Stock Analysis

- Canada

- /

- Oil and Gas

- /

- TSX:PPL

With EPS Growth And More, Pembina Pipeline (TSE:PPL) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Pembina Pipeline (TSE:PPL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Pembina Pipeline

Pembina Pipeline's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Pembina Pipeline has achieved impressive annual EPS growth of 39%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Pembina Pipeline's EBIT margins are flat but, worryingly, its revenue is actually down. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

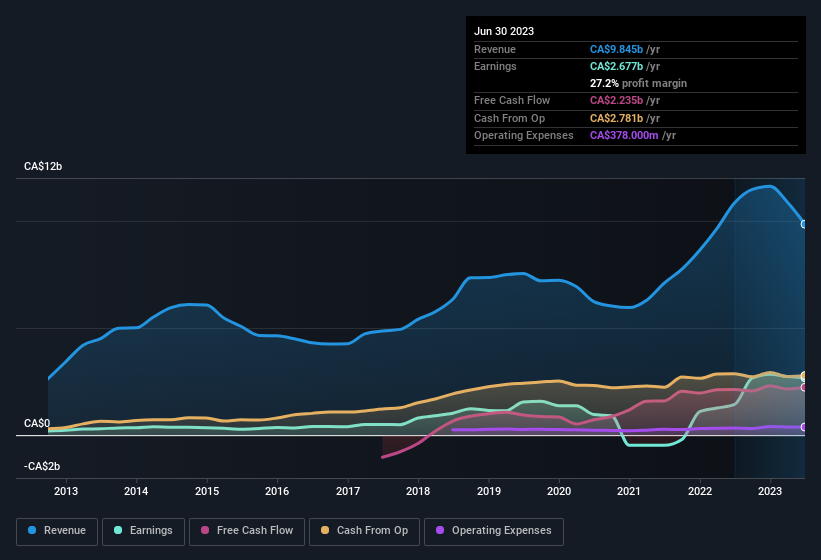

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Pembina Pipeline's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Pembina Pipeline Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that Pembina Pipeline insiders spent a whopping CA$1.6m on stock in just one year, without so much as a single sale. Knowing this, Pembina Pipeline will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Independent Director, Robert Gwin, who made the biggest single acquisition, paying CA$413k for shares at about CA$41.34 each.

The good news, alongside the insider buying, for Pembina Pipeline bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$20m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.08% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Pembina Pipeline Worth Keeping An Eye On?

Pembina Pipeline's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Pembina Pipeline belongs near the top of your watchlist. We should say that we've discovered 3 warning signs for Pembina Pipeline (1 is concerning!) that you should be aware of before investing here.

The good news is that Pembina Pipeline is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Pembina Pipeline is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PPL

Pembina Pipeline

Pembina Pipeline Corporation provides energy transportation and midstream services.

Established dividend payer and fair value.