, a smaller company in the energy sector, recently announced a share repurchase program to buy back up to 6.3 million shares, reflecting insider confidence in its potential. For Q3 2025, they reported US$159 million in revenue and US$15.81 million net income, reversing last year's loss. Production guidance for 2025 remains strong with daily oil output expected between 23 and 25.5 mbbls/d. Despite high-risk funding from external borrowing and projected earnings decline over three years, their recent performance suggests resilience amidst industry challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Valeura Energy.

Examine Valeura Energy's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click here to access our complete index of 148 Undervalued Global Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VGN

Virgin Australia Holdings

Provides domestic and international travel services to leisure, corporate and government, regional and charter travel, and air freight customers in Australia.

Fair value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion