- Canada

- /

- Metals and Mining

- /

- TSX:ARG

3 Top TSX Dividend Stocks With At Least 3% Yield

Reviewed by Simply Wall St

In the face of ongoing economic uncertainties, including potential tariff impacts and inflationary pressures, the Canadian market remains resilient, supported by strong household balance sheets and healthy labor-market conditions. For investors seeking stability amidst this volatility, dividend stocks with yields of at least 3% can offer a reliable income stream while providing exposure to some of Canada's most established companies.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 9.41% | ★★★★★★ |

| SECURE Waste Infrastructure (TSX:SES) | 3.08% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.60% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 4.04% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.44% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.75% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.48% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.43% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.91% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.29% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

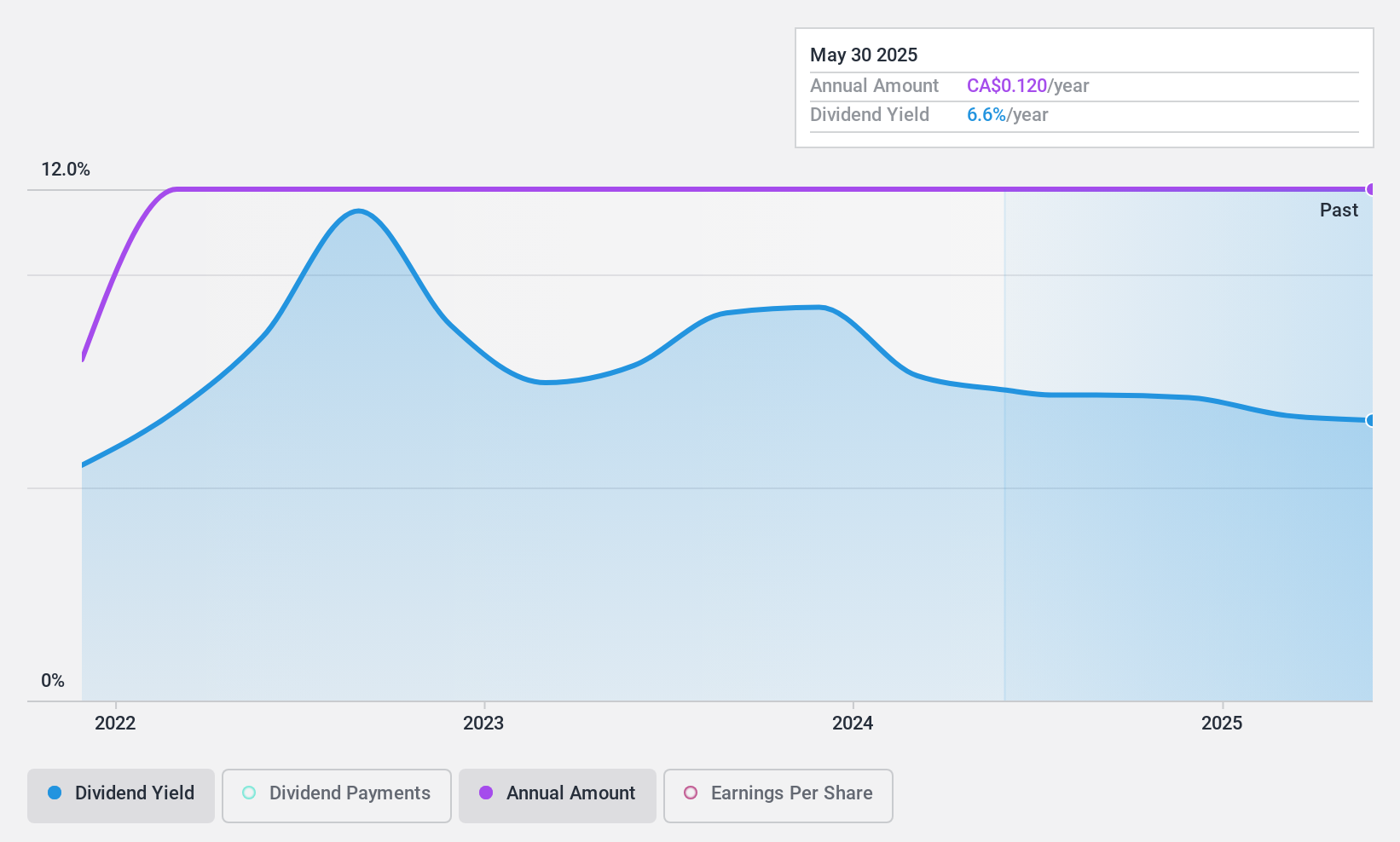

Amerigo Resources (TSX:ARG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., focuses on producing copper and molybdenum concentrates in Chile, with a market cap of CA$280.75 million.

Operations: Amerigo Resources Ltd. generates revenue primarily from the production of copper concentrates under a tolling agreement with DET, amounting to $192.77 million.

Dividend Yield: 6.9%

Amerigo Resources has shown growth in dividend payments over three years, but these have been volatile, with a payout ratio of 71.7% indicating coverage by earnings. The cash payout ratio is low at 26.8%, suggesting dividends are well-covered by cash flows. Despite significant insider selling recently, the stock trades below its estimated fair value and offers a top-tier dividend yield of 6.92%. Recent earnings showed substantial improvement with net income rising to US$19.24 million from US$3.38 million the previous year, supporting ongoing dividend distributions.

- Click here and access our complete dividend analysis report to understand the dynamics of Amerigo Resources.

- Our valuation report unveils the possibility Amerigo Resources' shares may be trading at a discount.

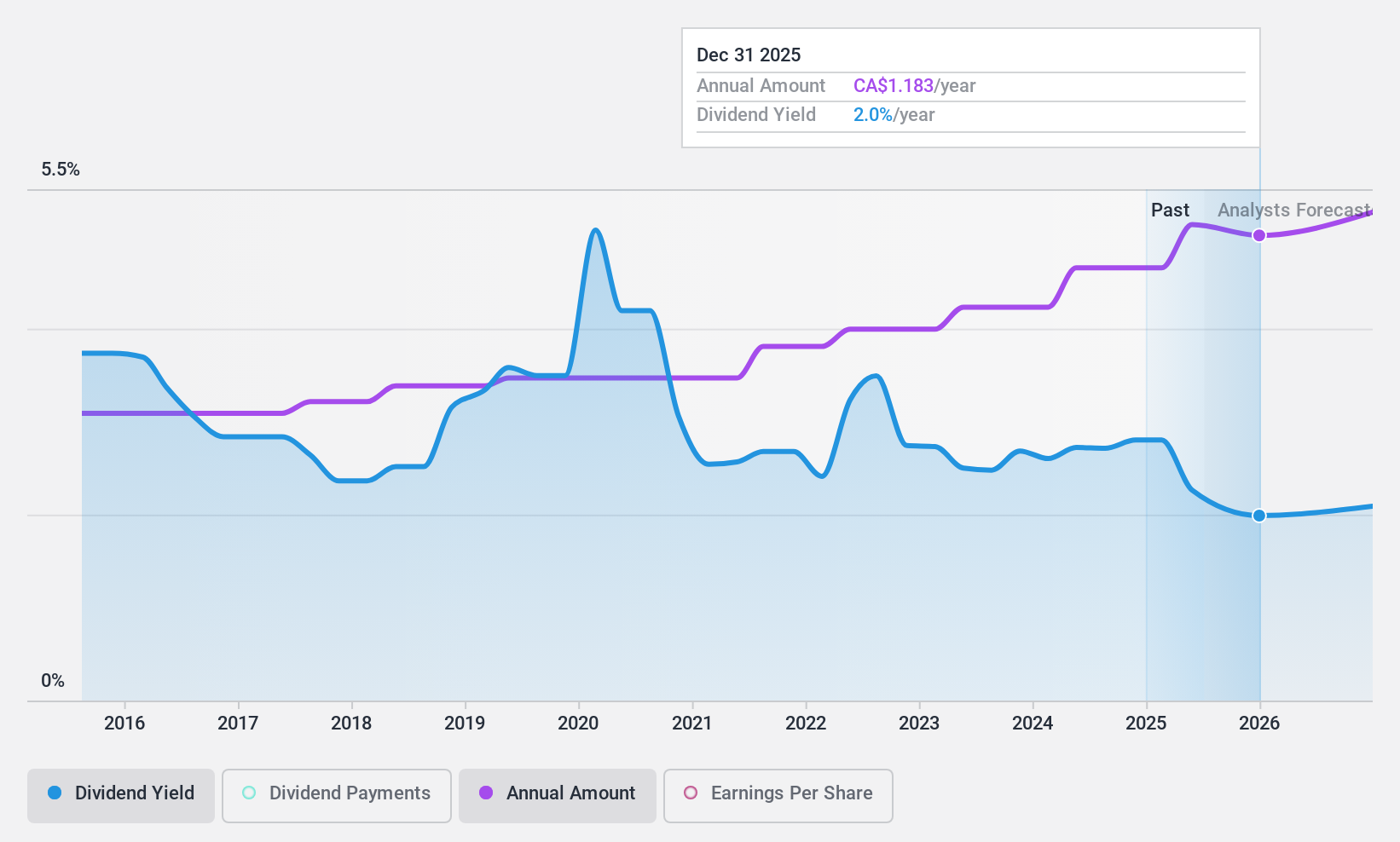

Finning International (TSX:FTT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Finning International Inc. is involved in the sale, service, and rental of heavy equipment and engines across Canada, Chile, the United Kingdom, Argentina, and other international markets with a market cap of CA$4.89 billion.

Operations: Finning International Inc.'s revenue from the sale, service, and rental of heavy equipment, engines, and related products amounts to CA$11.21 billion.

Dividend Yield: 3%

Finning International offers a stable dividend yield of 3.03%, supported by a low payout ratio of 29.7% and cash payout ratio of 17.3%, indicating strong coverage by earnings and cash flows. The dividend has grown steadily over the past decade, although it remains below top-tier Canadian payers' yields. Recent financials showed slight declines in net income to C$509 million, but revenues increased to C$11.21 billion, underpinning its reliable dividend payments amidst board leadership changes and share buybacks totaling C$175 million.

- Delve into the full analysis dividend report here for a deeper understanding of Finning International.

- Insights from our recent valuation report point to the potential undervaluation of Finning International shares in the market.

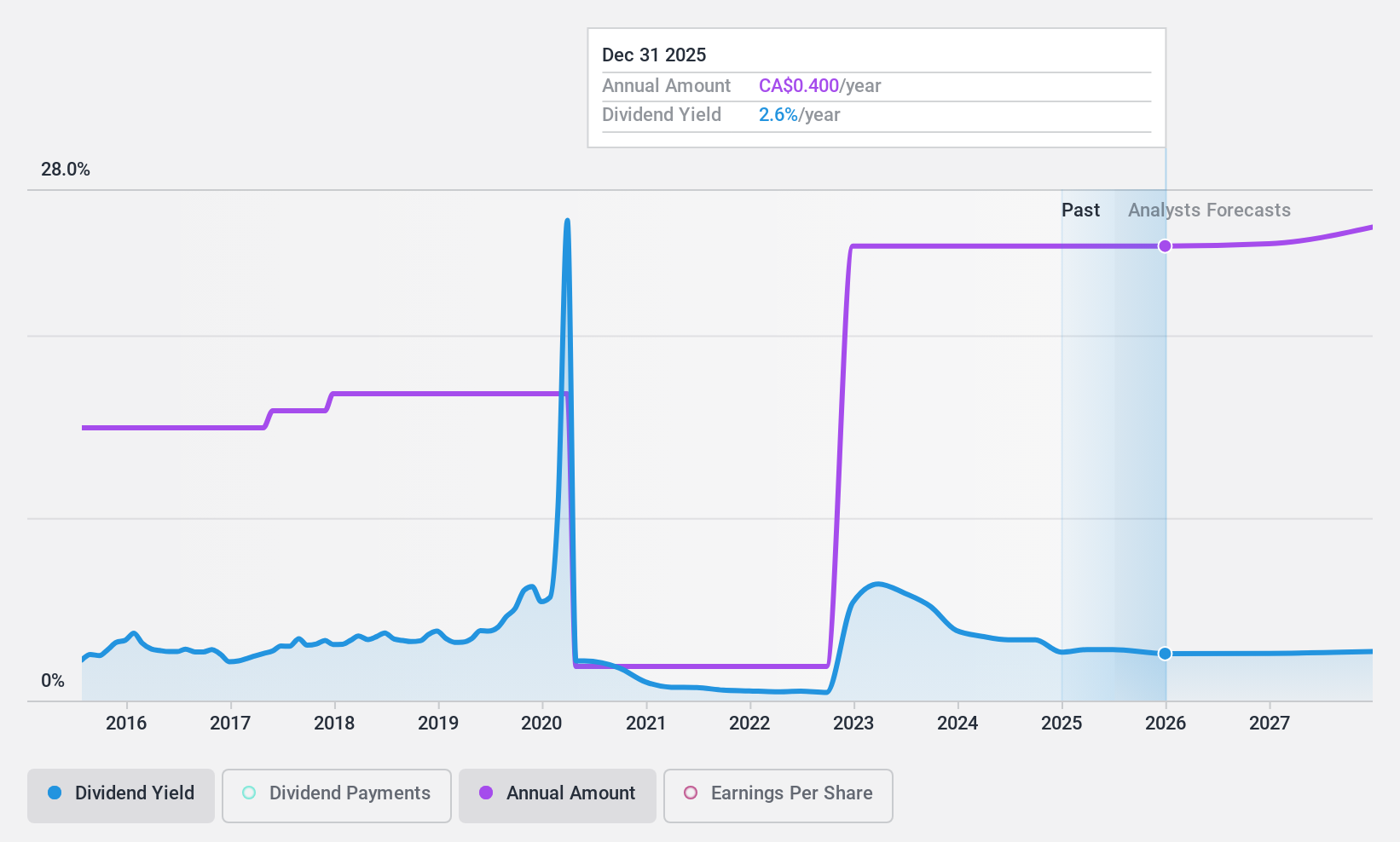

SECURE Waste Infrastructure (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SECURE Waste Infrastructure Corp. operates in the waste management and energy infrastructure sectors across Canada and the United States, with a market cap of CA$3 billion.

Operations: SECURE Waste Infrastructure Corp. generates revenue from its Energy Infrastructure segment, contributing CA$9.49 billion, and Environmental Waste Management (EWM), contributing CA$1.19 billion.

Dividend Yield: 3.1%

SECURE Waste Infrastructure pays a reliable dividend of C$0.10 per share, supported by a low payout ratio of 17.5% and cash payout ratio of 25.5%, ensuring strong coverage by earnings and cash flows. The dividend has grown steadily over the past decade but remains below top-tier Canadian yields at 3.08%. Recent financials revealed significant earnings growth to C$582 million, alongside strategic acquisitions and share buybacks totaling C$332.65 million, enhancing shareholder value amidst robust revenue increases to C$10.67 billion.

- Click to explore a detailed breakdown of our findings in SECURE Waste Infrastructure's dividend report.

- In light of our recent valuation report, it seems possible that SECURE Waste Infrastructure is trading behind its estimated value.

Taking Advantage

- Embark on your investment journey to our 26 Top TSX Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., produces copper and molybdenum concentrates in Chile.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)