- Canada

- /

- Oil and Gas

- /

- TSX:RGSI

Rockpoint Gas Storage (TSX:RGSI): How Do Latest Earnings and Dividend Moves Impact Its Valuation?

Reviewed by Simply Wall St

Rockpoint Gas Storage (TSX:RGSI) just announced its latest quarterly earnings. The company reported higher revenue compared to last year, alongside the initiation of a quarterly dividend. Both of these developments could influence investor sentiment.

See our latest analysis for Rockpoint Gas Storage.

After a burst of interest around Rockpoint Gas Storage's latest earnings and dividend announcement, the shares have shown some momentum, climbing to $26.28 with a 1-week share price return of nearly 7% and a steady positive trend so far this year. Over both the short- and longer-term, recent price gains hint that investor confidence may be strengthening on signs of growth and improving capital returns.

If these kinds of strong quarterly moves have you thinking bigger picture, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading at a modest discount to analyst price targets and strong revenue growth, investors are left to consider if Rockpoint Gas Storage is undervalued at current levels or if the market has already factored in its future potential.

Price-to-Earnings of 4.8x: Is it justified?

Rockpoint Gas Storage trades at a price-to-earnings (P/E) ratio of 4.8x, which appears significantly lower than both its peers and the broader industry. This suggests the market may be undervaluing its earnings power at the last close price of CA$26.28.

The P/E ratio measures how much investors are willing to pay for a dollar of earnings. For Rockpoint Gas Storage, a relatively low P/E is notable given the company’s recent revenue growth and improving capital returns announced this quarter. It could mean the market is not fully recognizing the company’s underlying profitability or expects slower future growth compared to its peers.

Compared to its industry, Rockpoint Gas Storage's P/E of 4.8x is a fraction of the Canadian Oil and Gas industry average of 14.7x. It is also well below the peer average of 21.4x. This significant discount stands out and may indicate a potential value opportunity, especially if the company continues to post resilient financials.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 4.8x (UNDERVALUED)

However, weaker net income growth and short-term price volatility could challenge the case for undervaluation, even in light of recent momentum and improving returns.

Find out about the key risks to this Rockpoint Gas Storage narrative.

Another View: SWS DCF Model Suggests a Steeper Discount

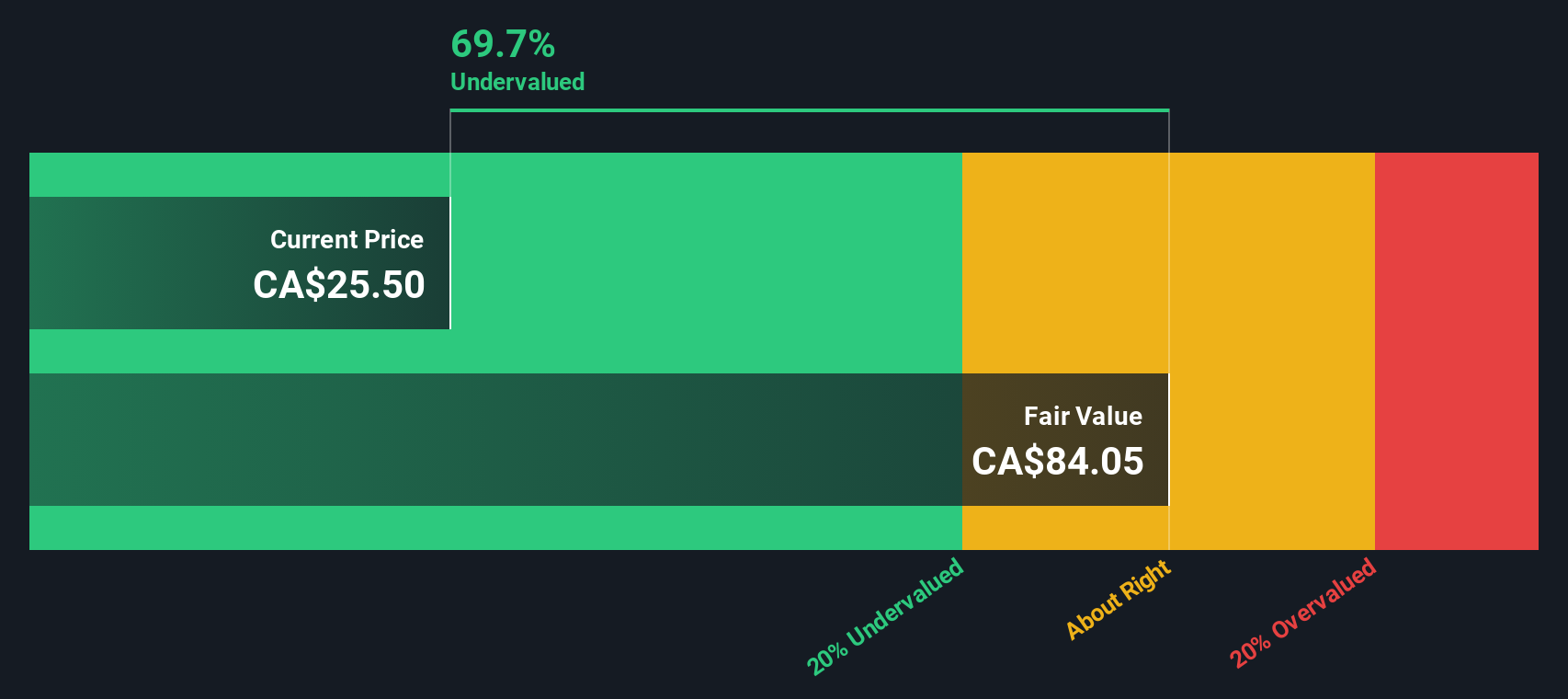

Looking at the SWS DCF model, the numbers tell an even more dramatic story. The model estimates Rockpoint Gas Storage’s fair value at CA$87.54, putting the current price at a significant 70% discount. Is this deep margin a real opportunity, or does it signal hidden risks ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rockpoint Gas Storage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rockpoint Gas Storage Narrative

If you see things differently or want to dig deeper, you can easily put together your own perspective on Rockpoint Gas Storage in just a few minutes, so why not Do it your way

A great starting point for your Rockpoint Gas Storage research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your investing journey by tapping into unique market opportunities. The right idea now could be tomorrow's standout performer, but only if you act.

- Find strong yields for your portfolio and tap into growth with these 16 dividend stocks with yields > 3% offering attractive dividend opportunities above 3%.

- Capitalize on the AI boom by spotting emerging trends among these 25 AI penny stocks before the rest of the market catches on.

- Catch undervalued gems poised for a rebound by scanning these 886 undervalued stocks based on cash flows and gain a potential edge over the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RGSI

Rockpoint Gas Storage

Owns and operates natural gas storage infrastructure facilities in North America.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives