- Canada

- /

- Oil and Gas

- /

- TSX:QEC

These 4 Measures Indicate That Questerre Energy (TSE:QEC) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Questerre Energy Corporation (TSE:QEC) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Questerre Energy

What Is Questerre Energy's Debt?

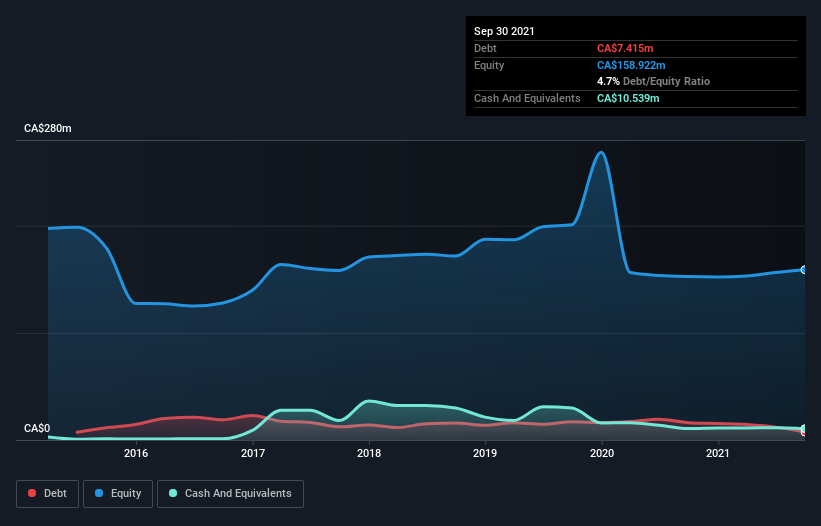

As you can see below, Questerre Energy had CA$7.42m of debt at September 2021, down from CA$16.2m a year prior. But it also has CA$10.5m in cash to offset that, meaning it has CA$3.12m net cash.

A Look At Questerre Energy's Liabilities

According to the last reported balance sheet, Questerre Energy had liabilities of CA$12.7m due within 12 months, and liabilities of CA$21.0m due beyond 12 months. Offsetting this, it had CA$10.5m in cash and CA$3.45m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$19.8m.

Since publicly traded Questerre Energy shares are worth a total of CA$107.1m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Questerre Energy boasts net cash, so it's fair to say it does not have a heavy debt load!

Although Questerre Energy made a loss at the EBIT level, last year, it was also good to see that it generated CA$5.5m in EBIT over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Questerre Energy will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Questerre Energy has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, Questerre Energy actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While Questerre Energy does have more liabilities than liquid assets, it also has net cash of CA$3.12m. And it impressed us with free cash flow of CA$9.5m, being 174% of its EBIT. So is Questerre Energy's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Questerre Energy that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Questerre Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:QEC

Questerre Energy

An energy technology and innovation company, engages in the acquisition, exploration, and development non-conventional oil and gas projects in Canada.

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026