The board of Pason Systems Inc. (TSE:PSI) has announced that it will pay a dividend of CA$0.05 per share on the 29th of September. The dividend yield will be 2.4% based on this payment which is still above the industry average.

See our latest analysis for Pason Systems

Pason Systems' Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, the company's dividend was higher than its profits, and made up 93% of cash flows. This indicates that the company could be more focused on returning cash to shareholders than reinvesting to grow the business.

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we estimate that the payout ratio could reach 47%, which is in a comfortable range for us.

Dividend Volatility

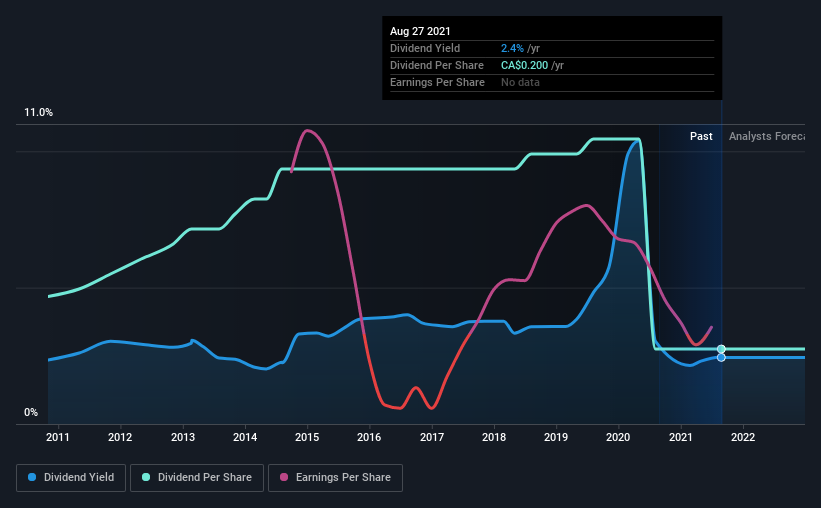

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from CA$0.34 in 2011 to the most recent annual payment of CA$0.20. Doing the maths, this is a decline of about 5.2% per year. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Could Be Constrained

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Pason Systems has impressed us by growing EPS at 32% per year over the past five years. EPS has been growing well, but Pason Systems has been paying out a massive proportion of its earnings, which can make the dividend tough to maintain.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. Strong earnings growth means Pason Systems has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Pason Systems that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:PSI

Pason Systems

Provides instrumentation and data management systems for oil and gas drilling in Canada, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026