The board of TerraVest Industries Inc. (TSE:TVK) has announced that it will pay a dividend of CA$0.10 per share on the 10th of January. This payment means the dividend yield will be 1.4%, which is below the average for the industry.

Check out our latest analysis for TerraVest Industries

TerraVest Industries' Earnings Easily Cover the Distributions

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, TerraVest Industries' dividend was only 20% of earnings, however it was paying out 180% of free cash flows. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

Over the next year, EPS could expand by 38.0% if recent trends continue. If the dividend continues on this path, the payout ratio could be 14% by next year, which we think can be pretty sustainable going forward.

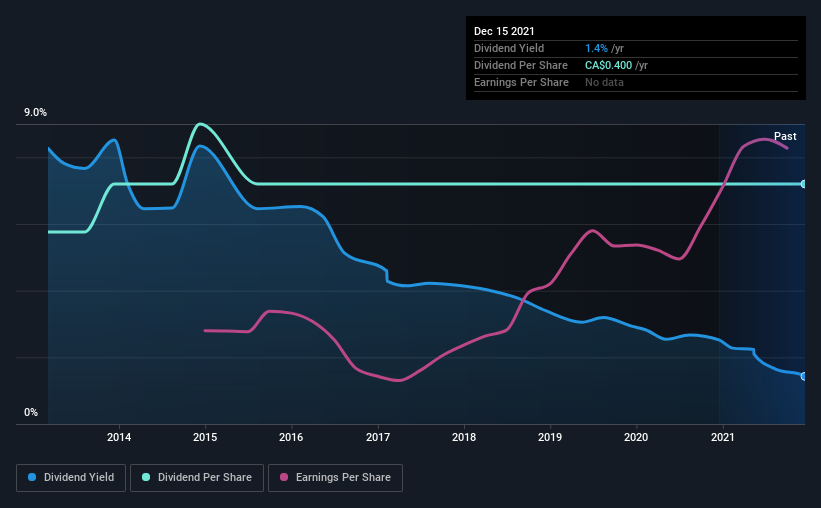

TerraVest Industries' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. This suggests that the dividend might not be the most reliable. The dividend has gone from CA$0.32 in 2012 to the most recent annual payment of CA$0.40. This works out to be a compound annual growth rate (CAGR) of approximately 2.5% a year over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. TerraVest Industries has seen EPS rising for the last five years, at 38% per annum. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While TerraVest Industries is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for TerraVest Industries that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Proven track record and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026