Readers hoping to buy Pason Systems Inc. (TSE:PSI) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. If you purchase the stock on or after the 12th of September, you won't be eligible to receive this dividend, when it is paid on the 27th of September.

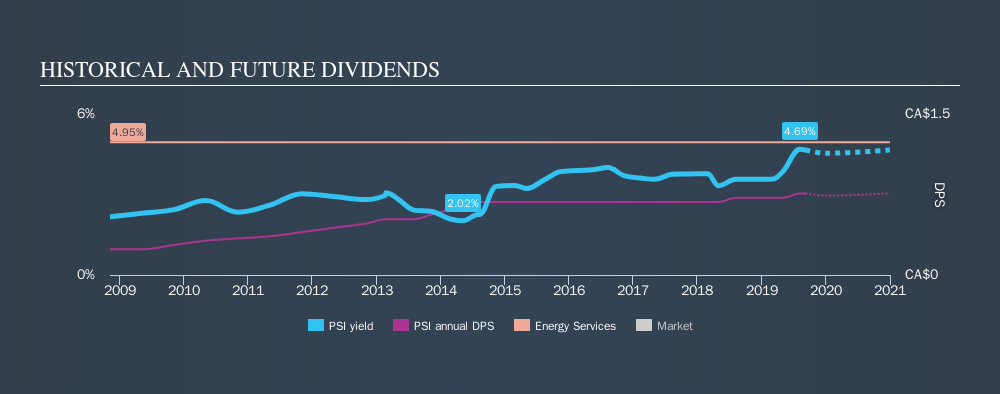

Pason Systems's upcoming dividend is CA$0.19 a share, following on from the last 12 months, when the company distributed a total of CA$0.76 per share to shareholders. Calculating the last year's worth of payments shows that Pason Systems has a trailing yield of 4.7% on the current share price of CA$16.31. If you buy this business for its dividend, you should have an idea of whether Pason Systems's dividend is reliable and sustainable. As a result, readers should always check whether Pason Systems has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Pason Systems

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Its dividend payout ratio is 84% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth We'd be worried about the risk of a drop in earnings. A useful secondary check can be to evaluate whether Pason Systems generated enough free cash flow to afford its dividend. It paid out 81% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Pason Systems has grown its earnings rapidly, up 24% a year for the past five years. The company is paying out more than three-quarters of its earnings, but it is also generating strong earnings growth.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past ten years, Pason Systems has increased its dividend at approximately 12% a year on average. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

To Sum It Up

From a dividend perspective, should investors buy or avoid Pason Systems? Higher earnings per share generally lead to higher dividends from dividend-paying stocks over the long run. That's why we're glad to see Pason Systems's earnings per share growing, although as we saw, the company is paying out more than half of its earnings and cashflow - 84% and 81% respectively. In summary, while it has some positive characteristics, we're not inclined to race out and buy Pason Systems today.

Curious what other investors think of Pason Systems? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:PSI

Pason Systems

Provides instrumentation and data management systems for oil and gas drilling in Canada, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)