Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Prairie Provident Resources Inc. (TSE:PPR) share price is down 46% in the last year. That contrasts poorly with the market return of 3.6%. Prairie Provident Resources may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days.

See our latest analysis for Prairie Provident Resources

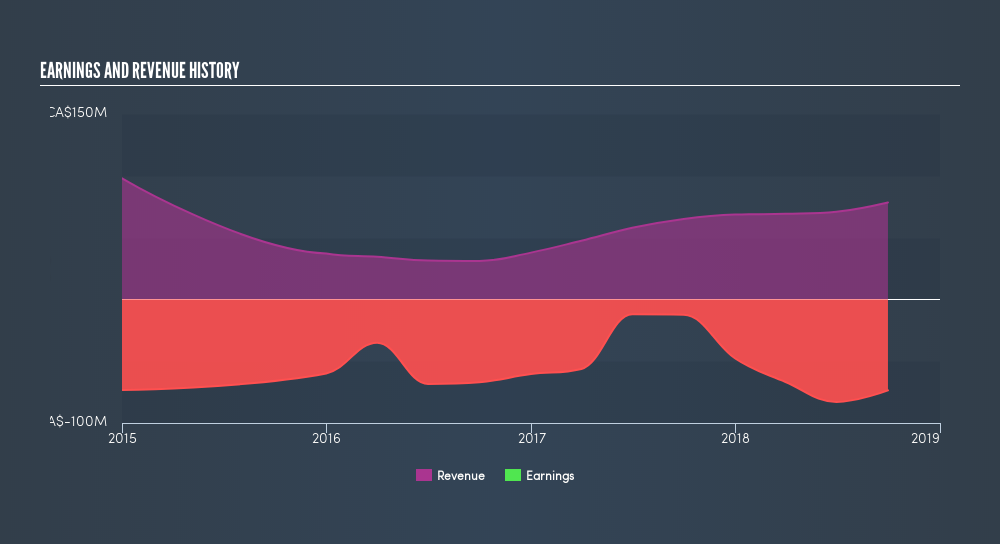

Because Prairie Provident Resources is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Prairie Provident Resources increased its revenue by 21%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 46%. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Prairie Provident Resources's financial health with this freereport on its balance sheet.

A Different Perspective

While Prairie Provident Resources shareholders are down 46% for the year, the market itself is up 3.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before spending more time on Prairie Provident Resources it might be wise to click here to see if insiders have been buying or selling shares.

We will like Prairie Provident Resources better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:PPR

Prairie Provident Resources

Engages in the exploration, development, and production of oil and natural gas properties in Alberta.

Moderate and slightly overvalued.

Market Insights

Community Narratives