- Canada

- /

- Oil and Gas

- /

- TSX:SOBO

What South Bow (TSX:SOBO)'s Potential Pipeline Access Means For Shareholders

Reviewed by Sasha Jovanovic

- Alberta's government recently announced it will lead the planning for a new oil pipeline to British Columbia's northern Pacific coast, committing C$14 million for initial engineering and design efforts and engaging Indigenous and industry partners in the process.

- This initiative, described as nationally significant by Premier Danielle Smith, stands to improve market access for oil-sands producers such as South Bow by advancing collaborative infrastructure development.

- We'll examine how government backing for expanded pipeline infrastructure could shape South Bow's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is South Bow's Investment Narrative?

For South Bow shareholders, the central narrative centers on access to energy markets and the reliability of cash flows. The Alberta government’s new pipeline initiative, with C$14 million committed to early design and planning, is a positive signal that could shift the investment thesis in the short term. Previously, risk factors clustered around pipeline capacity constraints, the company’s elevated payout ratio and slower forecast revenue growth. If the project progresses and secures regulatory approvals, it could meaningfully ease bottlenecks for oil-sands producers like South Bow, possibly supporting throughput volumes and reinforcing the case for its high dividend. However, as the project remains in its early stages and regulatory uncertainties still loom, the most important short-term catalysts, namely, execution of new projects and operational reliability, remain unchanged, while risks tied to capital intensity and dividend sustainability are still front of mind.

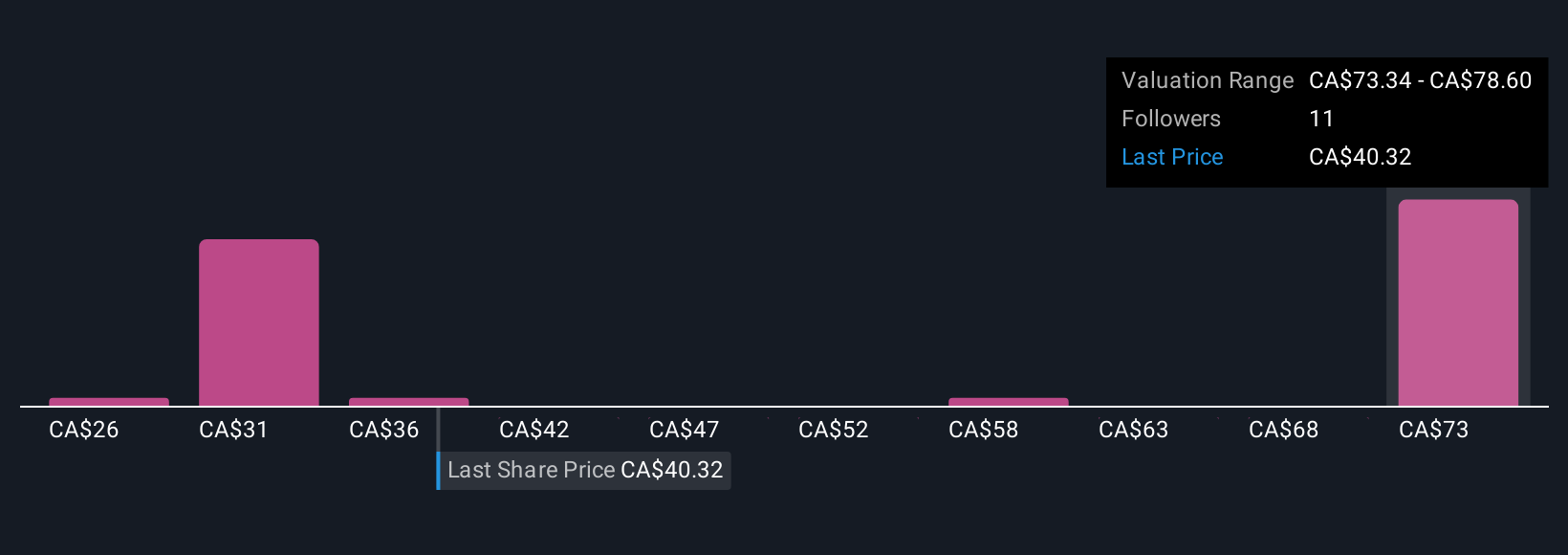

But without clarity on project approvals, heightened regulatory risk is information every investor should consider. South Bow's shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on South Bow - why the stock might be worth as much as 93% more than the current price!

Build Your Own South Bow Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your South Bow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free South Bow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate South Bow's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SOBO

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives