- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Does Tourmaline Offer Strong Value After Recent LNG Export Expansion in 2025?

Reviewed by Simply Wall St

If you have been watching Tourmaline Oil stock and wondering whether now is the time to make a move, you are not alone. The company has a reputation for weathering the ups and downs of the energy sector, but its recent performance might have you scratching your head. Over the past year, Tourmaline’s share price is down about 3.4%, with recent three-month and year-to-date returns also in negative territory. Yet, those numbers only tell part of the story. If you zoom out, the five-year total return jumps to an impressive 354.6%. This reflects the company’s ability to generate value over the long run, despite some short-term bumps.

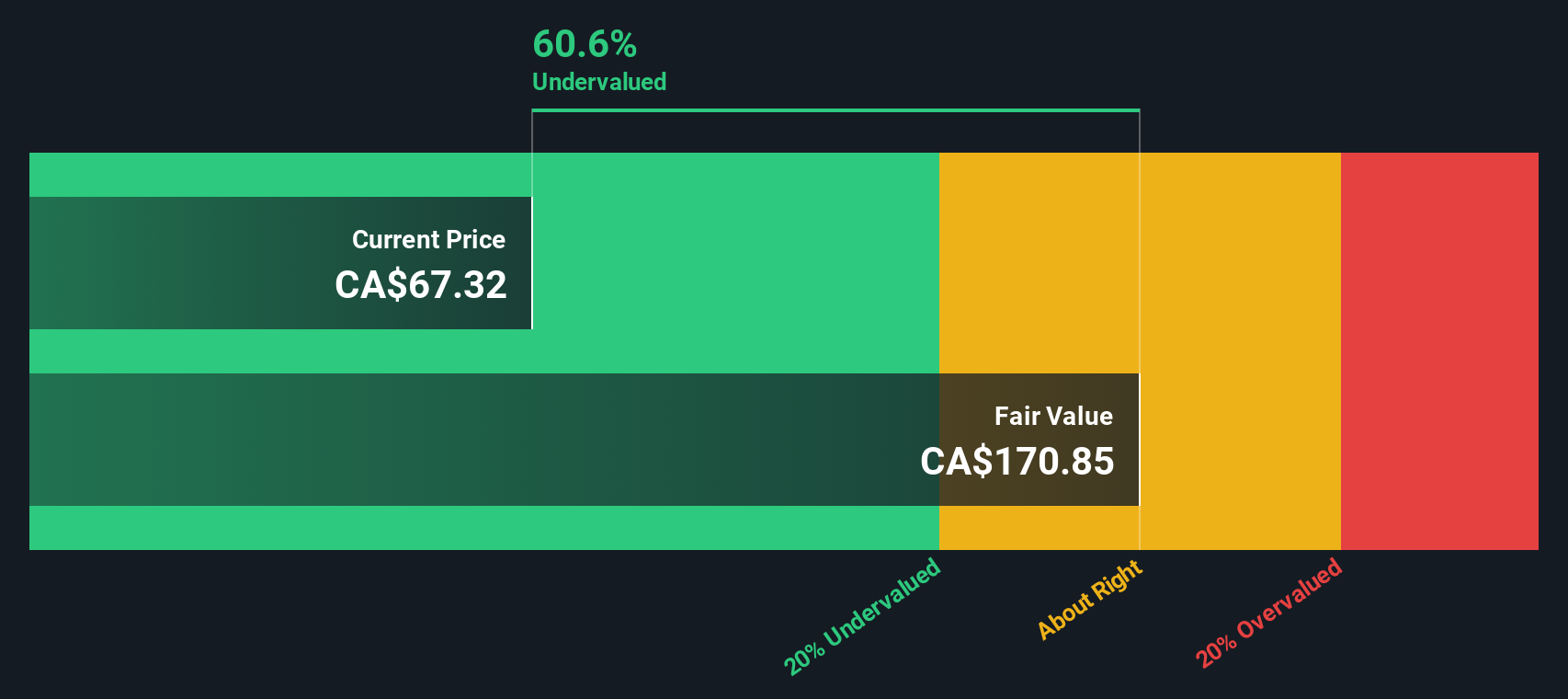

A big piece of the recent narrative is market sentiment shifting on energy stocks. Concerns about commodity price volatility and the global economic picture might have weighed on Tourmaline shares recently, but the fundamentals still stand out. Revenue grew by nearly 27.5% over the last twelve months, and net income climbed just under 20%. With the stock closing recently at CA$56.85, it trades at a significant discount compared to analyst price targets. Analysts see potential upside of around 32% from current levels. Even more striking is the estimated intrinsic value discount of more than 60%, indicating the market might not be fully recognizing Tourmaline’s earning power and growth prospects.

So, how does Tourmaline stack up when it comes to value? Based on six different metrics used to spot undervalued stocks, Tourmaline scores a solid 4 out of 6. This suggests it’s undervalued more often than not. Of course, not all valuation methods are created equal, and understanding the nuances can make all the difference in your decision-making. Let’s break down how Tourmaline fares by the most common valuation approaches, and consider why there might be an even smarter way to look at its true worth in today’s market.

Tourmaline Oil delivered -3.4% returns over the last year. See how this stacks up to the rest of the Oil and Gas industry.Approach 1: Tourmaline Oil Cash Flows

The Discounted Cash Flow (DCF) model is a common way to estimate a company's true worth by projecting how much cash it can generate in the future and then adjusting those future amounts to today’s value. This method gives investors a clearer picture of what a stock might really be worth, based on future cash rather than just recent earnings.

Tourmaline Oil’s latest twelve months saw Free Cash Flow (FCF) of roughly CA$1.23 billion, with analyst projections suggesting steady growth over the next decade. By 2029, annual FCF is expected to reach CA$1.8 billion, and by 2035, estimates climb to just over CA$2.57 billion. When all these future cash flows are added up and discounted back to the present, Tourmaline’s estimated intrinsic value is CA$148.30 per share.

Compared to the recent share price of CA$56.85, the stock appears about 61.7% undervalued relative to its DCF fair value. According to this approach, the market seems to be significantly discounting Tourmaline’s growth potential and offering a substantial margin of safety for investors who are confident in the company’s cash-generating ability.

Result: UNDERVALUED

Approach 2: Tourmaline Oil Price vs Earnings

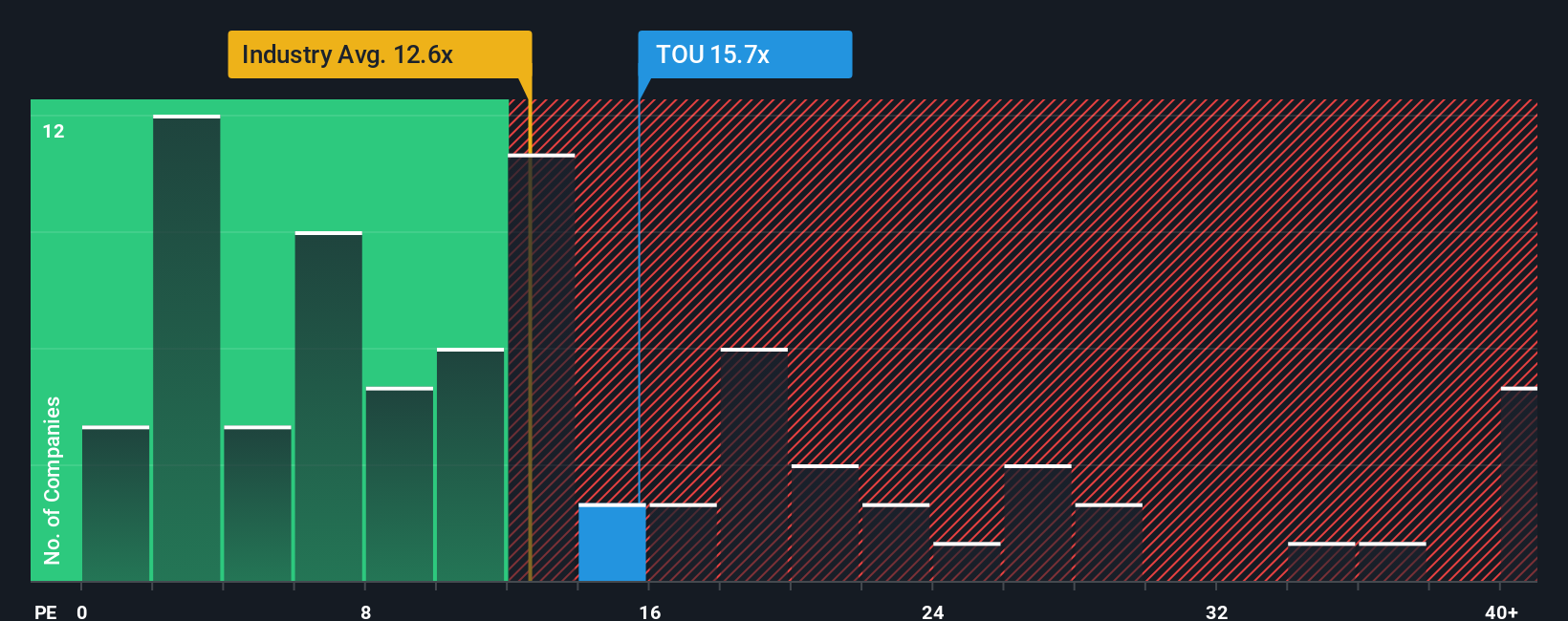

The price-to-earnings (PE) ratio is widely used to value profitable companies because it directly ties a company's share price to its actual profits. For investors, the PE ratio offers a quick read on how much they are paying for each dollar of earnings, making it particularly relevant for established, consistently profitable firms like Tourmaline Oil.

What is considered a “normal” PE ratio can vary, since expectations for future earnings growth and company-specific risks should influence what investors are willing to pay. Companies with strong growth prospects, stable revenues, or lower risk typically justify higher PE multiples. Conversely, slower growth or riskier stocks tend to command lower ratios.

Currently, Tourmaline Oil trades at a PE ratio of 14.76x. This is above the oil and gas industry average of 11.79x and higher than the selected peer average of 11.88x. Simply Wall St’s proprietary Fair Ratio for Tourmaline is calculated at 18.68x, reflecting the company’s above-average growth, profitability, and market standing.

Comparing Tourmaline’s current PE ratio of 14.76x to the Fair Ratio of 18.68x, the stock appears undervalued by this metric. This indicates that investors are getting more earnings for their money than Tourmaline’s fundamentals would typically command, supporting the case for value.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Tourmaline Oil Narrative

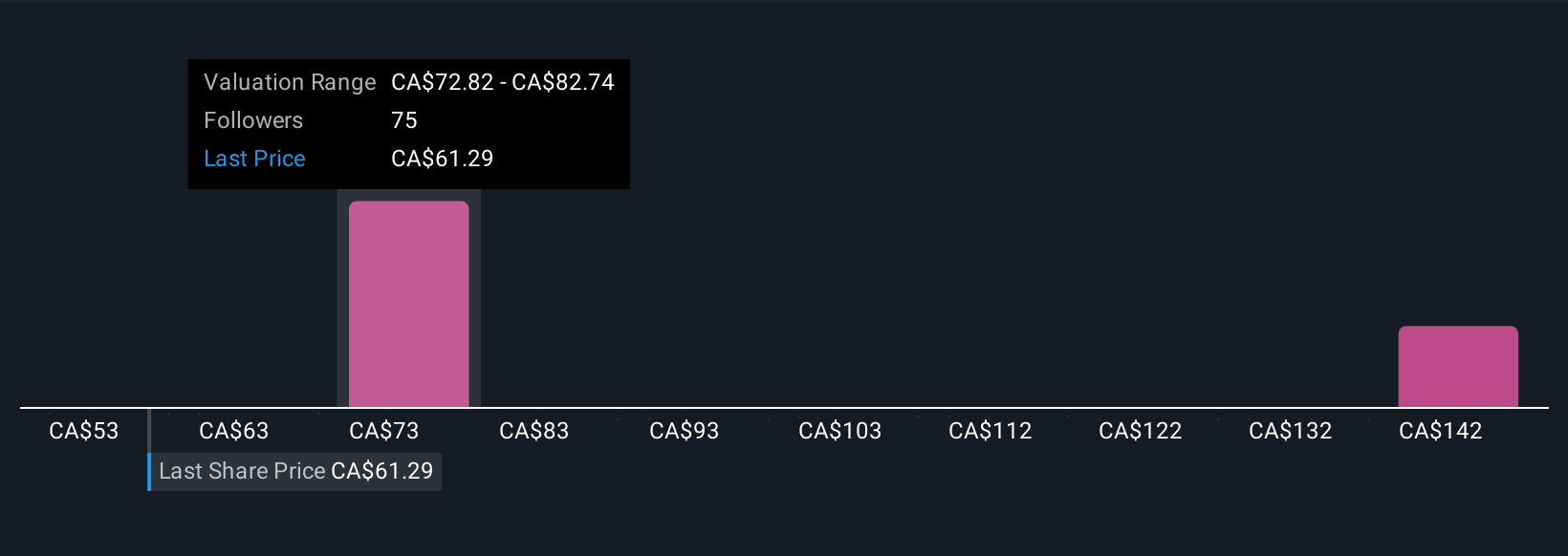

Rather than relying purely on static ratios or backward-looking data, many investors are embracing the power of Narratives. Narratives are a tool for shaping and sharing your own story about a company’s future, from its business drivers to its underlying value. They allow you to connect your perspective on Tourmaline Oil’s opportunities and risks with your own financial forecasts, such as revenue, profit margins, or target multiples, to arrive at a Fair Value that reflects what you truly believe the business is worth.

On the Simply Wall St platform, Narratives offer an accessible way to test your investment thesis, compare it with millions of other investors, and stay updated as new information becomes available. Narratives help you quickly compare your Fair Value to the current price, making it easier to decide when you might want to buy or sell as conditions change. For example, one Narrative forecasts Tourmaline Oil reaching CA$90.00 based on strong LNG growth and global market access, while another projects a more cautious CA$67.00, citing natural gas price volatility and execution risks. This demonstrates how your unique insights can directly influence your valuation and investment decisions.

Do you think there's more to the story for Tourmaline Oil? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives