- Canada

- /

- Oil and Gas

- /

- TSX:PPL

Pembina Pipeline (TSX:PPL): Assessing Valuation as Greenlight Project Advances With New Partnerships and Funding Moves

Reviewed by Kshitija Bhandaru

Investor attention on Pembina Pipeline (TSX:PPL) is picking up after the company advanced the Greenlight Electricity Centre project, providing details about a key land deal, partnership progress, and its path toward a final investment decision.

See our latest analysis for Pembina Pipeline.

Pembina Pipeline’s recent preferred share redemption and new debt issuance come as its major Greenlight project gains momentum. This has drawn attention from investors eager for long-term growth. After a steady few months, its 1-year total shareholder return sits at -5.9%. However, the 3- and 5-year total returns of 42% and 148% respectively highlight resilient, compounding performance as confidence in its infrastructure strategy grows.

If recent infrastructure moves have you watching the market more closely, this could be the perfect moment to expand your perspective and discover fast growing stocks with high insider ownership

With shares recently lagging while the company makes strategic moves and trades below analyst price targets, is Pembina Pipeline currently undervalued, or is the market fairly pricing in its future growth prospects?

Most Popular Narrative: 9.5% Undervalued

Pembina Pipeline’s current fair value estimate sits above the latest closing price, suggesting potential upside if analyst forecasts play out. The recommended discount rate reflects updated profitability and revenue assumptions by the broader market consensus.

“Strong ongoing investments in expanding midstream and export terminal assets (notably Cedar LNG, Prince Rupert LPG terminal, and new pipeline projects) position Pembina to capture incremental volumes and diversify revenue sources. This supports both top-line growth and future EBITDA expansion. Sustained global demand for energy (particularly from Asian markets) is driving long-term, contract-backed LNG and LPG export capacity growth, increasing asset utilization rates and improving revenue visibility via multiyear take-or-pay agreements. These factors serve as catalysts for future revenue and earnings growth.”

What’s the secret sauce behind this bullish target? The narrative leans heavily on the company’s continued investment surge and a future profit margin leap that sets it apart from traditional peers. Want to see the projections and bold assumptions that drive this optimism? Get the full story in the complete narrative.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges and shifts in Western Canadian energy demand could quickly alter Pembina's growth trajectory and put the current optimistic outlook to the test.

Find out about the key risks to this Pembina Pipeline narrative.

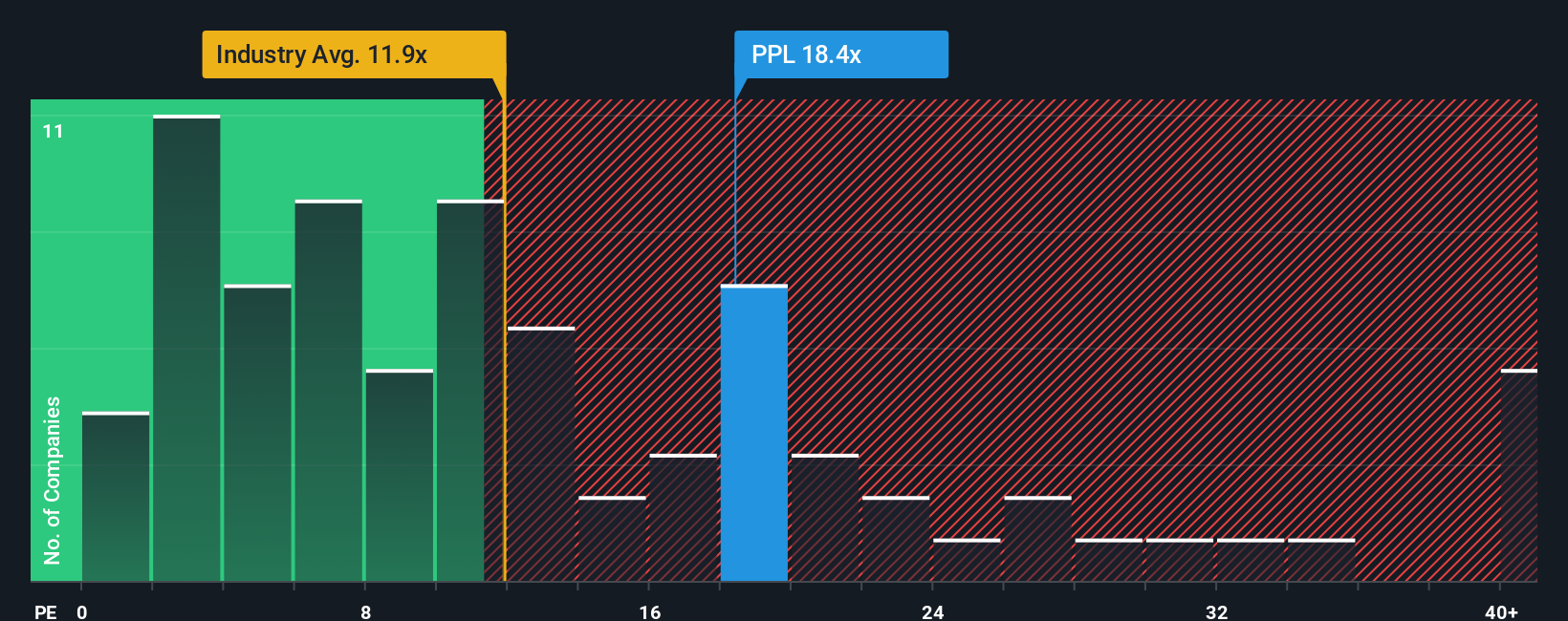

Another View: Multiples Signal a Pricier Stock

While our main valuation paints Pembina Pipeline as undervalued, its price-to-earnings ratio tells a different story. Trading at 17.9x, Pembina looks expensive compared to both the Canadian oil and gas industry average of 12x and the fair ratio of 15.9x. This gap suggests there may be some valuation risk if the broader market's appetite for pipeline stocks softens. How long can this premium last as markets shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pembina Pipeline Narrative

If you want to drill into the numbers yourself or take a different approach to Pembina Pipeline’s outlook, you can build your own narrative in just minutes with our streamlined tools. Do it your way

A great starting point for your Pembina Pipeline research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make the most of your research by targeting top stocks beyond Pembina Pipeline. Acting now could put you ahead of the market’s next big opportunity.

- Unlock reliable passive income streams and scan these 18 dividend stocks with yields > 3% with strong yields for steady returns.

- Help your portfolio grow by tracking the innovators driving tomorrow’s breakthroughs through these 24 AI penny stocks.

- Take advantage of quality bargains ahead of the crowd with these 878 undervalued stocks based on cash flows based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPL

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives