Investors looking for stocks with high market liquidity and little debt on the balance sheet should consider Suncor Energy Inc. (TSE:SU). With a market valuation of CA$69b, SU is a safe haven in times of market uncertainty due to its strong balance sheet. These firms won’t be left high and dry if liquidity dries up, and they will be relatively unaffected by rises in interest rates. Using the most recent data for SU, I will determine its financial status based on its solvency and liquidity, and assess whether the stock is a safe investment.

View our latest analysis for Suncor Energy

Does SU Produce Much Cash Relative To Its Debt?

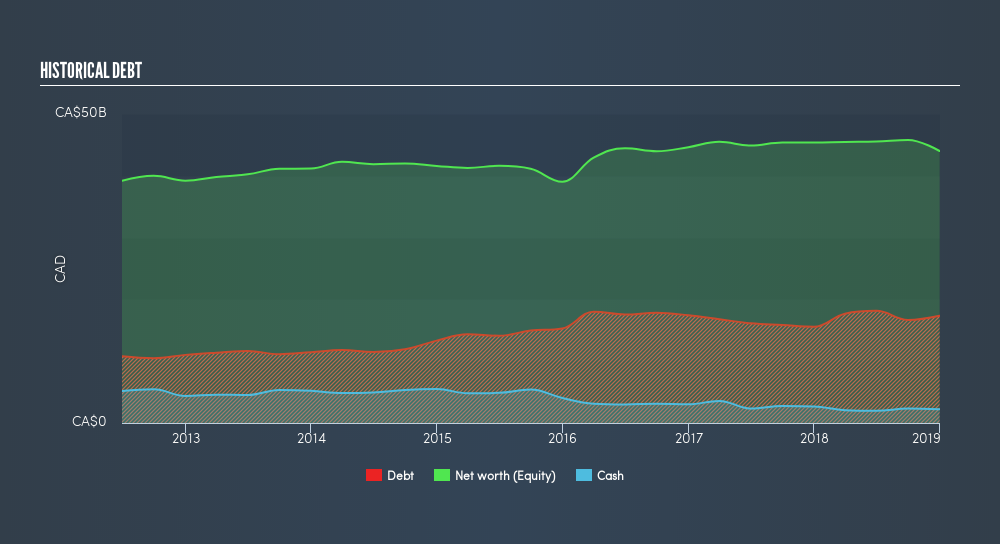

Over the past year, SU has ramped up its debt from CA$16b to CA$17b , which accounts for long term debt. With this growth in debt, the current cash and short-term investment levels stands at CA$2.2b to keep the business going. Additionally, SU has produced cash from operations of CA$11b in the last twelve months, leading to an operating cash to total debt ratio of 61%, signalling that SU’s current level of operating cash is high enough to cover debt.

Can SU pay its short-term liabilities?

With current liabilities at CA$10b, the company may not be able to easily meet these obligations given the level of current assets of CA$8.7b, with a current ratio of 0.84x. The current ratio is the number you get when you divide current assets by current liabilities.

Can SU service its debt comfortably?

With a debt-to-equity ratio of 39%, SU's debt level may be seen as prudent. This range is considered safe as SU is not taking on too much debt obligation, which can be restrictive and risky for equity-holders. We can test if SU’s debt levels are sustainable by measuring interest payments against earnings of a company. Net interest should be covered by earnings before interest and tax (EBIT) by at least three times to be safe. For SU, the ratio of 8.68x suggests that interest is appropriately covered. Large-cap investments like SU are often believed to be a safe investment due to their ability to pump out ample earnings multiple times its interest payments.

Next Steps:

SU’s high cash coverage and appropriate debt levels indicate its ability to utilise its borrowings efficiently in order to generate ample cash flow. However, its low liquidity raises concerns over whether current asset management practices are properly implemented for the large-cap. Keep in mind I haven't considered other factors such as how SU has been performing in the past. I suggest you continue to research Suncor Energy to get a better picture of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for SU’s future growth? Take a look at our free research report of analyst consensus for SU’s outlook.

- Valuation: What is SU worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether SU is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.