- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Undiscovered Gems in Canada Featuring Hammond Power Solutions and 2 Other Promising Small Caps

Reviewed by Simply Wall St

As we head into the fourth quarter, Canadian markets have shown resilience despite initial volatility, with the TSX gaining over 14% this year. Amidst geopolitical tensions and economic uncertainties, solid fundamentals in both U.S. and Canadian economies provide a backdrop for exploring promising small-cap stocks like Hammond Power Solutions. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors seeking undiscovered gems in Canada's market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

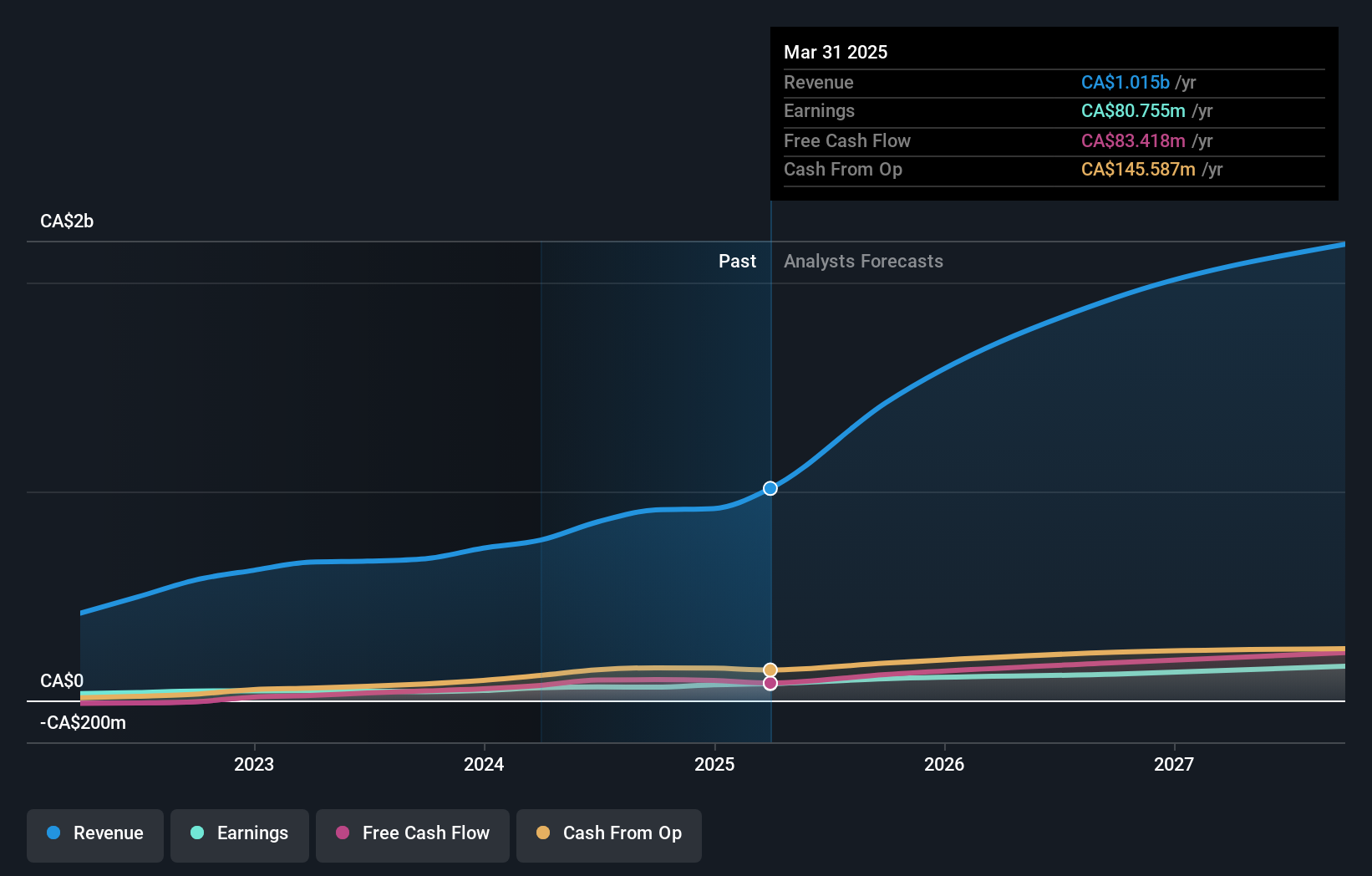

Overview: Hammond Power Solutions Inc. designs, manufactures, and sells a variety of transformers across Canada, the United States, Mexico, and India with a market capitalization of CA$1.71 billion.

Operations: Hammond Power Solutions generates revenue primarily from the manufacture and sale of transformers, with reported sales amounting to CA$754.37 million.

Hammond Power Solutions, a notable player in the electrical industry, has demonstrated impressive financial health with earnings growing 12.3% over the past year, surpassing the industry's 9.3%. The company trades at a value 36% below estimated fair value and has reduced its debt-to-equity ratio from 27.7% to just 5% over five years. Despite recent insider selling, Hammond's high-quality earnings and well-covered interest payments (87.6x EBIT coverage) suggest robust operational performance.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

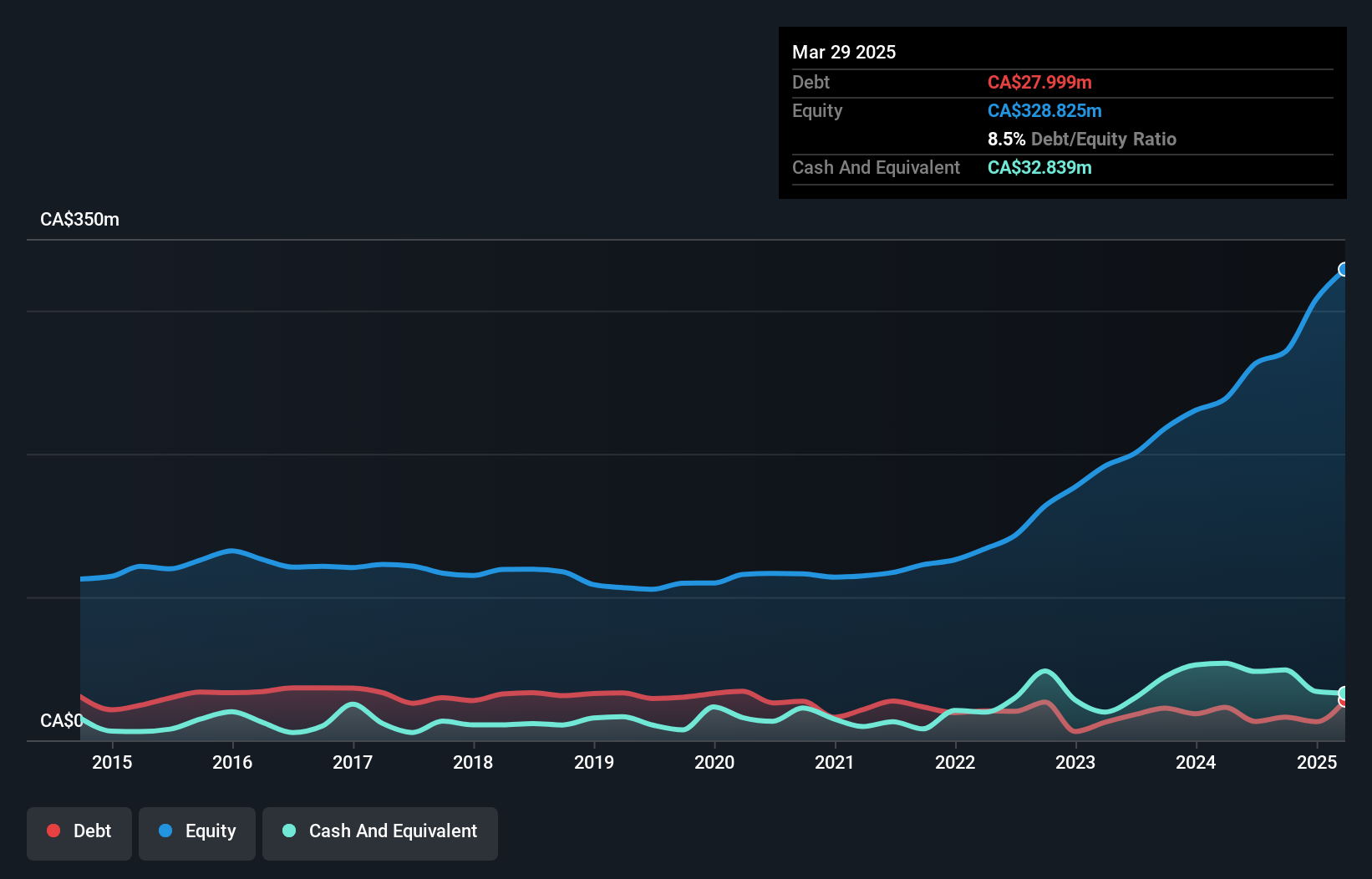

Overview: Silvercorp Metals Inc. is a company that, along with its subsidiaries, focuses on acquiring, exploring, developing, and mining mineral properties and has a market capitalization of CA$1.39 billion.

Operations: Silvercorp Metals generates revenue primarily from its mining operations, with $27.35 million coming from Guangdong and $200 million from Henan Luoning.

Silvercorp Metals, a nimble player in the mining sector, showcases impressive financial health with no debt and high-quality earnings. The company's recent renewal of the SGX Mine permit for 11 years increases capacity to 500,000 tonnes annually. Earnings surged by 149% last year, outpacing industry growth of 2.8%. Trading at a significant discount to its estimated fair value enhances its appeal. Despite some shareholder dilution recently, Silvercorp's strategic buyback plan aims to bolster share value further.

- Navigate through the intricacies of Silvercorp Metals with our comprehensive health report here.

Understand Silvercorp Metals' track record by examining our Past report.

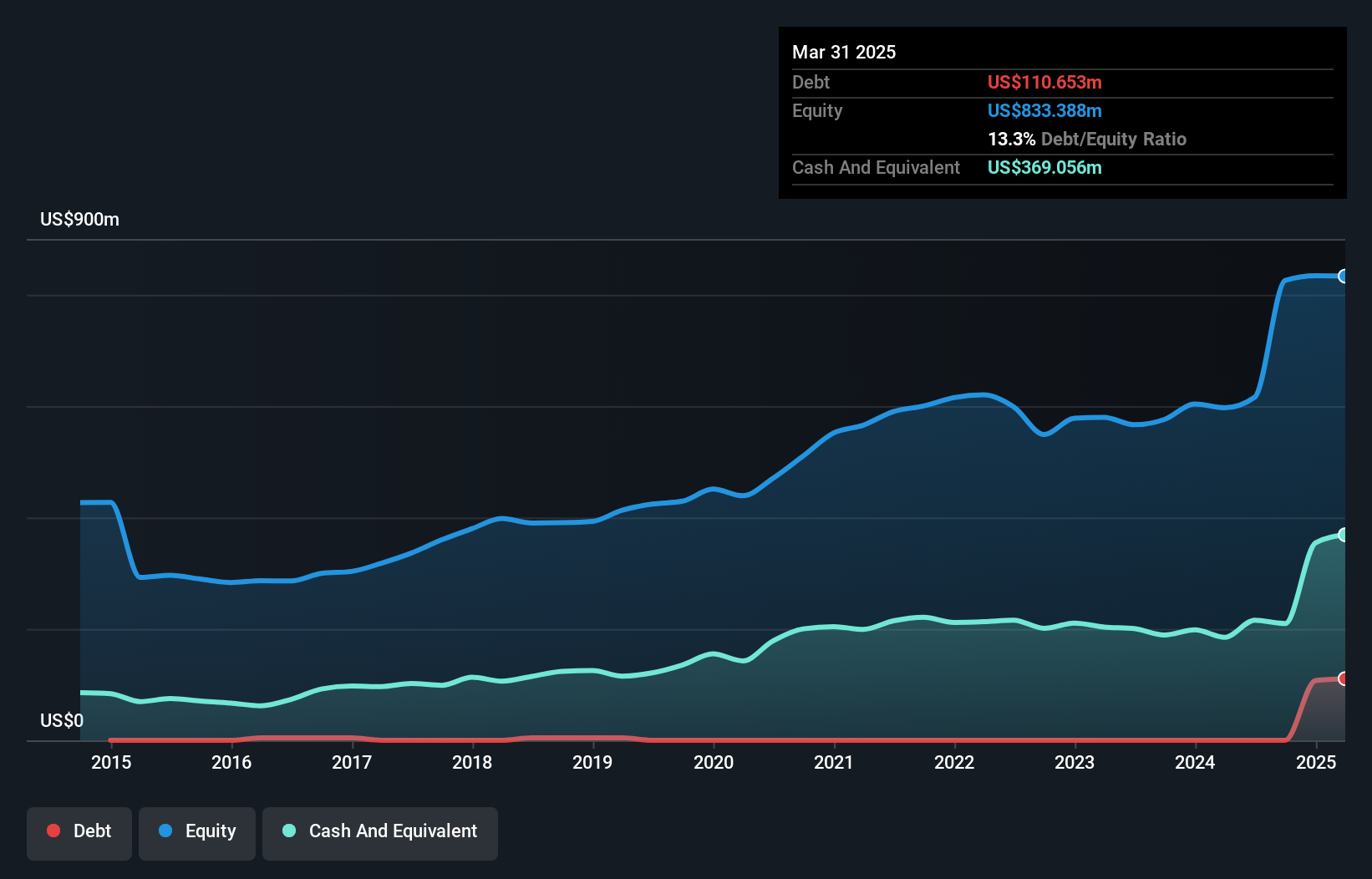

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States, with a market cap of CA$1.90 billion.

Operations: TerraVest Industries derives its revenue primarily from HVAC and Containment Equipment (CA$292.90 million) and Compressed Gas Equipment (CA$243.77 million), with additional contributions from Service (CA$201.78 million) and Processing Equipment (CA$117.58 million). The Corporate segment shows a negative contribution of CA$0.93 million to the overall revenue mix, impacting the company's financial structure.

TerraVest Industries, a promising player in its sector, has demonstrated notable growth with earnings rising 43.6% over the past year, outpacing the industry average. The firm's debt to equity ratio has impressively decreased from 117.9% to 49.4% over five years, showcasing financial prudence. Trading at a value below estimated fair worth by 22.7%, it offers potential upside for investors seeking value opportunities in Canada’s market landscape while maintaining high-quality earnings and well-covered interest payments (5x EBIT).

Key Takeaways

- Discover the full array of 48 TSX Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026