In 2016 Neil Korchinski was appointed CEO of Petrus Resources Ltd. (TSE:PRQ). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Petrus Resources

How Does Neil Korchinski's Compensation Compare With Similar Sized Companies?

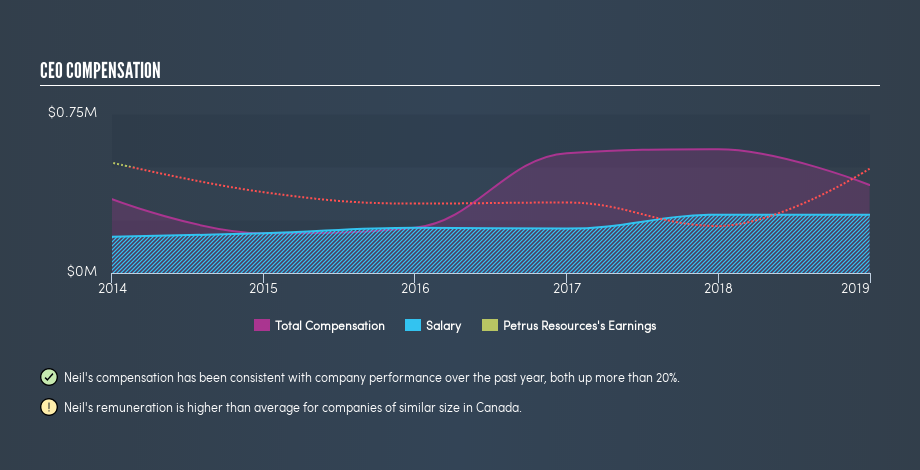

According to our data, Petrus Resources Ltd. has a market capitalization of CA$17m, and pays its CEO total annual compensation worth CA$415k. (This figure is for the year to December 2018). That's actually a decrease on the year before. We think total compensation is more important but we note that the CEO salary is lower, at CA$275k. We examined a group of similar sized companies, with market capitalizations of below CA$269m. The median CEO total compensation in that group is CA$150k.

Thus we can conclude that Neil Korchinski receives more in total compensation than the median of a group of companies in the same market, and of similar size to Petrus Resources Ltd.. However, this doesn't necessarily mean the pay is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

The graphic below shows how CEO compensation at Petrus Resources has changed from year to year.

Is Petrus Resources Ltd. Growing?

Petrus Resources Ltd. has increased its earnings per share (EPS) by an average of 23% a year, over the last three years (using a line of best fit). It saw its revenue drop -15% over the last year.

This demonstrates that the company has been improving recently. A good result. Revenue growth is a real positive for growth, but ultimately profits are more important. Shareholders might be interested in this free visualization of analyst forecasts.

Has Petrus Resources Ltd. Been A Good Investment?

With a three year total loss of 83%, Petrus Resources Ltd. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

We examined the amount Petrus Resources Ltd. pays its CEO, and compared it to the amount paid by similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. However, the returns to investors are far less impressive, over the same period. One might thus conclude that it would be better if the company waited until growth is reflected in the share price, before increasing CEO compensation. So you may want to check if insiders are buying Petrus Resources shares with their own money (free access).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:PRQ

Petrus Resources

Engages in the acquisition, development, exploration, and exploitation of energy business-related assets in Canada.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion