- Canada

- /

- Energy Services

- /

- TSX:TVK

3 TSX Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In the current environment, where market volatility remains elevated due to ongoing trade tensions and potential economic slowdowns, investors are closely watching how central banks might respond with monetary policy adjustments. As uncertainty persists, identifying stocks that may be trading below their estimated value can offer opportunities for those focusing on long-term investment strategies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$7.54 | CA$11.10 | 32.1% |

| Savaria (TSX:SIS) | CA$15.70 | CA$31.13 | 49.6% |

| K92 Mining (TSX:KNT) | CA$11.10 | CA$18.30 | 39.4% |

| Galaxy Digital Holdings (TSX:GLXY) | CA$13.53 | CA$21.52 | 37.1% |

| Thunderbird Entertainment Group (TSXV:TBRD) | CA$1.60 | CA$3.12 | 48.7% |

| Lithium Royalty (TSX:LIRC) | CA$4.85 | CA$9.45 | 48.7% |

| illumin Holdings (TSX:ILLM) | CA$1.93 | CA$3.69 | 47.6% |

| AtkinsRéalis Group (TSX:ATRL) | CA$62.89 | CA$107.77 | 41.6% |

| Theratechnologies (TSX:TH) | CA$2.20 | CA$3.22 | 31.8% |

| CAE (TSX:CAE) | CA$30.56 | CA$50.40 | 39.4% |

Let's explore several standout options from the results in the screener.

Cineplex (TSX:CGX)

Overview: Cineplex Inc., along with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$563.23 million.

Operations: The company's revenue is primarily derived from Film Entertainment and Content (CA$1.07 billion), Media (CA$133.80 million), and Location-Based Entertainment (CA$128.62 million).

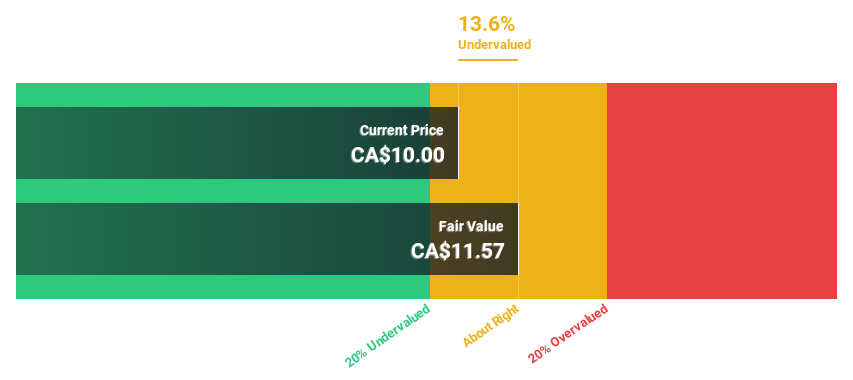

Estimated Discount To Fair Value: 23.3%

Cineplex is trading at CA$8.88, below its estimated fair value of CA$11.57, indicating a potential undervaluation based on cash flows. Despite negative equity and recent net losses of CAD 37.68 million for 2024, the company is expected to become profitable within three years with earnings forecasted to grow significantly by 89% annually. Recent box office revenue growth further supports its recovery trajectory, although overall revenue has declined slightly year-over-year.

- Our comprehensive growth report raises the possibility that Cineplex is poised for substantial financial growth.

- Navigate through the intricacies of Cineplex with our comprehensive financial health report here.

Converge Technology Solutions (TSX:CTS)

Overview: Converge Technology Solutions Corp. offers software-enabled IT and cloud solutions across North America and Europe, with a market cap of CA$1.12 billion.

Operations: The company's revenue segments are divided into North America (CA$2.05 billion), Germany (CA$281.78 million), the UK (CA$246.82 million), and Portage Saas Solutions (CA$9.33 million).

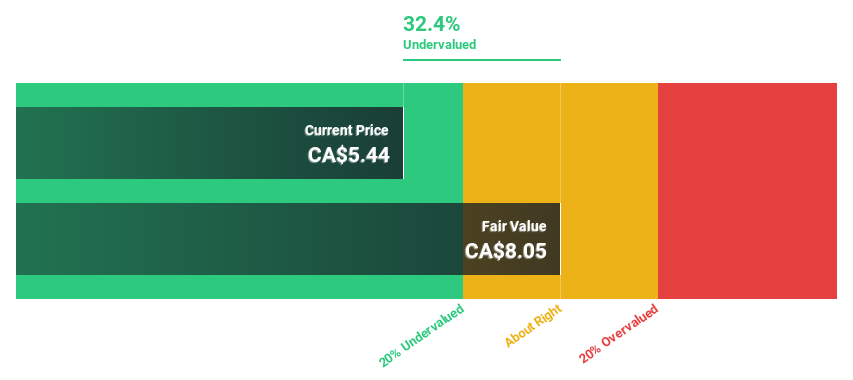

Estimated Discount To Fair Value: 26.6%

Converge Technology Solutions, trading at CA$5.96, is below its estimated fair value of CA$8.12, suggesting potential undervaluation based on cash flows despite recent net losses of CA$177.71 million for 2024. The company is expected to become profitable within three years, with earnings projected to grow significantly by over 140% annually. Recent acquisition proposals and legal proceedings have added volatility but highlight investor interest in its long-term prospects.

- Upon reviewing our latest growth report, Converge Technology Solutions' projected financial performance appears quite optimistic.

- Take a closer look at Converge Technology Solutions' balance sheet health here in our report.

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$2.53 billion.

Operations: The company's revenue is derived from several segments including Service (CA$202.65 million), Processing Equipment (CA$97.26 million), Compressed Gas Equipment (CA$280.72 million), and HVAC and Containment Equipment (CA$341.95 million).

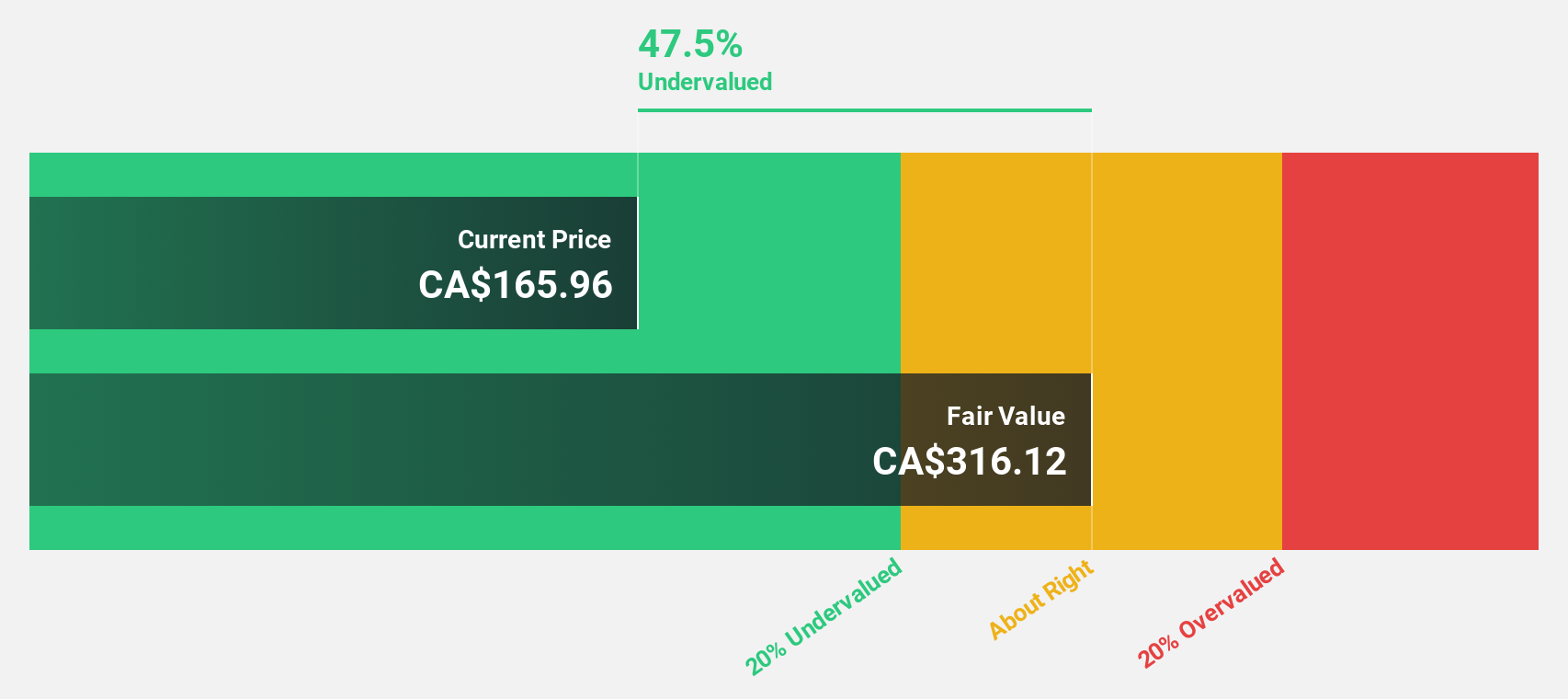

Estimated Discount To Fair Value: 30.3%

TerraVest Industries, trading at CA$129.72, is significantly undervalued with an estimated fair value of CA$186.09. Recent earnings show strong performance, with net income rising to CA$28.74 million from CA$17.38 million year-over-year and diluted EPS increasing to CA$1.42 from CA$0.94, highlighting robust cash flow generation potential despite market volatility. Earnings are forecasted to grow substantially by 30% annually, outpacing the Canadian market average growth rate of 14.8%.

- In light of our recent growth report, it seems possible that TerraVest Industries' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of TerraVest Industries stock in this financial health report.

Turning Ideas Into Actions

- Discover the full array of 25 Undervalued TSX Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives