- Canada

- /

- Oil and Gas

- /

- TSX:SOIL

Undervalued Small Caps With Insider Action In Global July 2025

Reviewed by Simply Wall St

In the global markets, recent tariff announcements have led to a muted response across major indices, with small-cap stocks showing little difference in performance compared to their large-cap counterparts. Meanwhile, the Federal Reserve's discussions on potential rate cuts and ongoing trade tensions have kept investors cautious but engaged. In this environment, identifying promising small-cap opportunities often involves looking at companies with solid fundamentals and insider activity that may signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.0x | 6.2x | 49.92% | ★★★★★☆ |

| Nexus Industrial REIT | 6.9x | 3.1x | 21.62% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.5x | 7.0x | 27.37% | ★★★★★☆ |

| Hemisphere Energy | 5.2x | 2.2x | 8.71% | ★★★★☆☆ |

| Sagicor Financial | 10.3x | 0.4x | -170.74% | ★★★★☆☆ |

| Seeing Machines | NA | 2.8x | 46.07% | ★★★★☆☆ |

| A.G. BARR | 19.7x | 1.9x | 45.71% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.7x | 1.8x | 12.36% | ★★★☆☆☆ |

| CVS Group | 45.5x | 1.3x | 38.47% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.9x | 0.7x | 8.49% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Aris Mining (TSX:ARIS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aris Mining is a company engaged in gold mining operations, primarily through its Marmato and Segovia projects, with a market capitalization of approximately $1.2 billion.

Operations: Aris Mining generates revenue primarily from its Segovia and Marmato operations, with Segovia contributing significantly more to the total. The company has seen fluctuations in its gross profit margin, which reached 41.86% as of March 2025. Operating expenses and non-operating expenses are notable costs impacting net income, with general and administrative expenses being a consistent component of operating costs.

PE: 45.6x

Aris Mining, a company with a small market capitalization, has been making strategic moves to enhance its production capabilities. The installation of a second mill at Segovia boosts processing capacity by 50%, setting the stage for increased gold output in the latter half of 2025. Despite relying on external borrowing for funding, their earnings are projected to grow significantly at 64.73% annually. Insider confidence is evident with recent share purchases, signaling potential growth prospects as they expand operations in Colombia and Guyana.

- Navigate through the intricacies of Aris Mining with our comprehensive valuation report here.

Explore historical data to track Aris Mining's performance over time in our Past section.

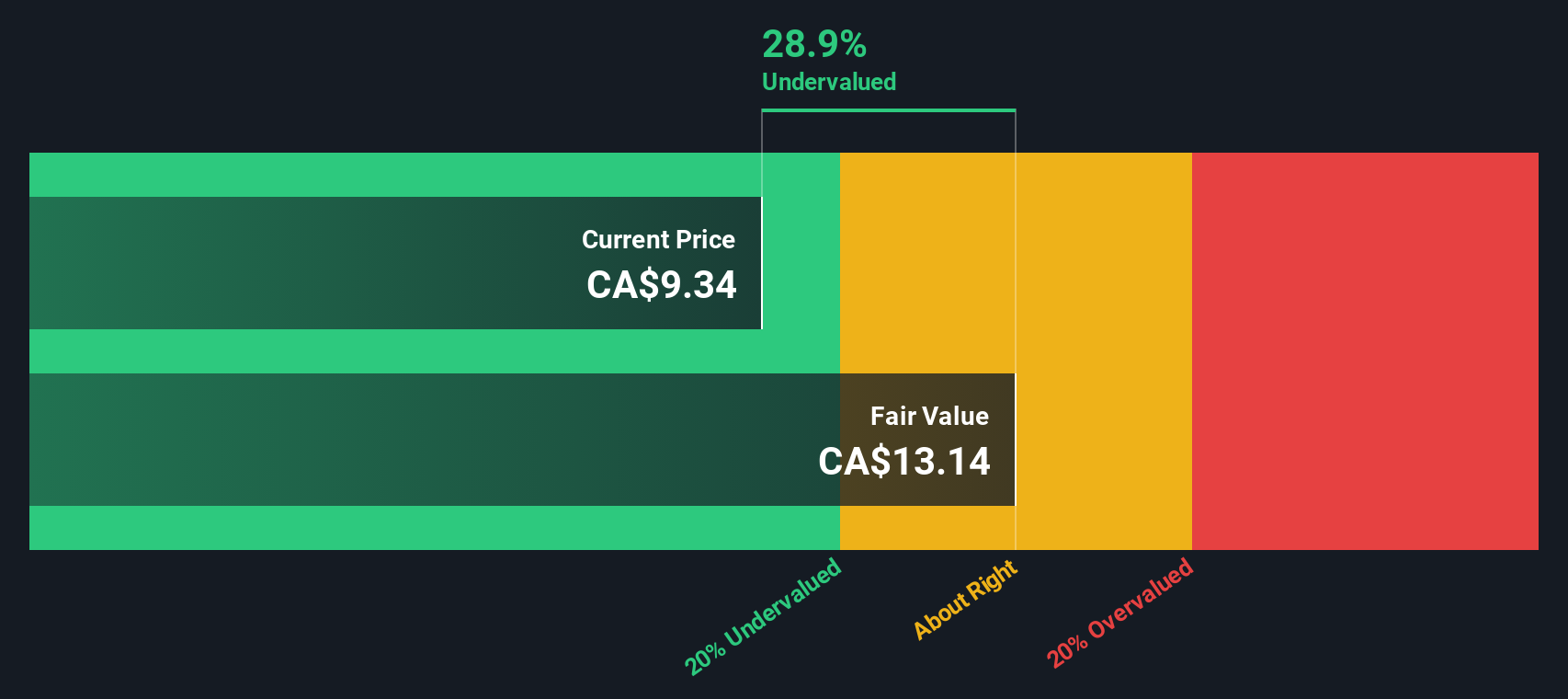

MCAN Mortgage (TSX:MKP)

Simply Wall St Value Rating: ★★★★★☆

Overview: MCAN Mortgage operates in the financial services sector, focusing on mortgage lending, with a market cap of CA$0.51 billion.

Operations: MCAN Mortgage generates revenue primarily from its financial services, specifically mortgage operations, with recent revenue reaching CA$126.46 million. The company's cost of goods sold (COGS) is CA$14.15 million, resulting in a gross profit of CA$112.31 million and a gross profit margin of 88.81%. Operating expenses are significant at CA$42.39 million, impacting the net income which stands at CA$70.96 million with a net income margin of 56.11%.

PE: 11.0x

MCAN Mortgage, a smaller player in its sector, recently reported a drop in net income to C$16.59 million for Q1 2025 from C$23.22 million the previous year, with earnings per share at C$0.43 down from C$0.65. Despite this dip, insider confidence is evident as they increased their holdings over the past few months. The company maintains quarterly dividends of C$0.41 per share and anticipates earnings growth of 13.95% annually, suggesting potential future gains amidst higher-risk funding challenges without customer deposits.

- Click here to discover the nuances of MCAN Mortgage with our detailed analytical valuation report.

Gain insights into MCAN Mortgage's historical performance by reviewing our past performance report.

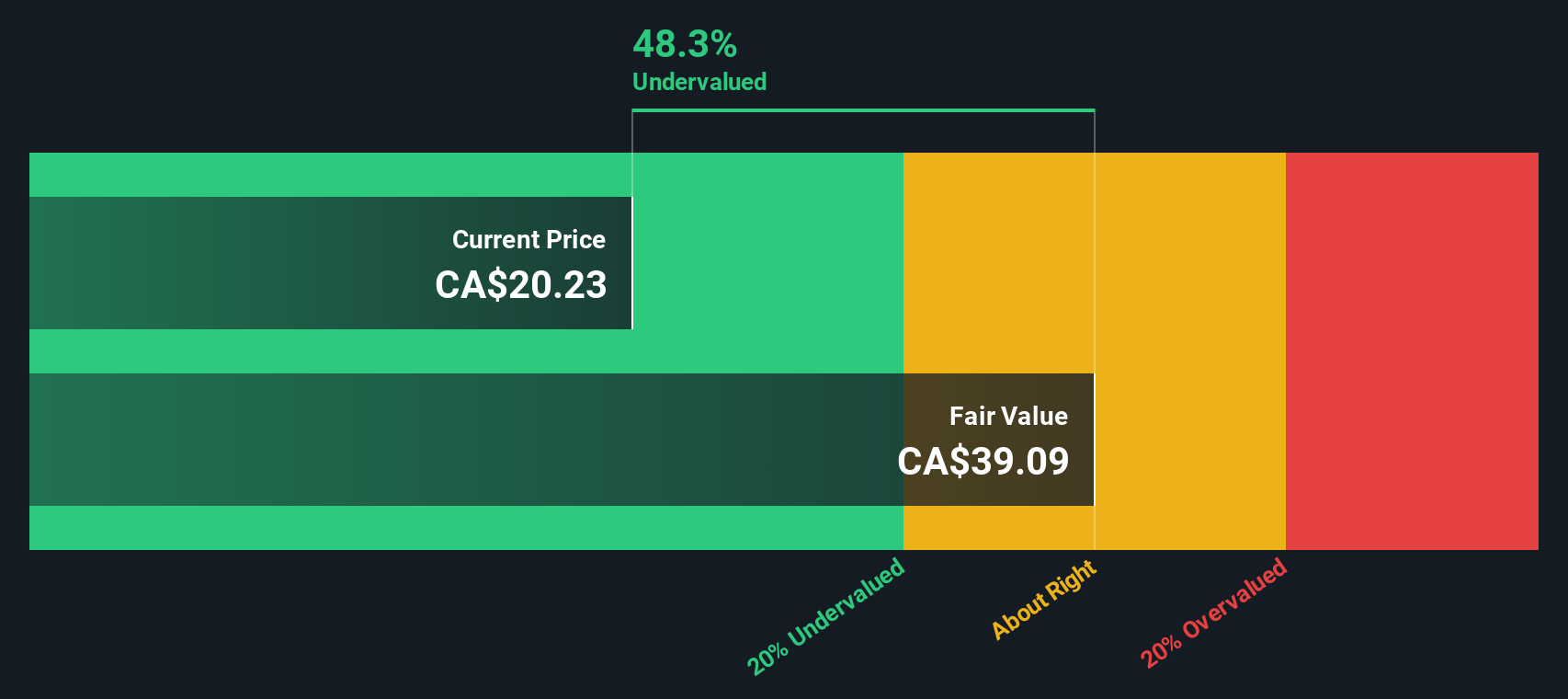

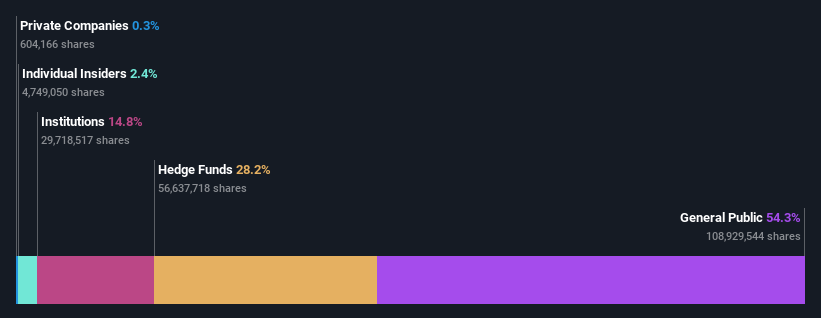

Saturn Oil & Gas (TSX:SOIL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Saturn Oil & Gas is engaged in the acquisition and exploration of resource properties, with a market cap of CA$0.19 billion.

Operations: Saturn Oil & Gas generates revenue primarily through the acquisition and exploration of resource properties, with a recent figure reaching CA$903.95 million. The company's cost structure includes significant expenses in cost of goods sold (COGS) and operating expenses, with COGS reported at CA$276.34 million in the latest period. The gross profit margin has been observed at 69.43%.

PE: 2.9x

Saturn Oil & Gas, a smaller company in the energy sector, recently renewed a US$150 million credit facility with an additional US$100 million expansion option, underscoring its financial flexibility. Despite relying on external borrowing, it maintains a strong position with fully undrawn facilities. The company plans to repurchase 7 million shares for CAD 15.05 million by July 16, 2025. With earnings projected to grow annually by 6.52%, Saturn's strategic moves may enhance shareholder value and support future growth initiatives.

- Click to explore a detailed breakdown of our findings in Saturn Oil & Gas' valuation report.

Review our historical performance report to gain insights into Saturn Oil & Gas''s past performance.

Summing It All Up

- Get an in-depth perspective on all 123 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SOIL

Saturn Oil & Gas

Engages in the acquisition, exploration, and development of petroleum and natural gas resource deposits in Canada.

Undervalued with limited growth.

Market Insights

Community Narratives