As we head into the second half of 2025, the Canadian market is navigating a landscape influenced by ongoing trade negotiations and potential tariff adjustments, with particular attention on developments between major global economies like the U.S. and China. Despite these uncertainties, investors can find opportunities in stocks that are estimated to be trading below their intrinsic value, offering potential for growth even amidst fluctuating economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Timbercreek Financial (TSX:TF) | CA$7.51 | CA$10.98 | 31.6% |

| TerraVest Industries (TSX:TVK) | CA$168.83 | CA$297.69 | 43.3% |

| Teck Resources (TSX:TECK.B) | CA$53.16 | CA$73.14 | 27.3% |

| OceanaGold (TSX:OGC) | CA$6.87 | CA$12.20 | 43.7% |

| Magna Mining (TSXV:NICU) | CA$1.78 | CA$3.09 | 42.3% |

| Magellan Aerospace (TSX:MAL) | CA$19.05 | CA$37.84 | 49.7% |

| Lithium Royalty (TSX:LIRC) | CA$5.35 | CA$8.57 | 37.5% |

| Kolibri Global Energy (TSX:KEI) | CA$9.64 | CA$17.71 | 45.6% |

| Aris Mining (TSX:ARIS) | CA$9.38 | CA$13.08 | 28.3% |

| Alphamin Resources (TSXV:AFM) | CA$0.87 | CA$1.33 | 34.6% |

Underneath we present a selection of stocks filtered out by our screen.

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation operates in aerospace and aviation services and equipment, as well as manufacturing businesses globally, with a market cap of CA$2.94 billion.

Operations: The company's revenue segments include CA$1.66 billion from aerospace and aviation services and equipment, and CA$1.07 billion from manufacturing businesses.

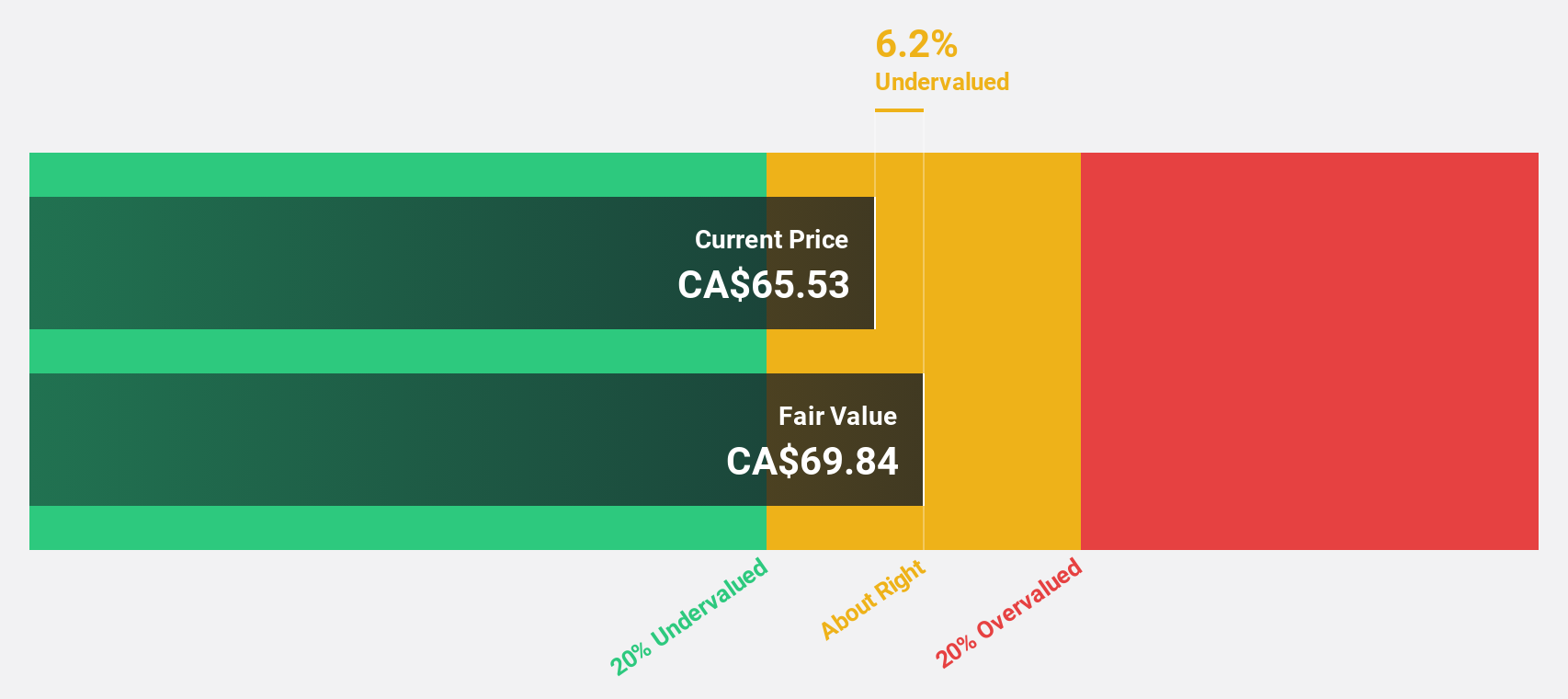

Estimated Discount To Fair Value: 16.4%

Exchange Income is trading at CA$57.74, below its fair value estimate of CA$69.07, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 24.66% annually over the next three years, outpacing the Canadian market's growth rate. However, its dividend yield of 4.57% is not well covered by earnings or free cash flows, and interest payments are not adequately covered by earnings despite a recent credit facility upsize to $3 billion.

- The analysis detailed in our Exchange Income growth report hints at robust future financial performance.

- Click here to discover the nuances of Exchange Income with our detailed financial health report.

Magellan Aerospace (TSX:MAL)

Overview: Magellan Aerospace Corporation, with a market cap of CA$1.03 billion, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe through its subsidiaries.

Operations: The company's revenue segment primarily consists of CA$968.02 million from the aerospace market, focusing on aeroengine and aerostructure components across Canada, the United States, and Europe.

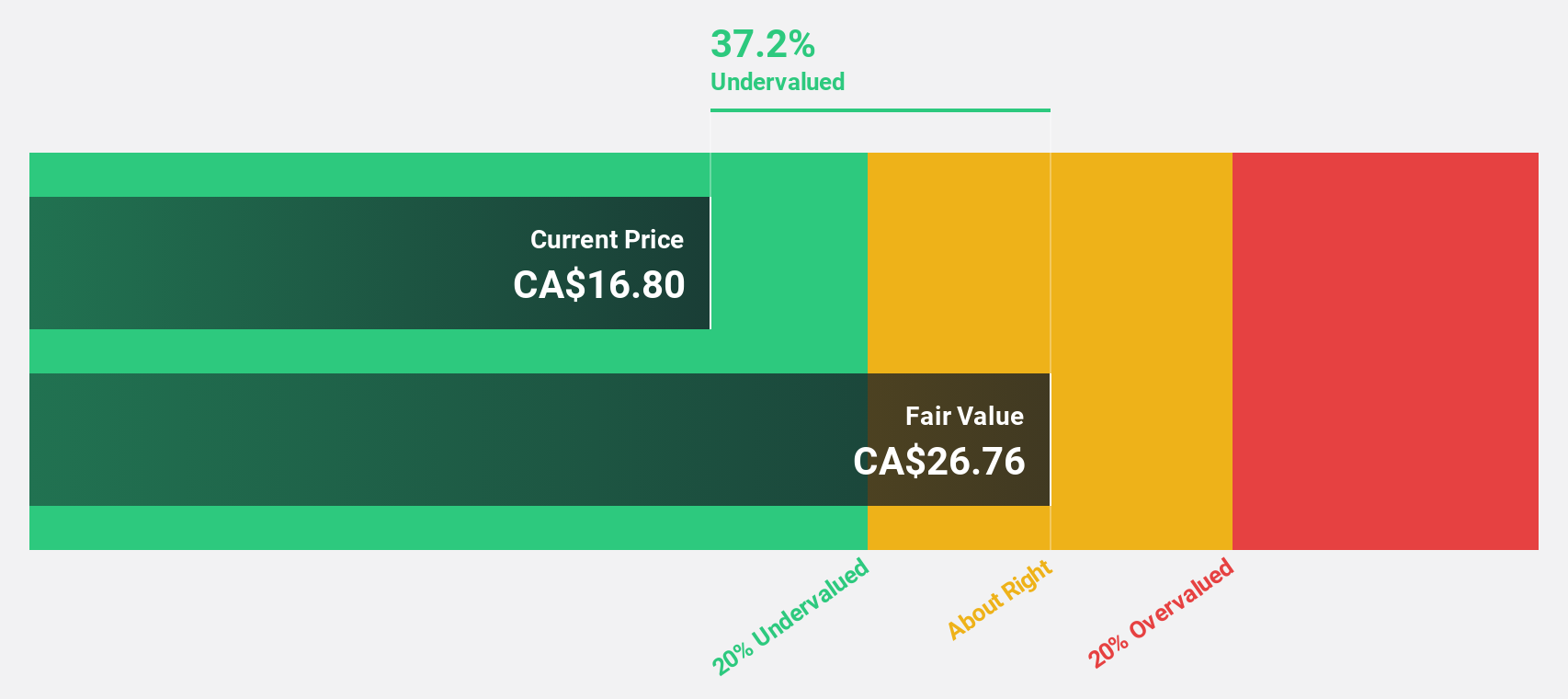

Estimated Discount To Fair Value: 49.7%

Magellan Aerospace is trading at CA$19.05, significantly below its fair value estimate of CA$37.84, highlighting potential undervaluation based on cash flows. Recent earnings growth of 242% and forecasted annual profit growth of over 32% outpace the Canadian market's average. Despite slower revenue growth projections compared to profits, recent agreements with Pratt & Whitney Canada and GE Aerospace enhance its long-term revenue prospects, supported by strategic investments in manufacturing capabilities.

- Our earnings growth report unveils the potential for significant increases in Magellan Aerospace's future results.

- Click to explore a detailed breakdown of our findings in Magellan Aerospace's balance sheet health report.

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services to various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction across Canada, the United States, and internationally with a market cap of CA$3.61 billion.

Operations: The company's revenue segments include CA$216.52 million from Service, CA$104.18 million from Processing Equipment, CA$336.15 million from Compressed Gas Equipment, and CA$363.00 million from HVAC and Containment Equipment.

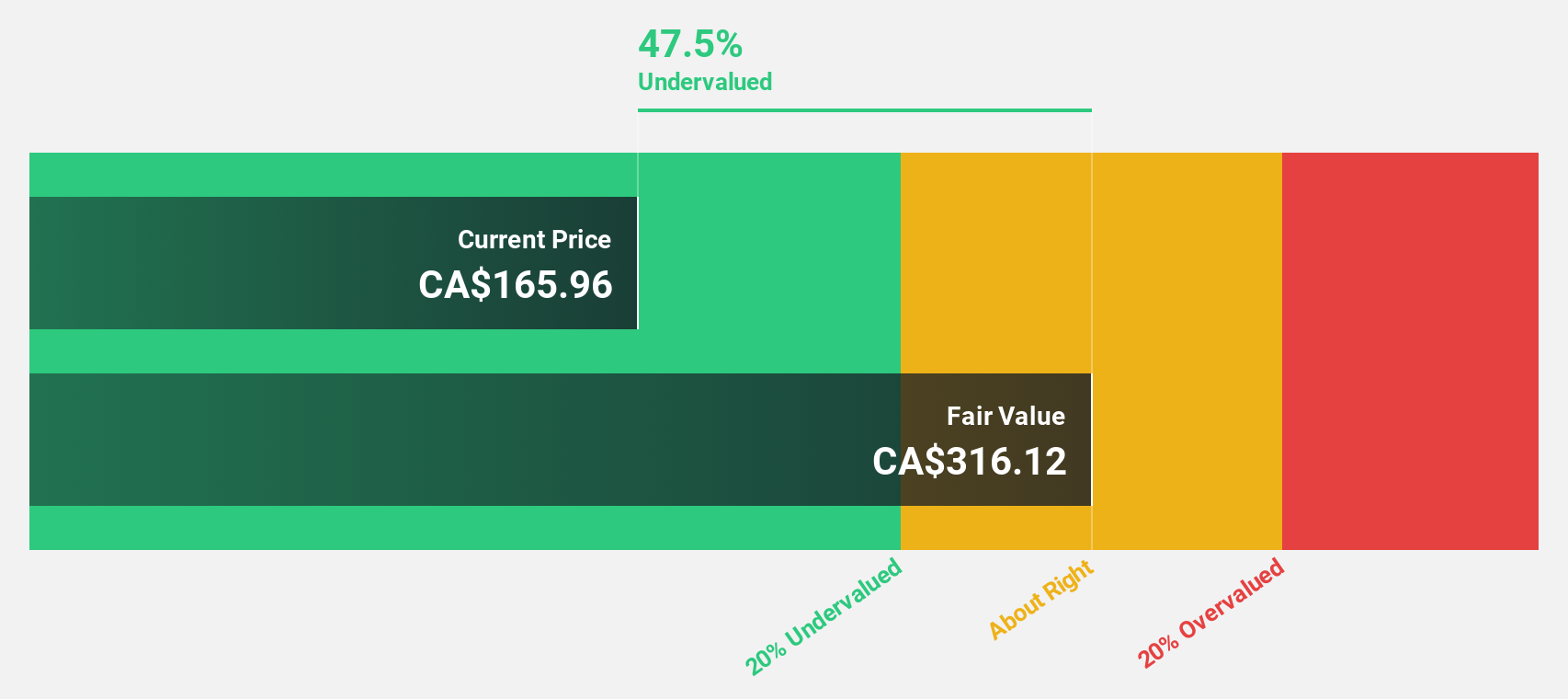

Estimated Discount To Fair Value: 43.3%

TerraVest Industries is trading at CA$168.83, significantly below its estimated fair value of CA$297.69, suggesting undervaluation based on cash flows. Recent earnings grew by 32.4%, with forecasts predicting annual profit growth of 26.8%, surpassing the Canadian market average. Despite strong revenue growth projections, recent significant insider selling and debt not well covered by operating cash flow present potential concerns for investors evaluating its financial health and stability.

- Our comprehensive growth report raises the possibility that TerraVest Industries is poised for substantial financial growth.

- Get an in-depth perspective on TerraVest Industries' balance sheet by reading our health report here.

Taking Advantage

- Reveal the 19 hidden gems among our Undervalued TSX Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion