- Canada

- /

- Oil and Gas

- /

- TSX:URC

Uranium Royalty Corp.'s (TSE:URC) 35% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Uranium Royalty Corp. (TSE:URC) shares have been powering on, with a gain of 35% in the last thirty days. The last 30 days bring the annual gain to a very sharp 66%.

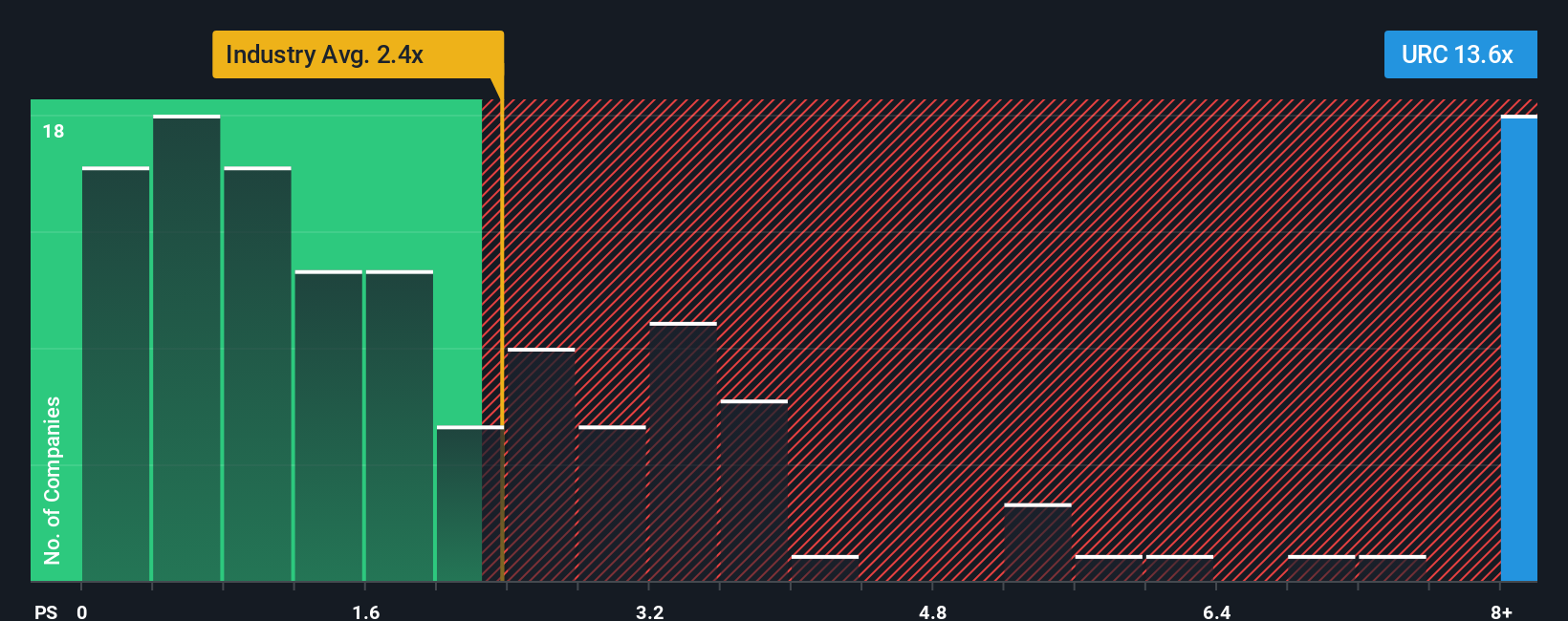

After such a large jump in price, you could be forgiven for thinking Uranium Royalty is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.6x, considering almost half the companies in Canada's Oil and Gas industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Uranium Royalty

How Has Uranium Royalty Performed Recently?

Recent revenue growth for Uranium Royalty has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Uranium Royalty.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Uranium Royalty's to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 29% during the coming year according to the two analysts following the company. That's not great when the rest of the industry is expected to grow by 5.1%.

With this in mind, we find it intriguing that Uranium Royalty's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Key Takeaway

Shares in Uranium Royalty have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Uranium Royalty currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Uranium Royalty with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:URC

Uranium Royalty

Operates as a pure-play uranium royalty company in Canada, the United States, Namibia, and Spain.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success