- Canada

- /

- Energy Services

- /

- TSX:TVK

Does a Fresh Valuation Debate Reveal Hidden Strengths in TerraVest Industries’ Strategy (TSX:TVK)?

Reviewed by Sasha Jovanovic

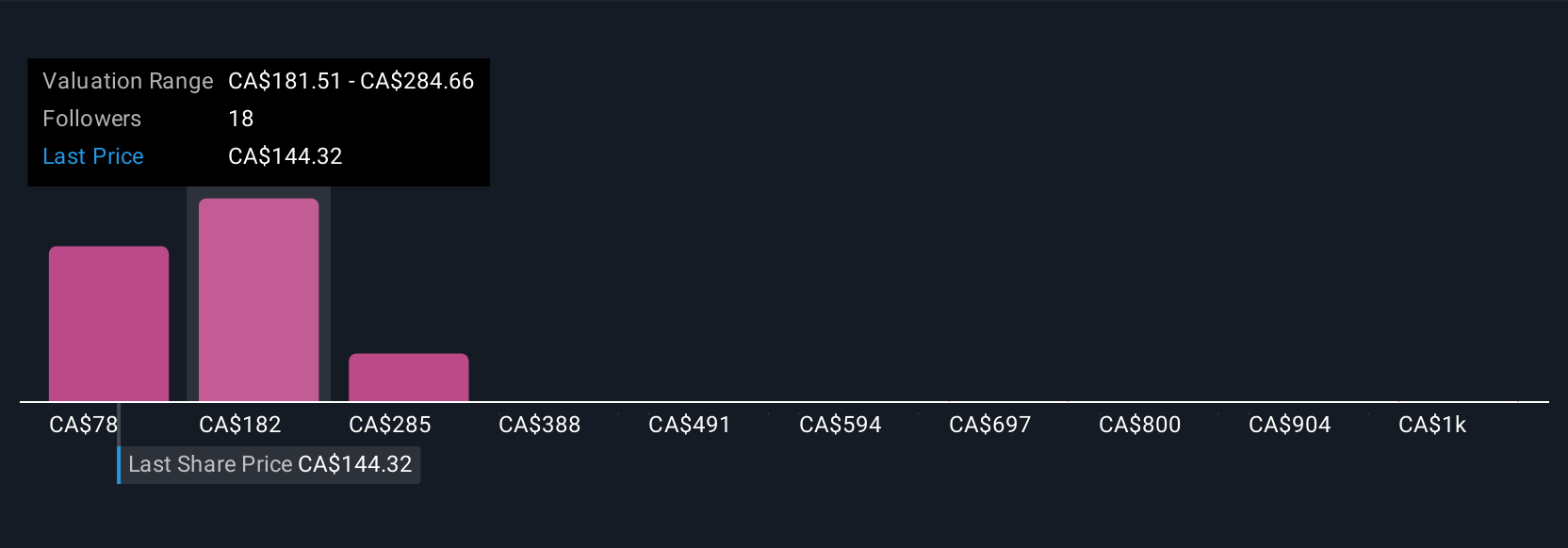

- Recent analysis suggests that TerraVest Industries may be 49% undervalued based on a 2 Stage Free Cash Flow to Equity valuation, estimating its fair value at CA$275 per share.

- This assessment has drawn attention to the potential for imprecise valuations, highlighting the importance of considering multiple factors when evaluating investment opportunities.

- We’ll explore how renewed focus on the stock’s valuation estimates is shaping TerraVest Industries’ investment narrative for investors.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is TerraVest Industries' Investment Narrative?

Owning TerraVest Industries means believing in the company’s ability to grow revenue faster than the broader Canadian market, while staying disciplined through a mix of share buybacks and regular dividends. The recent discussion around the stock’s potential undervaluation, as highlighted by the new fair value estimate, certainly invites fresh attention, but it may not shift the near-term catalysts that matter most. Short-term focus remains on the buyback program and upcoming dividend payments, as well as the company’s efforts to sustain earnings momentum after a recent dip in net profit margin. Risks, such as the premium price-to-earnings valuation, or whether profit growth can keep pace with revenue expansion, are magnified when valuations come under a spotlight. The latest valuation news increases scrutiny but does not fundamentally change immediate business risks or drivers.

Yet, some investors may be cautious about the current profit margins. TerraVest Industries' shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 8 other fair value estimates on TerraVest Industries - why the stock might be worth over 4x more than the current price!

Build Your Own TerraVest Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TerraVest Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TerraVest Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TerraVest Industries' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives