- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Undervalued Small Caps With Insider Buying In Global For June 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of escalating Middle East tensions and fluctuating trade dynamics, small-cap stocks have faced increased volatility, with indices like the S&P MidCap 400 and Russell 2000 experiencing notable declines. Despite these challenges, improved sentiment among small business owners and cooler-than-expected inflation data provide a backdrop where discerning investors may find opportunities in undervalued small-cap companies that exhibit strong fundamentals and potential insider confidence.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.9x | 0.5x | 34.40% | ★★★★★☆ |

| Lion Rock Group | 5.0x | 0.4x | 49.95% | ★★★★☆☆ |

| Tristel | 28.9x | 4.1x | 10.18% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.6x | 2.9x | 19.65% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.61% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.7x | 0.5x | -61.84% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.7x | 1.8x | 9.40% | ★★★☆☆☆ |

| H+H International | 32.7x | 0.8x | 45.99% | ★★★☆☆☆ |

| AInnovation Technology Group | NA | 2.4x | 46.49% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 47.43% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

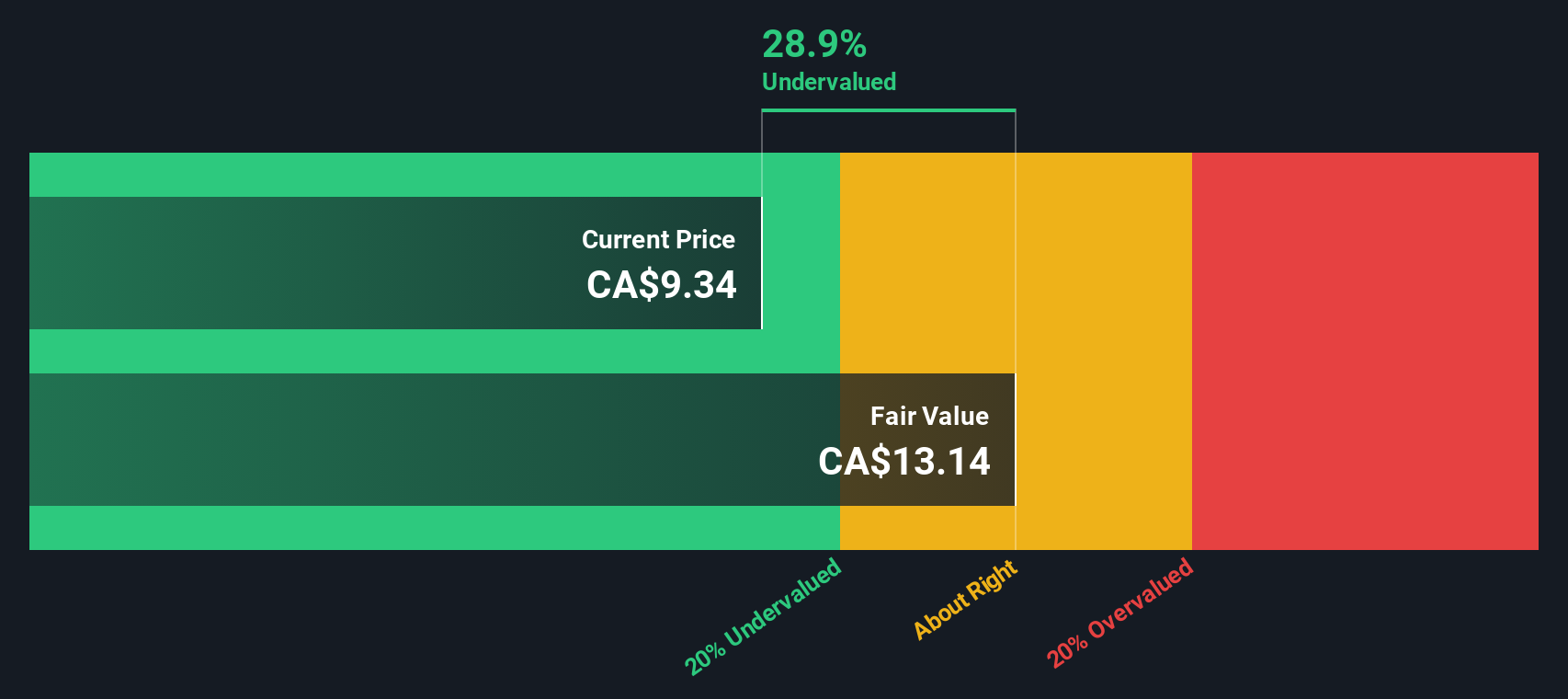

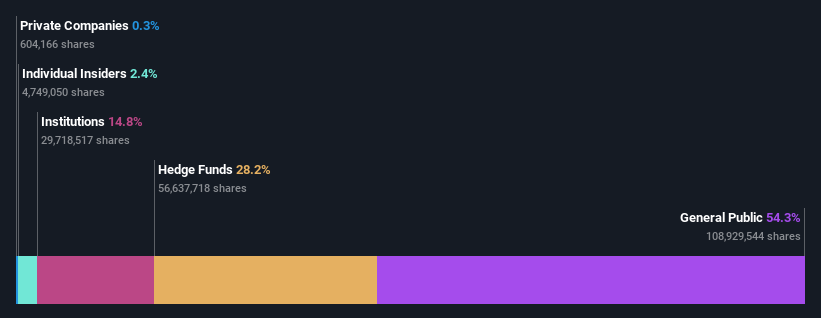

Aris Mining (TSX:ARIS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Aris Mining is a company engaged in gold mining operations, primarily focused on its Marmato and Segovia projects, with a market capitalization of approximately $1.02 billion.

Operations: Aris Mining generates revenue primarily from its Segovia and Marmato operations, with Segovia contributing significantly more. The company's gross profit margin has shown variability, reaching as high as 54.02% in recent periods but also experiencing declines to around 36.40%. Operating expenses and non-operating expenses are notable cost components impacting net income outcomes over time.

PE: 44.4x

Aris Mining, a smaller mining entity, has shown potential with a significant increase in sales for Q1 2025, reaching US$157.53 million from US$107.62 million the previous year. This growth reflects its strategic positioning despite having all liabilities tied to external borrowing, which carries inherent risks. The recent appointment of Cameron Paterson as CFO underscores their focus on financial governance and growth strategy execution. Earnings forecasts suggest robust expansion at 68% annually, hinting at promising future prospects amidst industry challenges.

- Get an in-depth perspective on Aris Mining's performance by reading our valuation report here.

Explore historical data to track Aris Mining's performance over time in our Past section.

Surge Energy (TSX:SGY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Surge Energy is an oil and gas exploration and production company with a market cap of CA$0.73 billion.

Operations: Surge Energy generates revenue primarily from its oil and gas exploration and production activities, with recent quarterly revenue reported at CA$549.28 million. The company's cost of goods sold (COGS) for the same period was CA$186.92 million, resulting in a gross profit margin of 65.97%. Operating expenses have been significant, impacting net income margins negatively in recent periods.

PE: -14.5x

Surge Energy, a smaller energy player, demonstrates potential value through recent strategic moves. The company announced a share repurchase program on June 16, 2025, aiming to buy back up to 9.6 million shares by June 18, 2026. This reflects insider confidence in the stock's prospects. Surge reported Q1 revenue of C$132 million and net income of C$8.3 million, marking a turnaround from last year's loss. Despite relying on external borrowing for funding, the company's earnings are projected to grow significantly at over 73% annually.

- Unlock comprehensive insights into our analysis of Surge Energy stock in this valuation report.

Review our historical performance report to gain insights into Surge Energy's's past performance.

Saturn Oil & Gas (TSX:SOIL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Saturn Oil & Gas is a company focused on the acquisition and exploration of resource properties, with operations contributing significantly to its market capitalization of CA$903.95 million.

Operations: Saturn Oil & Gas generates revenue primarily from the acquisition and exploration of resource properties, with recent figures reaching CA$903.95 million. The company's cost structure includes significant components such as Cost of Goods Sold (COGS) and General & Administrative Expenses, while operating expenses also play a notable role. A key financial metric is the gross profit margin, which was 69.43% in the most recent period, indicating a strong ability to manage production costs relative to sales revenue.

PE: 2.7x

Saturn Oil & Gas, a smaller oil player, recently announced a share repurchase program to buy back up to 7 million shares for CAD 15.05 million, aiming to enhance shareholder value. Despite high debt levels and reliance on external borrowing, the company reported significant revenue growth in Q1 2025 with CAD 242.08 million compared to CAD 42.66 million last year. However, earnings are expected to decline by an average of 33.1% annually over the next three years.

Summing It All Up

- Click this link to deep-dive into the 173 companies within our Undervalued Global Small Caps With Insider Buying screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives