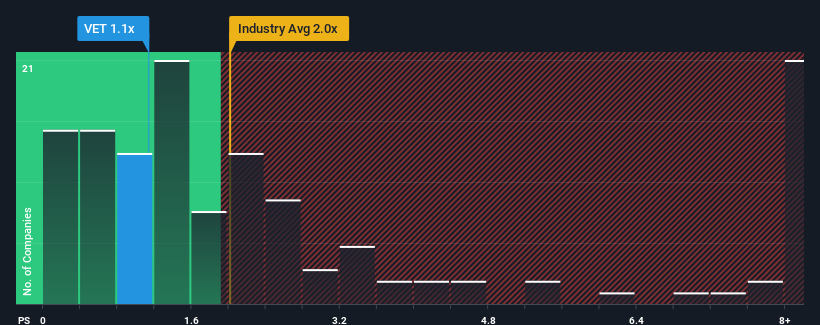

You may think that with a price-to-sales (or "P/S") ratio of 1.1x Vermilion Energy Inc. (TSE:VET) is a stock worth checking out, seeing as almost half of all the Oil and Gas companies in Canada have P/S ratios greater than 2x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Vermilion Energy

What Does Vermilion Energy's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Vermilion Energy's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Vermilion Energy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Vermilion Energy?

In order to justify its P/S ratio, Vermilion Energy would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. Even so, admirably revenue has lifted 47% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 3.0% per year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 1.3% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Vermilion Energy's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Vermilion Energy remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Vermilion Energy, and understanding should be part of your investment process.

If you're unsure about the strength of Vermilion Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VET

Vermilion Energy

An oil and gas producer, focuses on the acquisition, exploration, development, and optimization of producing properties in North America, Europe, and Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives