- Canada

- /

- Oil and Gas

- /

- TSX:TVE

What Tamarack Valley Energy (TSX:TVE)'s Asset Sale and Pure-Play Shift Mean For Shareholders

Reviewed by Sasha Jovanovic

- Tamarack Valley Energy Ltd. recently completed the sale of its non-core producing assets in Eastern Alberta, with gross proceeds of C$112.0 million and the assumption of C$63 million in asset retirement obligations, alongside the declaration of a monthly dividend of C$0.01275 per share payable in November 2025.

- This shift positions Tamarack as a dedicated Clearwater and Charlie Lake operator, enabling a focus on core area development and further debt reduction.

- We'll explore how Tamarack's pure-play transition in the Clearwater and Charlie Lake regions could impact its overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Tamarack Valley Energy Investment Narrative Recap

To be a Tamarack Valley Energy shareholder, you need to believe in the company’s potential to generate stable returns by focusing its efforts on the Clearwater and Charlie Lake plays, while achieving meaningful debt reduction and maintaining cost discipline. The recent sale of non-core Eastern Alberta assets, though financially significant, does not materially change the short-term catalyst for Tamarack, the operational performance of its core regions, or address the principal risk posed by high net debt and exposure to oil price swings.

Among the latest announcements, the company’s reaffirmation of full-year production guidance at 67,000 to 69,000 boe/d stands out. This production outlook aligns closely with Tamarack’s stated focus on its core Clearwater and Charlie Lake operations, indicating continued momentum in the areas expected to be the largest drivers of cash flow and near-term investor confidence.

But even with renewed focus and ongoing asset sales, investors should be keenly aware of continued financial leverage and ...

Read the full narrative on Tamarack Valley Energy (it's free!)

Tamarack Valley Energy's outlook anticipates CA$1.7 billion in revenue and CA$80.5 million in earnings by 2028. This scenario assumes annual revenue growth of 4.8% but a significant earnings decrease of CA$178.7 million from the current earnings of CA$259.2 million.

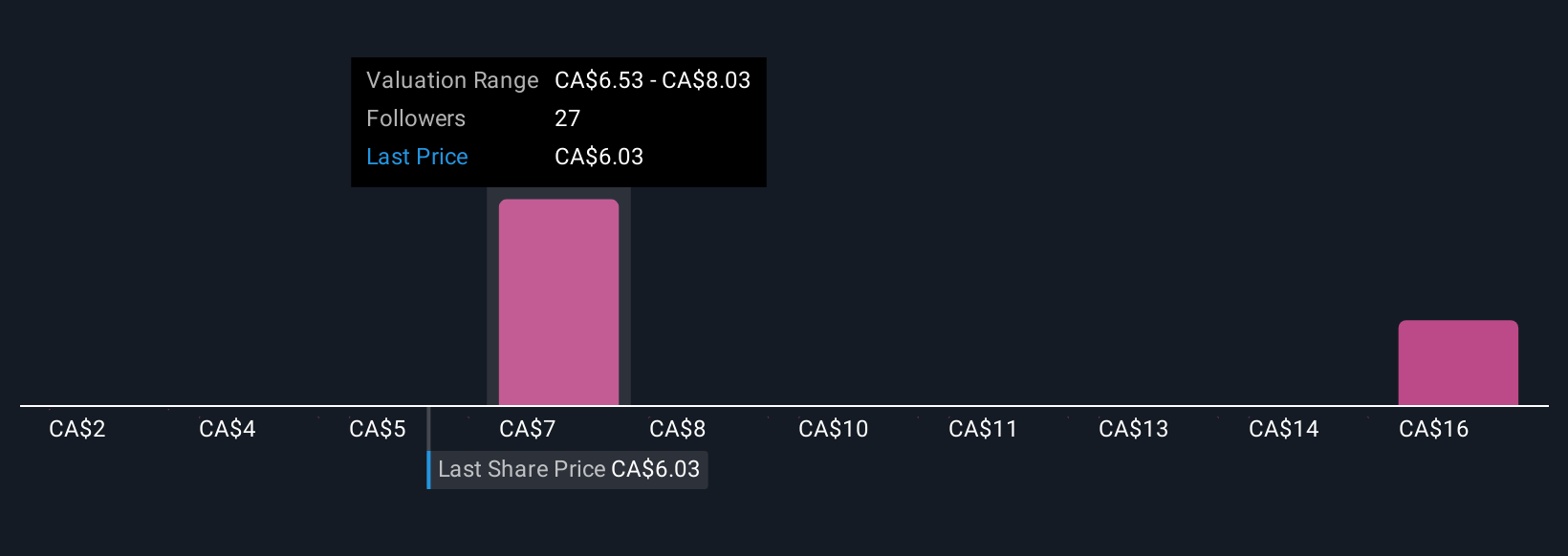

Uncover how Tamarack Valley Energy's forecasts yield a CA$7.38 fair value, a 22% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for Tamarack Valley Energy span from C$2.04 to C$17.02, based on three distinct approaches. Community members’ expectations contrast with persistent concerns about Tamarack’s net debt and commodity price exposure, underlining how opinions differ on future resilience and returns.

Explore 3 other fair value estimates on Tamarack Valley Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Tamarack Valley Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tamarack Valley Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tamarack Valley Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tamarack Valley Energy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tamarack Valley Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVE

Tamarack Valley Energy

Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives