Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Suncor Energy Inc. (TSE:SU) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Suncor Energy

What Is Suncor Energy's Debt?

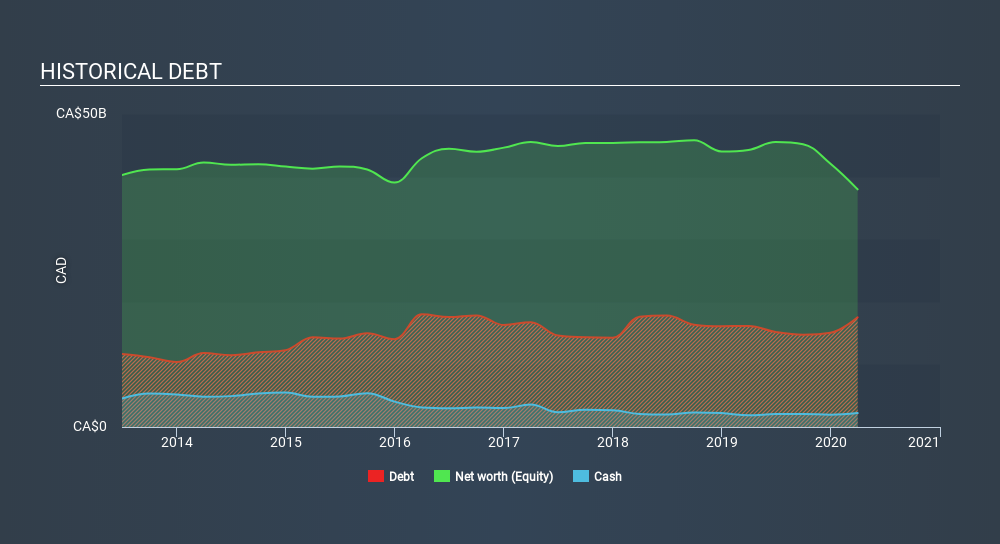

You can click the graphic below for the historical numbers, but it shows that as of March 2020 Suncor Energy had CA$17.5b of debt, an increase on CA$16.1b, over one year. However, it also had CA$2.23b in cash, and so its net debt is CA$15.3b.

A Look At Suncor Energy's Liabilities

According to the last reported balance sheet, Suncor Energy had liabilities of CA$10.2b due within 12 months, and liabilities of CA$37.1b due beyond 12 months. Offsetting this, it had CA$2.23b in cash and CA$2.63b in receivables that were due within 12 months. So its liabilities total CA$42.4b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's massive market capitalization of CA$37.6b, we think shareholders really should watch Suncor Energy's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Suncor Energy's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Suncor Energy had negative earnings before interest and tax, and actually shrunk its revenue by 5.1%, to CA$37b. That's not what we would hope to see.

Caveat Emptor

Importantly, Suncor Energy had negative earnings before interest and tax (EBIT), over the last year. To be specific the EBIT loss came in at CA$2.7b. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. For example, we would not want to see a repeat of last year's loss of CA$2.1b. And until that time we think this is a risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Suncor Energy has 3 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives