- Canada

- /

- Metals and Mining

- /

- TSX:WRN

TSX Penny Stocks To Watch With Market Caps Under CA$400M

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, investors are finding opportunities despite potential economic softening and inflationary pressures. In such a climate, penny stocks—though often seen as relics of past trading days—remain relevant for those seeking growth potential in smaller or newer companies. This article explores three penny stocks that stand out for their financial strength and potential to offer hidden value, providing investors with intriguing prospects beyond the more established names.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.75 | CA$73.84M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.64 | CA$576.47M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.43 | CA$759.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$3.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$472.37M | ✅ 3 ⚠️ 2 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.55 | CA$107.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.29 | CA$134.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.64 | CA$137.04M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.78 | CA$173.98M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 877 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on the acquisition, exploration, and development of non-conventional oil and gas projects in Canada, with a market cap of CA$107.13 million.

Operations: The company generates revenue primarily from its Oil & Gas - Exploration & Production segment, totaling CA$34.78 million.

Market Cap: CA$107.13M

Questerre Energy Corporation, with a market cap of CA$107.13 million, recently reported first-quarter revenue of CA$8.58 million and a net income turnaround to CA$0.004 million from a loss last year. Despite being unprofitable overall, the company has reduced its losses significantly over the past five years and maintains strong liquidity with short-term assets exceeding both short- and long-term liabilities. The management team is highly experienced, which could provide stability in navigating challenges within the volatile oil and gas sector. Additionally, Questerre's debt levels have decreased substantially over time, enhancing financial flexibility for future operations.

- Click here to discover the nuances of Questerre Energy with our detailed analytical financial health report.

- Gain insights into Questerre Energy's historical outcomes by reviewing our past performance report.

Lithium Chile (TSXV:LITH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lithium Chile Inc. focuses on acquiring and developing lithium properties in Chile and Argentina, with a market cap of CA$113.65 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$113.65M

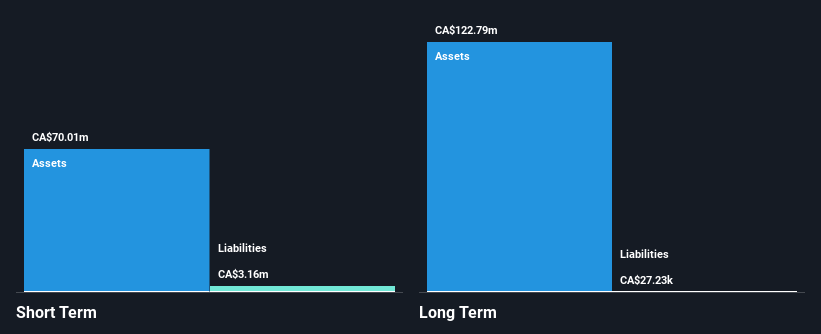

Lithium Chile Inc., with a market cap of CA$113.65 million, is pre-revenue but has shown significant earnings growth, achieving net income of CA$7.17 million in 2024 from a previous loss. The company operates debt-free and recently secured a historic Special Lithium Operation Contract in Chile, enhancing its strategic position within the lithium sector. Despite its strong management team and board, there are concerns regarding its ability to cover liabilities with short-term assets and doubts about its ongoing viability expressed by auditors. However, the company's involvement in transformative projects could offer potential long-term benefits.

- Take a closer look at Lithium Chile's potential here in our financial health report.

- Assess Lithium Chile's previous results with our detailed historical performance reports.

Western Copper and Gold (TSX:WRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Western Copper and Gold Corporation is an exploration stage company focused on the exploration and development of mineral properties in Canada, with a market cap of CA$3.30 billion.

Operations: Western Copper and Gold Corporation has not reported any revenue segments.

Market Cap: CA$330.01M

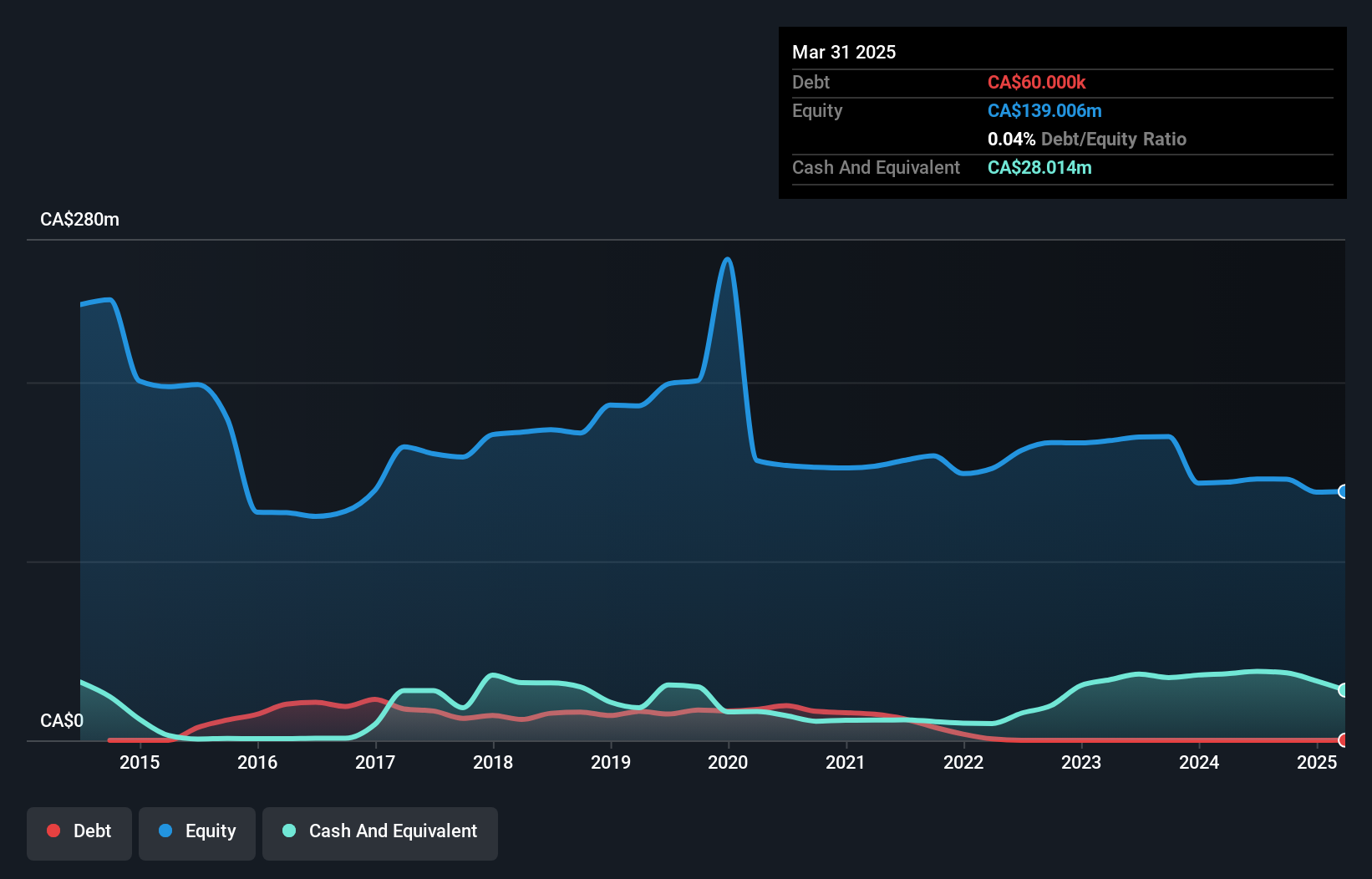

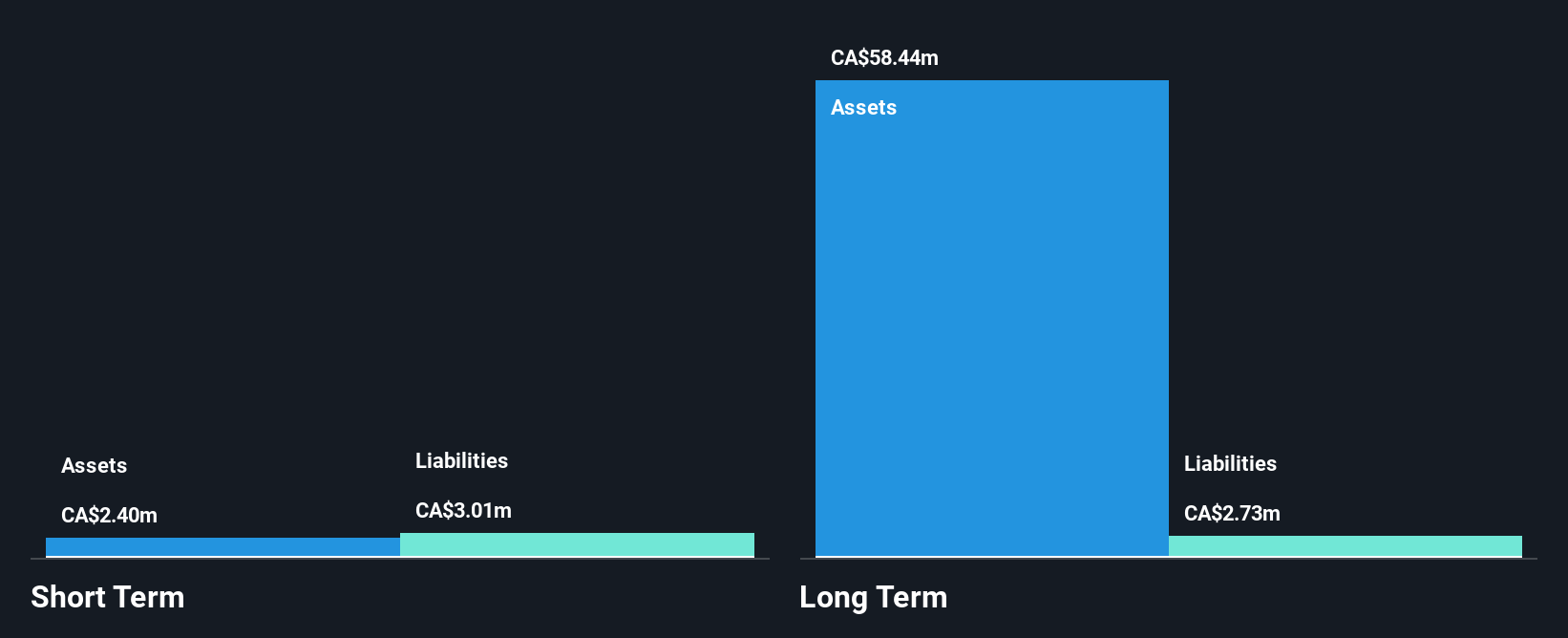

Western Copper and Gold Corporation, with a market cap of CA$3.30 billion, is pre-revenue and currently unprofitable. The company has no debt and its short-term assets significantly exceed both short-term and long-term liabilities. Despite an inexperienced management team, the board of directors is considered experienced. Recent developments include progress on infrastructure initiatives for the Casino Project, which could enhance Yukon's connectivity and economic prospects. While earnings are forecast to decline by 14.3% annually over the next three years, Western's strong cash position provides a runway exceeding three years under current conditions without dilution concerns for shareholders.

- Navigate through the intricacies of Western Copper and Gold with our comprehensive balance sheet health report here.

- Learn about Western Copper and Gold's future growth trajectory here.

Summing It All Up

- Gain an insight into the universe of 877 TSX Penny Stocks by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Copper and Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WRN

Western Copper and Gold

An exploration stage company, engages in the exploration and development of mineral properties in Canada.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives