- Canada

- /

- Oil and Gas

- /

- TSX:QEC

Here's Why We Think Questerre Energy (TSE:QEC) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Questerre Energy (TSE:QEC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Questerre Energy with the means to add long-term value to shareholders.

Check out our latest analysis for Questerre Energy

How Fast Is Questerre Energy Growing Its Earnings Per Share?

Over the last three years, Questerre Energy has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Questerre Energy's EPS soared from CA$0.0079 to CA$0.012, over the last year. That's a fantastic gain of 56%.

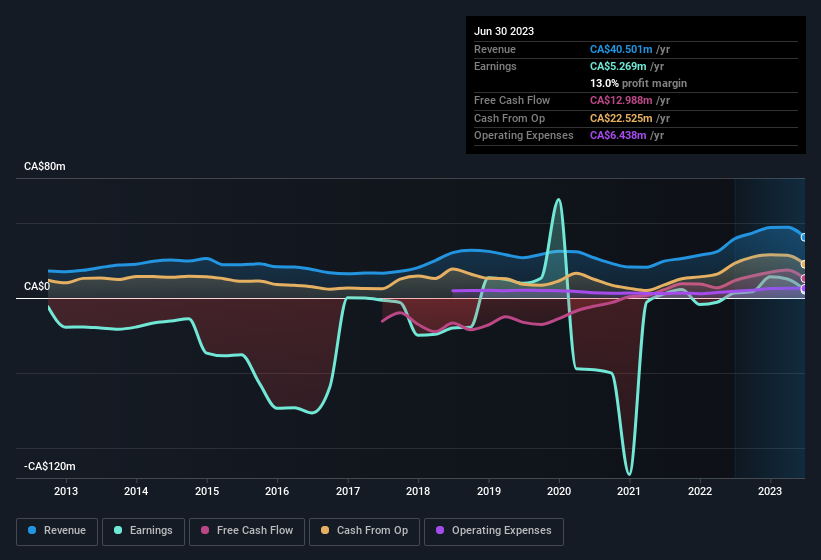

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Questerre Energy is growing revenues, and EBIT margins improved by 238.0 percentage points to 14%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Questerre Energy isn't a huge company, given its market capitalisation of CA$94m. That makes it extra important to check on its balance sheet strength.

Are Questerre Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Questerre Energy shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Michael Binnion, the President of the company, paid CA$22k for shares at around CA$0.21 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Is Questerre Energy Worth Keeping An Eye On?

For growth investors, Questerre Energy's raw rate of earnings growth is a beacon in the night. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. In essence, your time will not be wasted checking out Questerre Energy in more detail. Still, you should learn about the 2 warning signs we've spotted with Questerre Energy.

The good news is that Questerre Energy is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Questerre Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:QEC

Questerre Energy

An energy technology and innovation company, engages in the acquisition, exploration, and development non-conventional oil and gas projects in Canada.

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success