- Canada

- /

- Energy Services

- /

- TSX:TVK

Is Now The Time To Put TerraVest Industries (TSE:TVK) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like TerraVest Industries (TSE:TVK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide TerraVest Industries with the means to add long-term value to shareholders.

See our latest analysis for TerraVest Industries

TerraVest Industries' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that TerraVest Industries has managed to grow EPS by 27% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

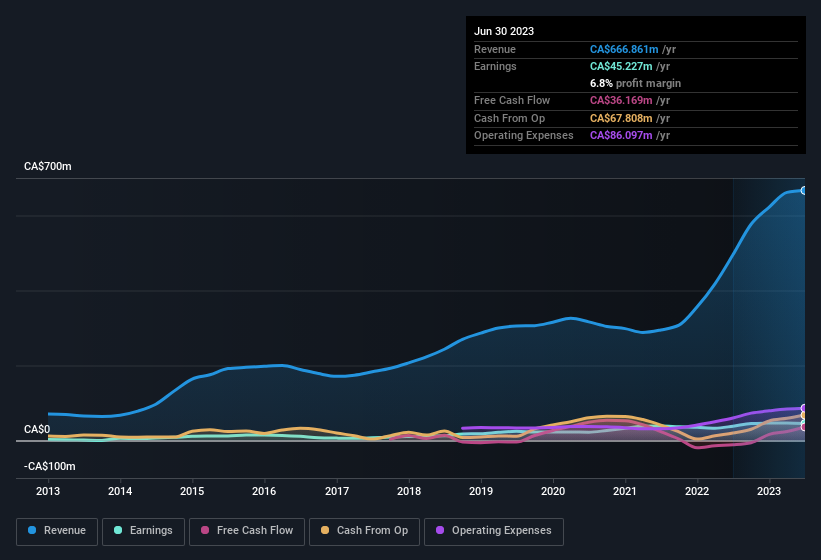

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for TerraVest Industries remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 35% to CA$667m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check TerraVest Industries' balance sheet strength, before getting too excited.

Are TerraVest Industries Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that TerraVest Industries insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth CA$168m. Coming in at 25% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to TerraVest Industries, with market caps between CA$270m and CA$1.1b, is around CA$1.8m.

The TerraVest Industries CEO received CA$1.4m in compensation for the year ending September 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does TerraVest Industries Deserve A Spot On Your Watchlist?

For growth investors, TerraVest Industries' raw rate of earnings growth is a beacon in the night. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that TerraVest Industries has underlying strengths that make it worth a look at. However, before you get too excited we've discovered 1 warning sign for TerraVest Industries that you should be aware of.

Although TerraVest Industries certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives