- Canada

- /

- Energy Services

- /

- TSX:PSD

TSX Spotlight: 3 Penny Stocks With Market Caps Under CA$400M

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of policy shifts and economic resilience, the TSX has reached new heights despite earlier volatility. Amid these conditions, penny stocks continue to capture investor interest, offering unique opportunities for growth beyond traditional large-cap investments. While often associated with smaller or newer companies, penny stocks can still provide significant potential when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.62 | CA$62.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.91 | CA$263.71M | ✅ 4 ⚠️ 1 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.04 | CA$105.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.77 | CA$512.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.96 | CA$19.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.57 | CA$181.2M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$176.45M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.15 | CA$6.57M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 445 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Erdene Resource Development (TSX:ERD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erdene Resource Development Corporation is engaged in the exploration and development of precious and base metal deposits in Mongolia, with a market cap of CA$354.78 million.

Operations: Currently, Erdene Resource Development Corporation does not report any revenue segments.

Market Cap: CA$354.78M

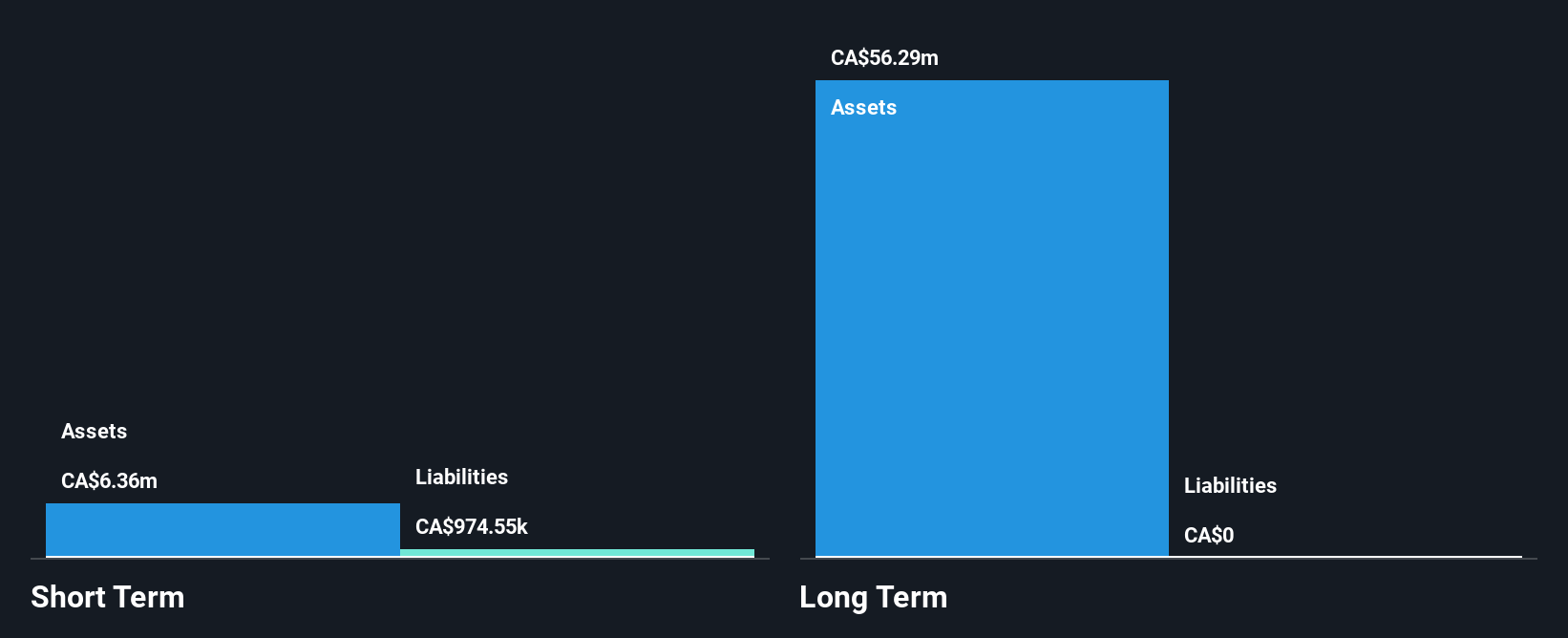

Erdene Resource Development Corporation is a pre-revenue company focused on mineral exploration in Mongolia, with a market cap of CA$354.78 million. The company has no long-term liabilities and maintains a sufficient cash runway for over a year based on its current free cash flow. Erdene recently executed an option agreement to potentially acquire up to 80% ownership in the Tereg Uul copper-gold prospect, which could enhance its asset base significantly if exploration milestones are met. Despite being unprofitable, Erdene has reduced losses annually by 11.7% over the past five years and remains debt-free with stable shareholder dilution levels.

- Click here to discover the nuances of Erdene Resource Development with our detailed analytical financial health report.

- Understand Erdene Resource Development's track record by examining our performance history report.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$181.20 million.

Operations: The company generates revenue from its Oil Well Equipment & Services segment, amounting to CA$37.36 million.

Market Cap: CA$181.2M

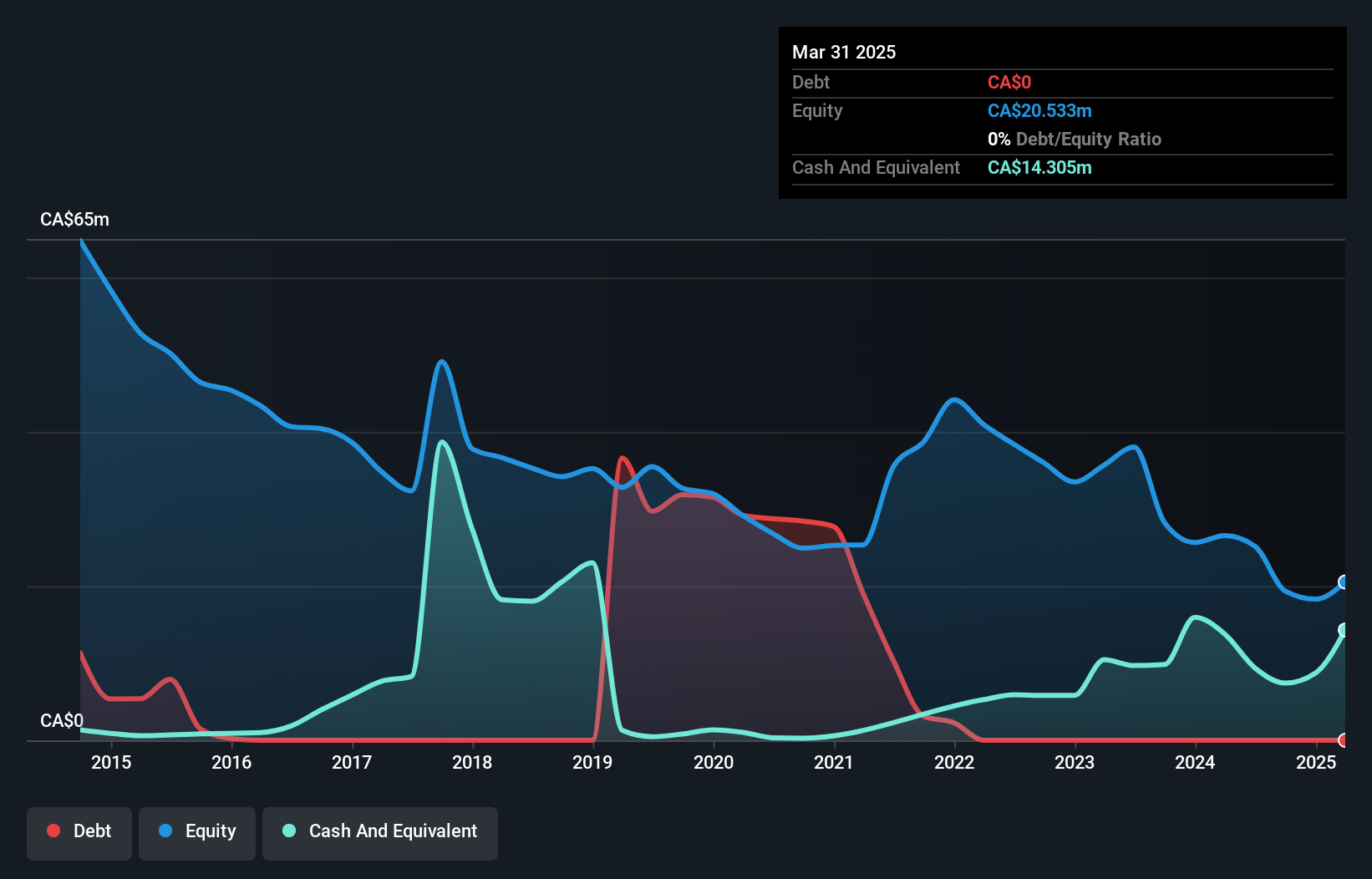

Pulse Seismic Inc., with a market cap of CA$181.20 million, has shown financial resilience by achieving profitability over the past five years and maintaining a debt-free status. The company's recent earnings report indicated significant growth, with net income rising to CA$13.38 million from CA$2.68 million year-over-year, reflecting high-quality earnings and an outstanding return on equity of 68.6%. Additionally, Pulse's board approved a 17% dividend increase and executed a modest share buyback program, demonstrating shareholder-friendly practices while its seasoned management team continues to navigate the energy sector adeptly despite recent negative earnings growth challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Pulse Seismic.

- Examine Pulse Seismic's past performance report to understand how it has performed in prior years.

NorthIsle Copper and Gold (TSXV:NCX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NorthIsle Copper and Gold Inc. is a junior resources company focused on the exploration, development, and acquisition of mineral properties in Canada, with a market cap of CA$305.84 million.

Operations: NorthIsle Copper and Gold Inc. does not report any revenue segments.

Market Cap: CA$305.84M

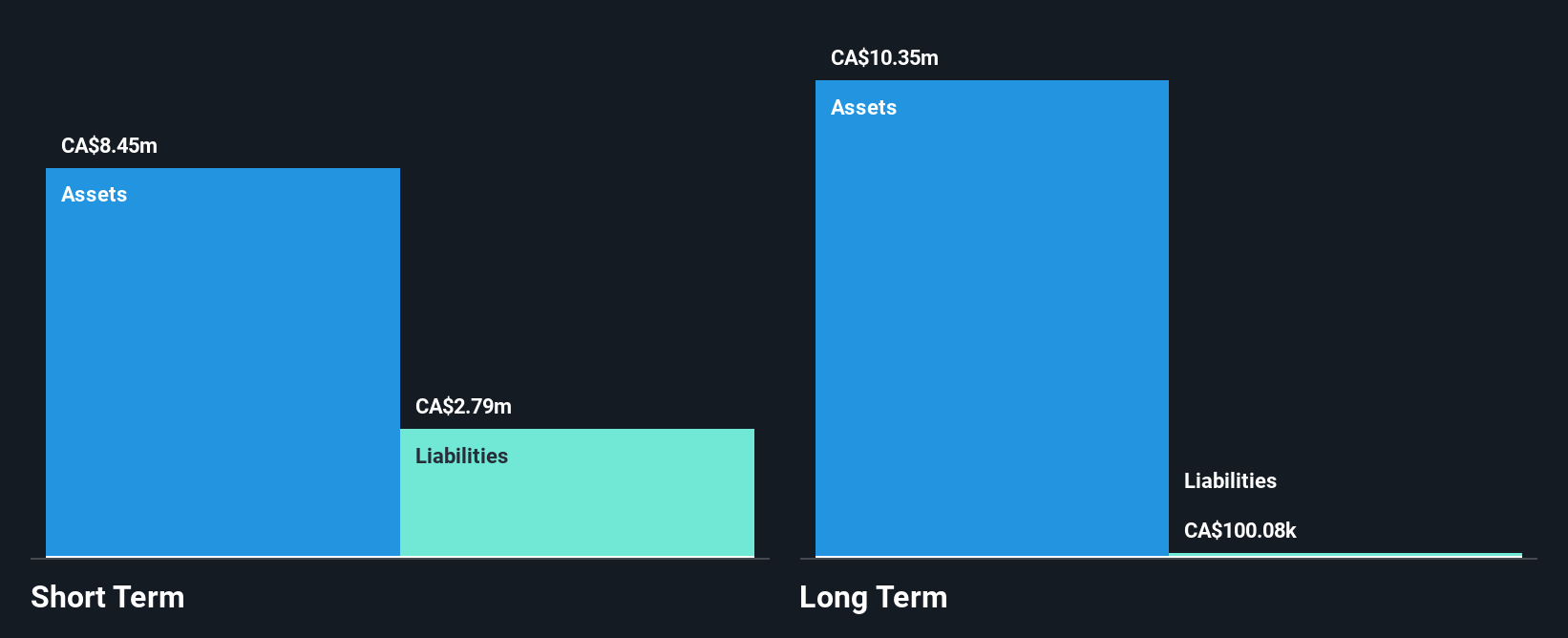

NorthIsle Copper and Gold Inc., with a market cap of CA$305.84 million, is a pre-revenue junior resources company focused on its North Island Project. The company recently announced initial results from its 2025 exploration campaign, including successful mobilization of advanced scanning technology to enhance resource identification and target generation across its 35-kilometre porphyry belt. Despite being unprofitable and facing increasing losses over the past five years, NorthIsle remains debt-free and has sufficient cash runway for nine months following recent capital raising efforts. The board's experience averages 4.7 years, contributing to strategic exploration initiatives aimed at enhancing project value.

- Click to explore a detailed breakdown of our findings in NorthIsle Copper and Gold's financial health report.

- Evaluate NorthIsle Copper and Gold's historical performance by accessing our past performance report.

Seize The Opportunity

- Navigate through the entire inventory of 445 TSX Penny Stocks here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives