- Canada

- /

- Diversified Financial

- /

- TSX:FN

Three Top Undervalued Small Caps In Canada With Insider Activity

Reviewed by Simply Wall St

As the Canadian market navigates a landscape influenced by shifting Fed expectations and broader economic dynamics, small-cap stocks are drawing attention for their potential resilience amid these changes. With the prospect of a more gradual rate-cutting cycle and ongoing global productivity trends, investors are increasingly focused on identifying small-cap opportunities that exhibit strong fundamentals and insider activity, which can signal confidence in a company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.9x | 0.9x | 20.97% | ★★★★★★ |

| AutoCanada | NA | 0.1x | 40.20% | ★★★★★★ |

| First National Financial | 13.8x | 3.9x | 42.81% | ★★★★☆☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 19.60% | ★★★★☆☆ |

| Rogers Sugar | 15.3x | 0.6x | 48.45% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.9x | 3.4x | 45.48% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -44.56% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 19.71% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.1x | -202.37% | ★★★★☆☆ |

| StorageVault Canada | NA | 5.2x | -638.86% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First National Financial is a Canadian company specializing in residential and commercial mortgage lending, with a market cap of approximately CA$2.46 billion.

Operations: First National Financial generates revenue primarily through its mortgage lending operations, with a significant portion of costs attributed to cost of goods sold (COGS) and operating expenses. Over recent periods, the gross profit margin has shown an upward trend, reaching 86.04% in September 2024. The company's financial performance is influenced by general and administrative expenses, which have been increasing alongside revenue growth.

PE: 13.8x

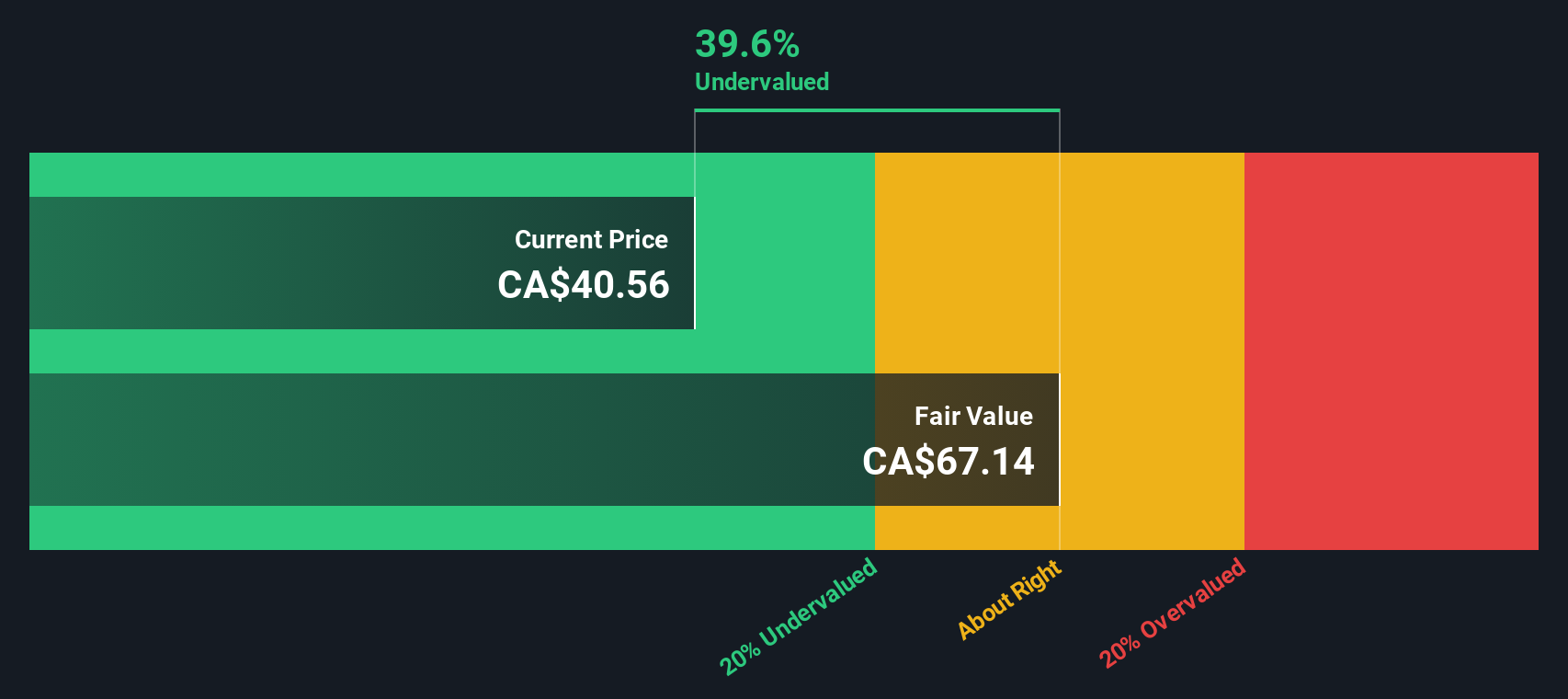

First National Financial, a smaller player in the Canadian market, has shown insider confidence with Stephen J. Smith purchasing 128,614 shares for approximately C$4.86 million between September and October 2024. Despite a drop in net income to C$36.41 million for Q3 2024 from C$83.63 million the previous year, the company increased its regular dividend and announced a special dividend of C$0.50 per share, reflecting potential long-term value amidst current financial challenges.

- Get an in-depth perspective on First National Financial's performance by reading our valuation report here.

Evaluate First National Financial's historical performance by accessing our past performance report.

Headwater Exploration (TSX:HWX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Headwater Exploration is engaged in the exploration, development, and production of petroleum and natural gas with a market capitalization of CA$1.48 billion.

Operations: The company generates revenue primarily from the exploration, development, and production of petroleum and natural gas. For the period ending in October 2024, it reported a gross profit margin of 76.21%.

PE: 8.6x

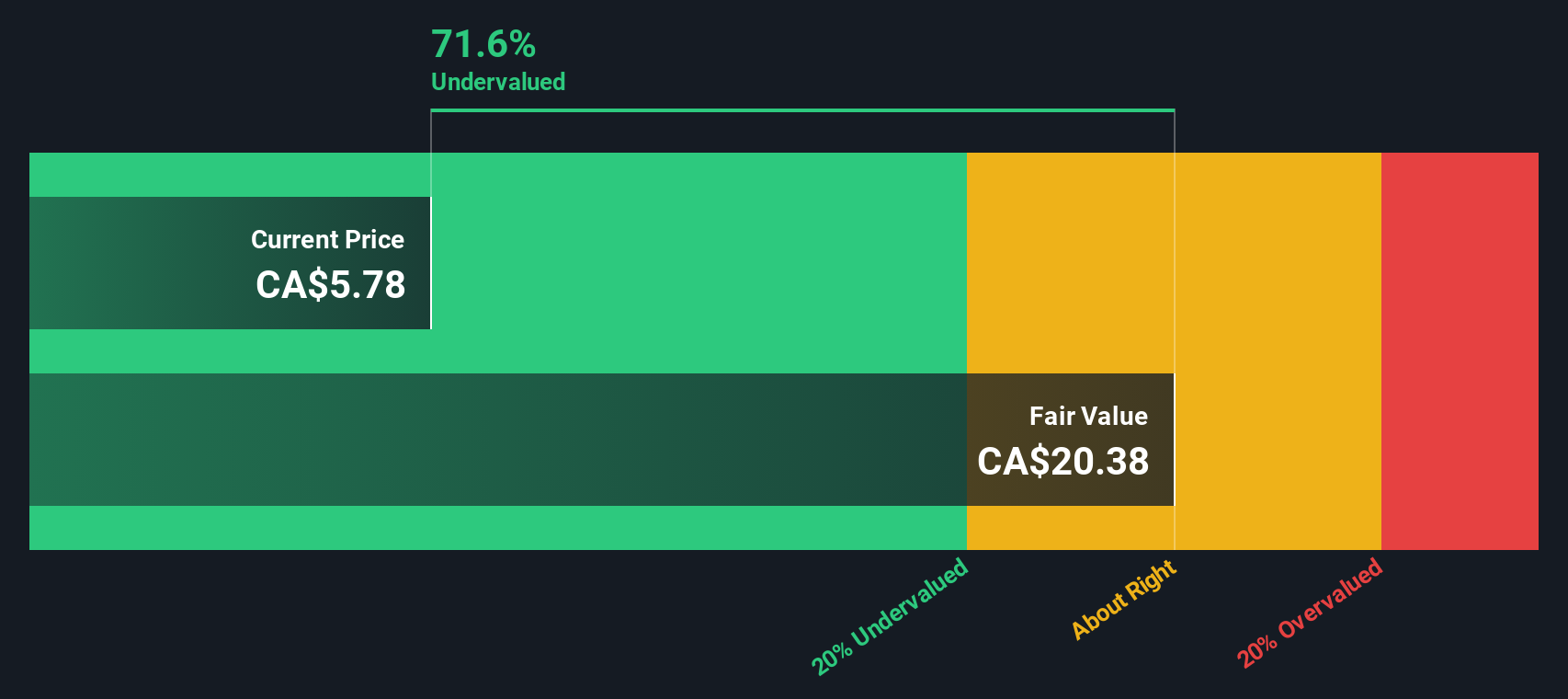

Headwater Exploration, a Canadian energy company, is garnering attention as an undervalued player with its small-scale operations. Despite facing a projected annual earnings decline of 10.9% over the next three years, insider confidence remains high with recent share purchases indicating belief in future prospects. The company's reliance on external borrowing poses higher risk but hasn't deterred insiders from investing further. Recent presentations at notable energy conferences highlight their proactive industry engagement and potential for strategic growth.

- Dive into the specifics of Headwater Exploration here with our thorough valuation report.

Explore historical data to track Headwater Exploration's performance over time in our Past section.

Trican Well Service (TSX:TCW)

Simply Wall St Value Rating: ★★★★★★

Overview: Trican Well Service is a Canadian company that provides oilfield services, including hydraulic fracturing and well cementing, with a market cap of approximately CA$1.06 billion.

Operations: Trican Well Service's revenue primarily comes from its core operations, with recent figures showing a gross profit margin reaching 29.22% as of June 2023. The company experienced fluctuations in net income and operating expenses over the years, with notable improvements in profitability metrics in recent periods, including a net income margin of 12.52% as of June 2024.

PE: 7.9x

Trican Well Service, a Canadian company in the energy sector, has been actively enhancing shareholder value through significant share repurchase programs. Between July and October 2024, they bought back over 13 million shares for C$61.61 million, completing a total buyback of over 21 million shares. This move reflects strategic capital management and potential undervaluation perception. Demonstrating insider confidence, their CFO acquired 27,000 shares for C$130K in recent months. Earnings are projected to grow by nearly 9% annually, indicating positive future prospects despite reliance on external borrowing for funding.

- Navigate through the intricacies of Trican Well Service with our comprehensive valuation report here.

Gain insights into Trican Well Service's past trends and performance with our Past report.

Seize The Opportunity

- Discover the full array of 24 Undervalued TSX Small Caps With Insider Buying right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FN

First National Financial

First National Financial Corporation, together with its subsidiaries, originates, underwrites, and services commercial and residential mortgages in Canada.

High growth potential established dividend payer.