- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Tourmaline Oil (TSX:TOU) Boosts Dividend Amid Strong Cash Flow Despite Lower Production Guidance

Reviewed by Simply Wall St

The Tourmaline Oil (TSX:TOU) is navigating a period of significant developments, marked by a strategic dividend increase and proactive risk management. However, challenges such as revised production guidance and market volatility present hurdles. In the discussion that follows, we will explore Tourmaline's financial strengths, operational challenges, growth opportunities, and potential threats to provide a comprehensive overview of the company's current business situation.

Explore the full analysis report here for a deeper understanding of Tourmaline Oil.

Strengths: Core Advantages Driving Sustained Success For Tourmaline Oil

Tourmaline Oil demonstrates strong financial health, as evidenced by its cash flow generation and free cash flow of $434 million or $1.22 per diluted share in Q2 2024. The company’s strategic decision to increase its quarterly base dividend by 3% to $0.33 per share highlights its commitment to returning value to shareholders. Additionally, Tourmaline’s diversified market and transportation portfolio has been beneficial, providing stability against market volatility. The company’s seasoned management team, with an average tenure of 5.9 years, contributes significantly to its strategic goals. Furthermore, Tourmaline’s hedging strategy for 2024, with an average of 1.03 Bcf hedged at CAD 4.66 per Mcf, showcases its proactive risk management approach.

Learn about Tourmaline Oil's dividend strategy and how it impacts shareholder returns and financial stability.

Weaknesses: Critical Issues Affecting Tourmaline Oil's Performance and Areas For Growth

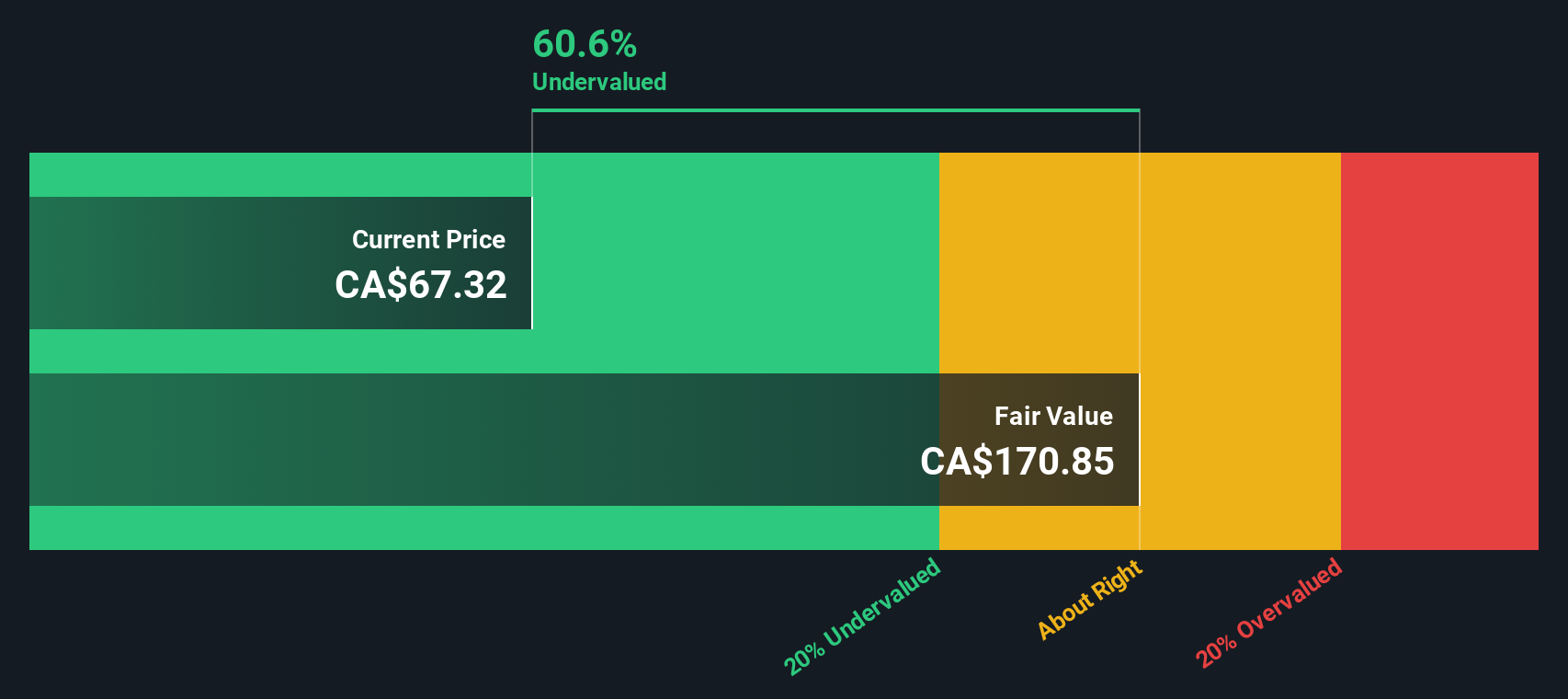

Tourmaline Oil faces challenges, particularly in the natural gas pricing environment. The company had to complete multiple planned facility maintenance turnarounds during a period of low natural gas prices, impacting its profitability. Additionally, the full-year 2024 average production guidance was revised down by 5,000 BOEs to a range of 575,000-585,000 BOEs per day. Tourmaline’s Price-To-Earnings Ratio (14.3x) is higher compared to the Canadian Oil and Gas industry average (11.5x), indicating it may be overvalued relative to its industry peers. Moreover, the company's Return on Equity is forecasted to be low at 16% in three years, which is below the benchmark.

To explore how Tourmaline Oil's valuation metrics are shaping its market position, check out our detailed analysis of Tourmaline Oil's Valuation.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Tourmaline Oil has several opportunities to enhance its market position. The company’s expansion into export markets is significant, with expectations to exit 2024 with 1.26 Bcf per day of natural gas going to these markets. The North Montney Phase 1 development is another growth driver, projected to add 50,000 BOEs a day over the next three years. Tourmaline’s investment in methane technologies, supported by a $15 million grant from the Alberta government, positions it well for technological advancements. Additionally, the growing demand in the California market presents a lucrative opportunity, particularly for data centers seeking additional capacity.

Threats: Key Risks and Challenges That Could Impact Tourmaline Oil's Success

Tourmaline Oil faces several external threats that could impact its growth. The competitive market environment necessitates strategic adjustments to maintain its market share. Economic factors also pose a risk; the company must be prepared to act if its stock becomes fundamentally dislocated. Regulatory changes are another concern, with the company receiving 63 new drilling permits in Northeast B.C. since March 2024. Operational risks, such as the need to finalize the EP budget annually, add to the complexity of managing its expansive operations. Additionally, the company’s profit margins have decreased from 51.7% to 30.7%, indicating potential profitability challenges.

Conclusion

Tourmaline Oil's strong financial health, highlighted by its substantial free cash flow and strategic dividend increase, underscores its commitment to shareholder value and operational stability. However, challenges such as the volatile natural gas pricing environment and reduced production guidance could impact near-term profitability. The company's higher Price-To-Earnings Ratio compared to industry peers suggests that investors may be pricing in its growth prospects, though its projected Return on Equity of 16% in three years remains a concern. Opportunities in export markets and technological advancements present significant growth avenues, but external threats like regulatory changes and declining profit margins necessitate vigilant risk management. Overall, while Tourmaline Oil shows promising growth potential, careful consideration of its financial metrics and external risks is crucial for assessing its future performance.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives